British Pound: A silent power among the majors

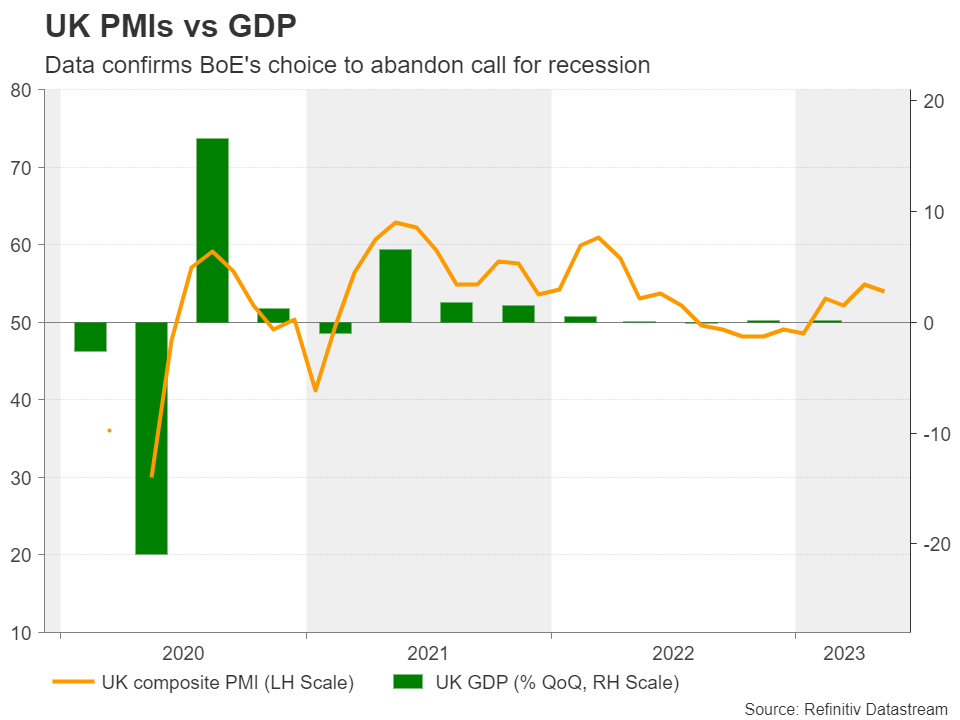

With the BoE abandoning its recession call and signaling that they will not hesitate to raise rates further should inflation pressures persist, market participants remained convinced that officials could deliver two more quarter-point increases by the end of the year.

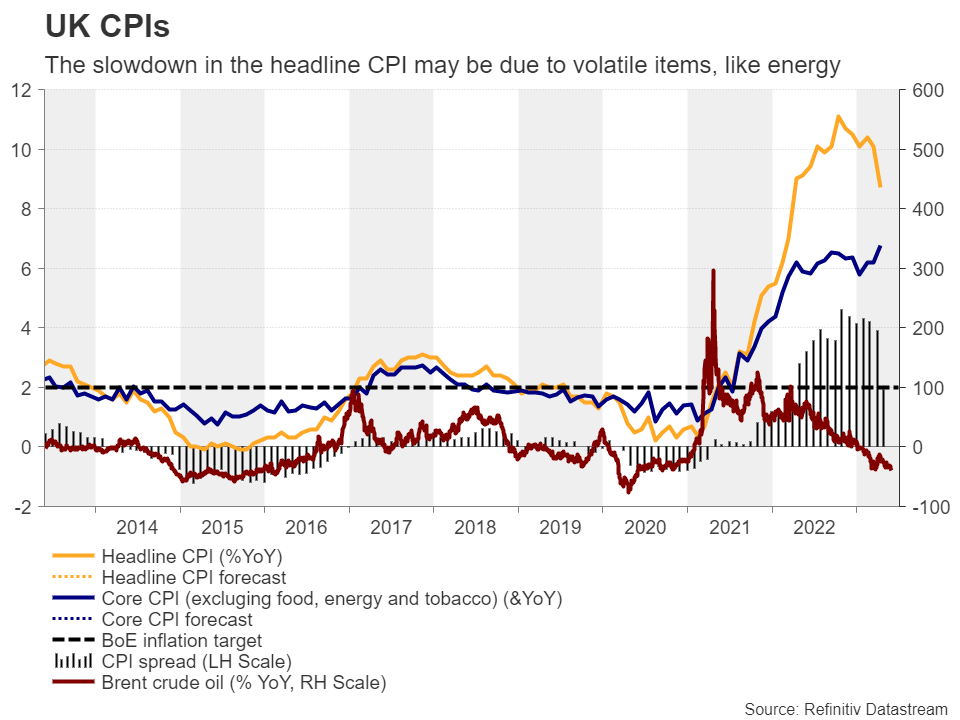

However, that was the case before May 24, the day when the inflation numbers for April were released. The data revealed that the headline CPI slowed by less than expected, to 8.7% year-on-year from 10.1%, but what was much more worrisome was the unexpected acceleration in underlying inflation to 6.8% y/y from 6.2%. This suggested that price pressures are becoming more embedded in the broader economy, and that the decline in the headline rate was just the result of a slowdown in the prices of volatile items like energy.

