Will Australia’s labor data tempt the RBA to hike again? – Forex News Preview

At its latest gathering, the RBA raised interest rates by 25bps, stunning investors who were expecting officials to stay sidelined for the second time in a row. Policymakers decided to hike due to stubbornly high services inflation and faster-than-expected rental increases, adding that more hikes may be required depending on how the economy and the inflation outlook evolve.

In the minutes of that meeting, released today, it was revealed that board members were considering staying sidelined for another month, but the inflation risks convinced them that a hike was a more appropriate decision.

Having said all that though, despite officials saying that more hikes may be required, and despite Australia’s consumer prices increasing 6.3% year-on-year in March, market participants are currently assigning an 87% probability for no change at the upcoming meeting in June, with the remaining 13% pointing to another quarter-point hike.

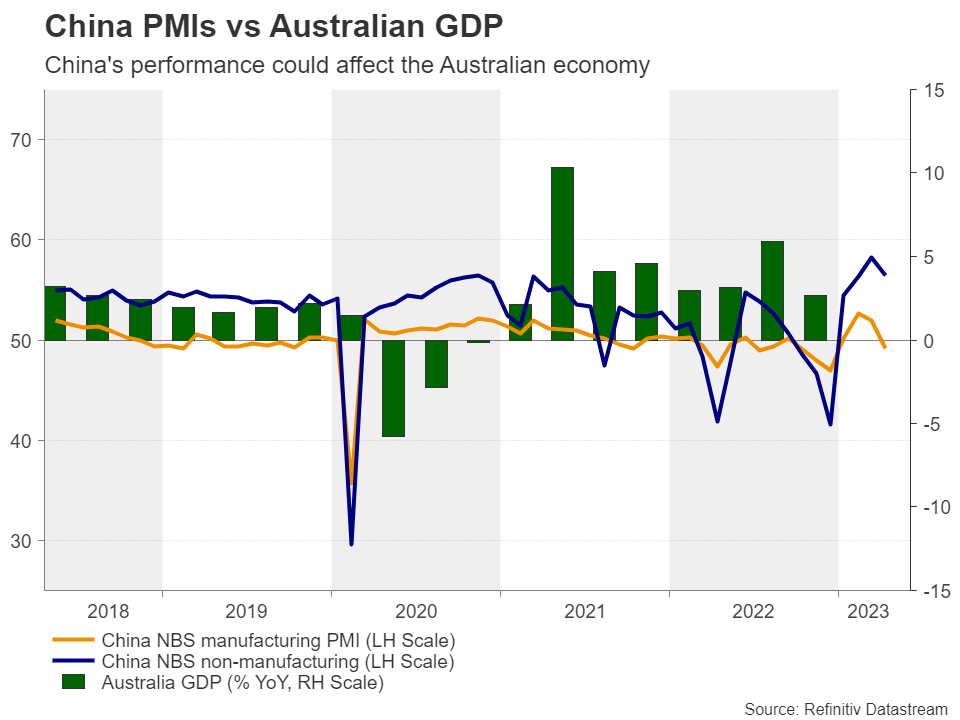

Perhaps that’s due to inflation being in a downtrend since December, when it hit 8.4% y/y, and due to Chinese data suggesting that after the post-reopening boost, the world’s second largest economy and Australia’s main trading partner is losing momentum.

Will the jobs data increase the chances of another hike?

Will the jobs data increase the chances of another hike?Beyond June, investors are pricing in around a 30% chance for a quarter-point hike in July, while they are evenly split for August and September. So, as they try to better understand how the RBA could proceed later this year, they may pay attention to the wage price index for Q1 and the employment report for April, due out during the Asian sessions Wednesday and Thursday, respectively.

