Daily Market Comment – Dollar succumbs to Powell’s dovish tune; stocks mixed

- Powell reiterates that rate hikes are a long way off, pressing down on yields

- Dollar skids again but upside risk from retail sales and jobless claims

- Banks kick off US earnings with a bang but only Dow Jones rises

Most dovish Fed Chair ever strikes again

Most dovish Fed Chair ever strikes againThe US dollar slid and the 10-year Treasury yield held near three-week lows as Fed Chair Jerome Powell went out of his way to dampen fears of pre-emptive action to stem rising inflation. Speaking on Wednesday to the Economic Club of Washington, Powell reiterated that the Fed would only begin winding down its asset purchases when it’s made substantial progress towards its goals. But crucially, Powell signalled that tapering would happen “well before” they start considering raising interest rates.

Treasury yields edged lower after Powell’s remarks, with the 10-yield falling towards 1.61%. Markets have finally started to take note of the Fed’s repeated assurances that creeping inflation won’t derail its current policy path even as the US consumer price index soars past 2%.

With growth accelerating amid a deluge of fiscal stimulus, a rapid vaccine rollout and falling virus cases, the Fed’s own agents are reporting stronger hiring and upward pressure on prices according to the April Beige Book.

The fast-improving economic backdrop is limiting how far Treasury yields can pull back. But the ongoing risks to the positive outlook are also supporting safe-haven bonds as the setbacks with the AstraZeneca and Johnson & Johnson vaccines have shown that there’s still plenty that can go wrong, especially if a new vaccine-resistant strain of Covid-19 emerges.

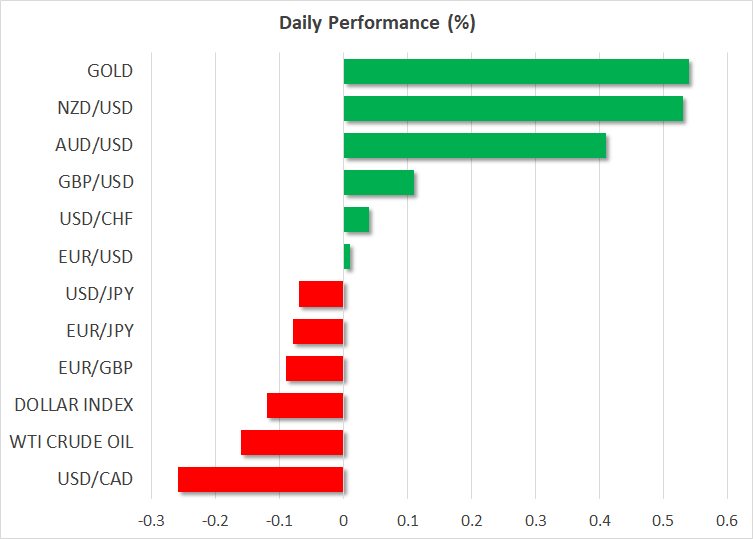

Dollar sags, aussie lifted by robust jobs dataBut for now, investors took comfort in Powell’s ultra-dovish stance, which weighed heavily on the greenback. The dollar index plumbed a fresh four-week low today, lifting its rivals. The improved risk tone further dented demand for the dollar, as well as for the yen, though some of the overnight moves had started to reverse by the European open.

The euro and pound both turned flat, easing slightly from one-month and one-week highs, respectively, against the dollar. Dovish comments by ECB President Christine Lagarde yesterday may be curbing the euro’s advances while rising political risks in the UK could be clipping the pound’s wings.

However, the Australian and New Zealand dollars extended their gains today to jump a further 0.5%, outperforming their peers. The aussie was additionally boosted by robust jobs numbers, which showed employment in Australia surpassed pre-pandemic levels in March.