With no recession calls, investors double their BoE hike bets

With no recession calls, investors double their BoE hike betsWith that in mind, investors have doubled their bets, now almost 100bps worth of additional rate increments by December, with a first quarter-point cut being nearly fully priced in for May 2024. And all this even after preliminary PMIs for May disappointed last week. Perhaps investors are content with the fact that the composite index is still pointing to expansion, which enhances the view that the UK economy may have avoided a recession.

After November, when the BoE predicted the longest recession in the UK economy’s history, the financial community viewed the Bank’s slow and cautious tightening as a wise choice, but with all the economic engines performing better than feared then and inflation remaining out of control, market participants are now hoping for, or even demanding, more aggressive action by the Bank.

Will Bailey and co rise to the occasion?Bailey and his fellow policymakers may have no other choice than to signal that more tightening is needed. Although the PMIs came in weaker than expected, they revealed that output charges continued to rise, and although they eased to the slowest in three months, they remained elevated by the survey’s historical standards. What’s more, average weekly earnings accelerated in March, which means that consumer demand could stay strong in the months to come and thereby keep inflation elevated.

Consequently, a 25bps hike at the BoE’s upcoming gathering may not constitute an adequate reason for celebration. Pound traders may feel satisfied and willing to add to their long positions if the Bank appears willing to keep raising rates as forcefully as needed to tame the inflation beast.

The pound may benefit heading into the June meeting by the fact that investors are taking a leap of faith and trust that the BoE may continue raising interest rates more aggressively than any other major central bank, while the currency may strengthen even more if policymakers appear determined to do whatever it takes to bring inflation to heel.

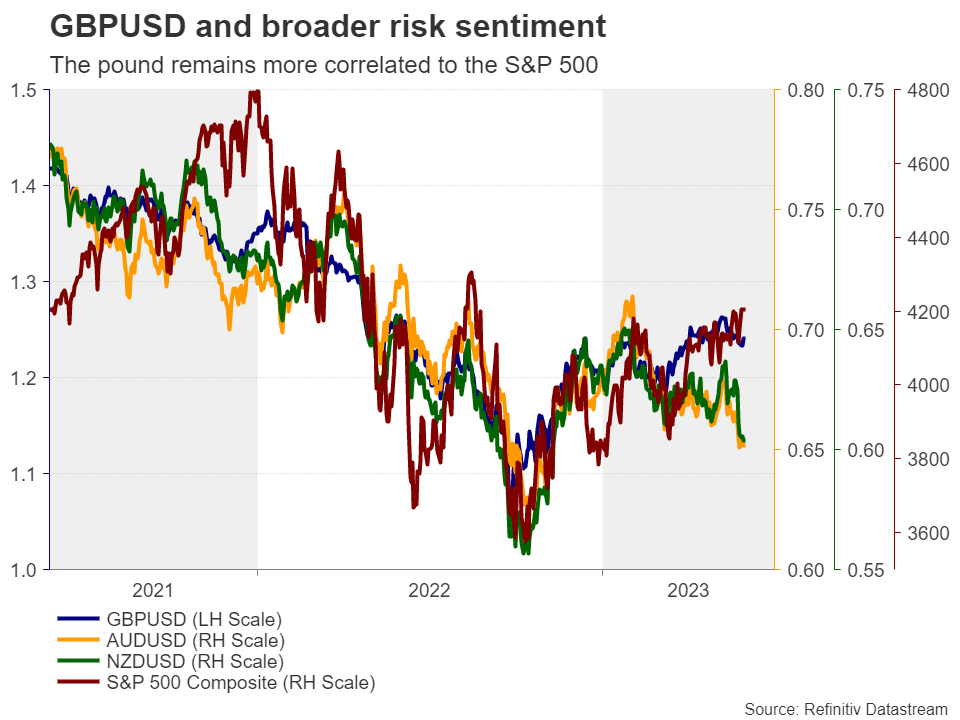

Pound remains the best performing major currency year-to-dateAlthough it pulled back against its US counterpart recently, the British currency remains the top performer among the majors since the beginning of the year, and monetary policy may have not been the only source of fuel. Due to the UK’s twin deficit, sterling has turned into a risk-linked currency the last few years, strengthening when equities rise and vice versa.

With Wall Street in an uptrend mode, it seems that the pound may have indeed benefited from investors’ willingness to keep increasing their risk exposure. But why didn’t the other traditional risk-linked currencies aussie and kiwi follow suit? Perhaps due to Chinese data suggesting that after the post-reopening boost, Australia’s and New Zealand’s main trading partner is losing momentum.

Currently, equity traders seem to be indifferent, or less interested, to Chinese data, preferring to ride the artificial intelligence (AI) trend as optimism and better forecasts of tech firms are probably on top of their lists.

Putting everything together, with the dollar staging a decent comeback lately due to the market reevaluating its implied Fed rate path, pound/dollar may not be the best choice for exploiting further gains in the pound, at least in the short run. The yen and the kiwi may be more appropriate candidates as the BoJ is sticking to its ultra-loose monetary policy and the RBNZ seems to be over with this tightening cycle.

Pound may continue to benefit the most against the kiwiHaving said that, choosing the yen carries more risks as the BoJ may eventually proceed with more normalizing steps, while an unexpected turbulent market episode will not only weigh on the pound, but also benefit the safe-haven yen. So, ultimately, the best option could be the pound/kiwi pair as the risk-on characteristics of both currencies are somewhat offsetting each other and thus, the probability of violent swings when sentiment changes may be smaller. Even if the sentiment-related forces are not equal, the current market landscape suggests that the pound has an advantage either way. It gains more in risk-on episodes and loses less in risk-off.

Indeed, since last Wednesday, when the RBNZ hinted that it is probably done raising interest rates, pound/kiwi has been in a fly mode, breaking above the high of April 26 just this Tuesday and signaling the continuation of the prevailing uptrend.

The pair now looks to be headed towards the 2.0700 territory, marked by the highs of May 2020, the break of which could carry extensions towards the 2.1000 zone, which acted as a ceiling between mid-March and mid-April of that same year.

For the outlook to turn bearish, the bears may have to drive the action all the way down and below the 1.9800 area, which offered strong support this month and coincided with the 38.2% Fibonacci retracement level of the February 3 – April 26 upleg.

관련 자산

최신 뉴스

면책조항: XM Group 회사는 체결 전용 서비스와 온라인 거래 플랫폼에 대한 접근을 제공하여, 개인이 웹사이트에서 또는 웹사이트를 통해 이용 가능한 콘텐츠를 보거나 사용할 수 있도록 허용합니다. 이에 대해 변경하거나 확장할 의도는 없습니다. 이러한 접근 및 사용에는 다음 사항이 항상 적용됩니다: (i) 이용 약관, (ii) 위험 경고, (iii) 완전 면책조항. 따라서, 이러한 콘텐츠는 일반적인 정보에 불과합니다. 특히, 온라인 거래 플랫폼의 콘텐츠는 금융 시장에서의 거래에 대한 권유나 제안이 아닙니다. 금융 시장에서의 거래는 자본에 상당한 위험을 수반합니다.

온라인 거래 플랫폼에 공개된 모든 자료는 교육/정보 목적으로만 제공되며, 금융, 투자세 또는 거래 조언 및 권고, 거래 가격 기록, 금융 상품 또는 원치 않는 금융 프로모션의 거래 제안 또는 권유를 포함하지 않으며, 포함해서도 안됩니다.

이 웹사이트에 포함된 모든 의견, 뉴스, 리서치, 분석, 가격, 기타 정보 또는 제3자 사이트에 대한 링크와 같이 XM이 준비하는 콘텐츠 뿐만 아니라, 제3자 콘텐츠는 일반 시장 논평으로서 "현재" 기준으로 제공되며, 투자 조언으로 여겨지지 않습니다. 모든 콘텐츠가 투자 리서치로 해석되는 경우, 투자 리서치의 독립성을 촉진하기 위해 고안된 법적 요건에 따라 콘텐츠가 의도되지 않았으며, 준비되지 않았다는 점을 인지하고 동의해야 합니다. 따라서, 관련 법률 및 규정에 따른 마케팅 커뮤니케이션이라고 간주됩니다. 여기에서 접근할 수 있는 앞서 언급한 정보에 대한 비독립 투자 리서치 및 위험 경고 알림을 읽고, 이해하시기 바랍니다.