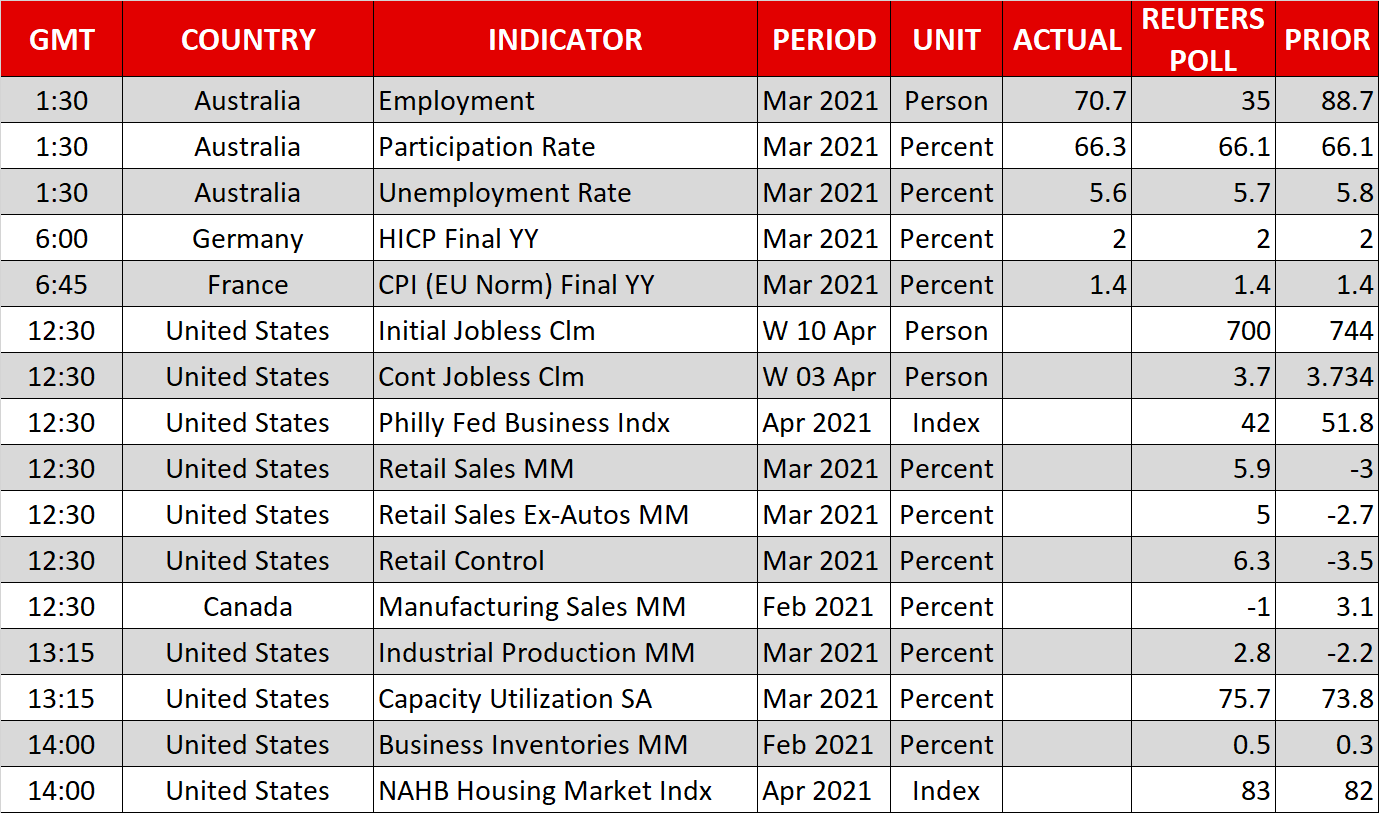

The US labour market will come in focus later today when the latest initial jobless claims figures are published. Retail sales data will also be eyed as Americans likely upped their consumption in March. Stronger-than-expected numbers might help the dollar stabilize even if they’re not able to reverse the latest declines.

Gold rose disproportionately to the weakness in the dollar and yields, indicating perhaps some safety flows from growing tensions between Moscow and Washington as the Biden administration prepares to impose yet more sanctions on Russia.

US stock futures up ahead of more key earningsIn equity markets, the S&P 500 slipped back from fresh record highs to close 0.4% lower on Wednesday. Stellar earnings from Wall Street’s big banks were unable to offset a bit of a selloff in tech stocks, which pulled the Nasdaq Composite down 1%. Only the Dow Jones was able to finish the day in positive territory, but futures were pointing to a stronger open for all three indices on Thursday.

Bank earnings will continue today with Bank of America and Citigroup reporting before the market open. Delta Air Lines will also be under the spotlight for clues on how well the airline and travel industries are weathering the pandemic storm.

최신 뉴스

면책조항: XM Group 회사는 체결 전용 서비스와 온라인 거래 플랫폼에 대한 접근을 제공하여, 개인이 웹사이트에서 또는 웹사이트를 통해 이용 가능한 콘텐츠를 보거나 사용할 수 있도록 허용합니다. 이에 대해 변경하거나 확장할 의도는 없습니다. 이러한 접근 및 사용에는 다음 사항이 항상 적용됩니다: (i) 이용 약관, (ii) 위험 경고, (iii) 완전 면책조항. 따라서, 이러한 콘텐츠는 일반적인 정보에 불과합니다. 특히, 온라인 거래 플랫폼의 콘텐츠는 금융 시장에서의 거래에 대한 권유나 제안이 아닙니다. 금융 시장에서의 거래는 자본에 상당한 위험을 수반합니다.

온라인 거래 플랫폼에 공개된 모든 자료는 교육/정보 목적으로만 제공되며, 금융, 투자세 또는 거래 조언 및 권고, 거래 가격 기록, 금융 상품 또는 원치 않는 금융 프로모션의 거래 제안 또는 권유를 포함하지 않으며, 포함해서도 안됩니다.

이 웹사이트에 포함된 모든 의견, 뉴스, 리서치, 분석, 가격, 기타 정보 또는 제3자 사이트에 대한 링크와 같이 XM이 준비하는 콘텐츠 뿐만 아니라, 제3자 콘텐츠는 일반 시장 논평으로서 "현재" 기준으로 제공되며, 투자 조언으로 여겨지지 않습니다. 모든 콘텐츠가 투자 리서치로 해석되는 경우, 투자 리서치의 독립성을 촉진하기 위해 고안된 법적 요건에 따라 콘텐츠가 의도되지 않았으며, 준비되지 않았다는 점을 인지하고 동의해야 합니다. 따라서, 관련 법률 및 규정에 따른 마케팅 커뮤니케이션이라고 간주됩니다. 여기에서 접근할 수 있는 앞서 언급한 정보에 대한 비독립 투자 리서치 및 위험 경고 알림을 읽고, 이해하시기 바랍니다.