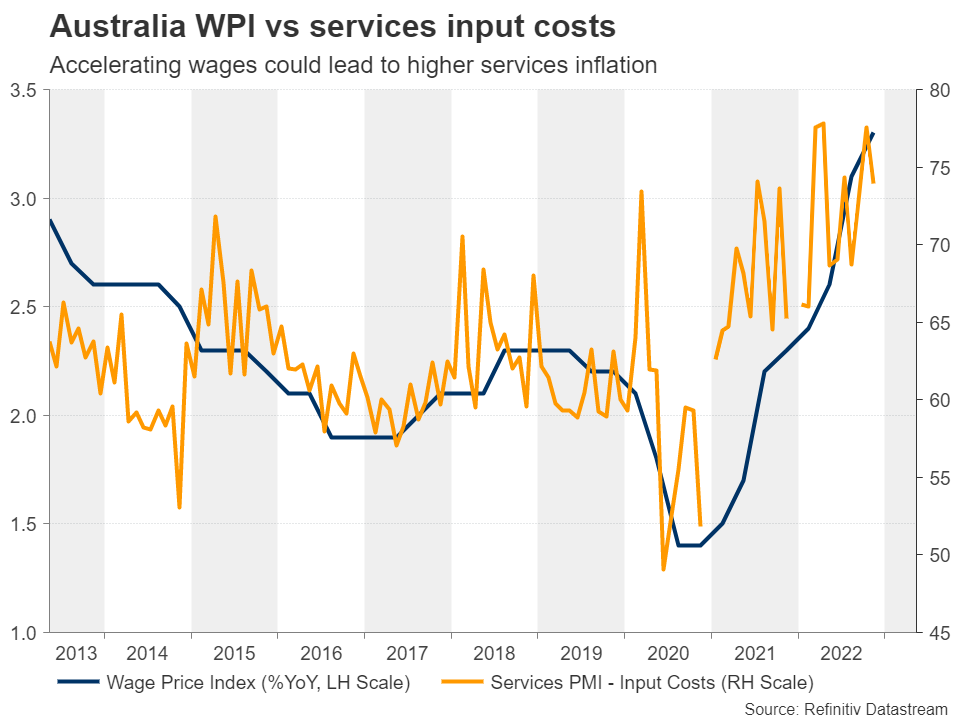

Wages are forecast to have continued to accelerate for the 9th consecutive quarter, which could add to concerns about inflation staying elevated, and although the employment change is expected to show that the economy added less than half the jobs it gained in March, the unemployment rate is seen holding steady at 3.5%, just a tick above its record low of 3.4%.

A tight labor market and rising wage growth, which according to the S&P Global services PMI, is contributing to accelerating price pressures for firms in Australia, could prompt investors to price in a higher probability for a hike during the summer months.

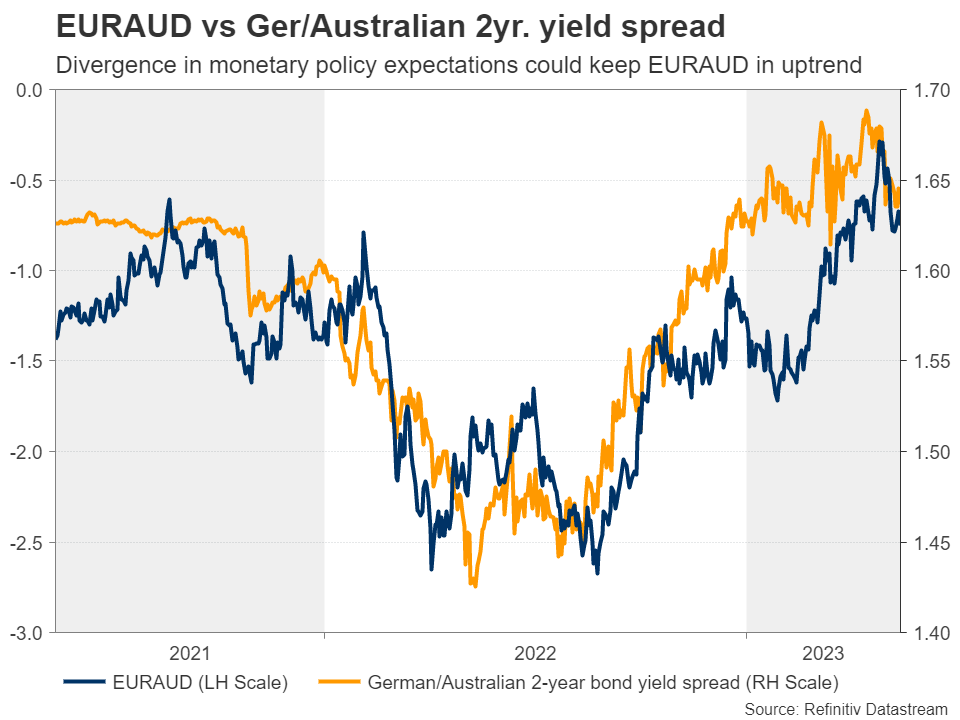

Aussie may be destined to stay weak for a while longerThis could prove positive for the Australian dollar, but its upside may be capped by market participants’ concerns over the outlook of the Chinese economy. With the Fed expected to proceed with nearly three quarter-point cuts by the end of the year, the picture in ausie/dollar may not be so clear, but with the ECB seen hiking by another 50bps, euro/aussie may be destined to continue its uptrend for a while longer, even if the Australian currency temporarily benefits by this week’s data.

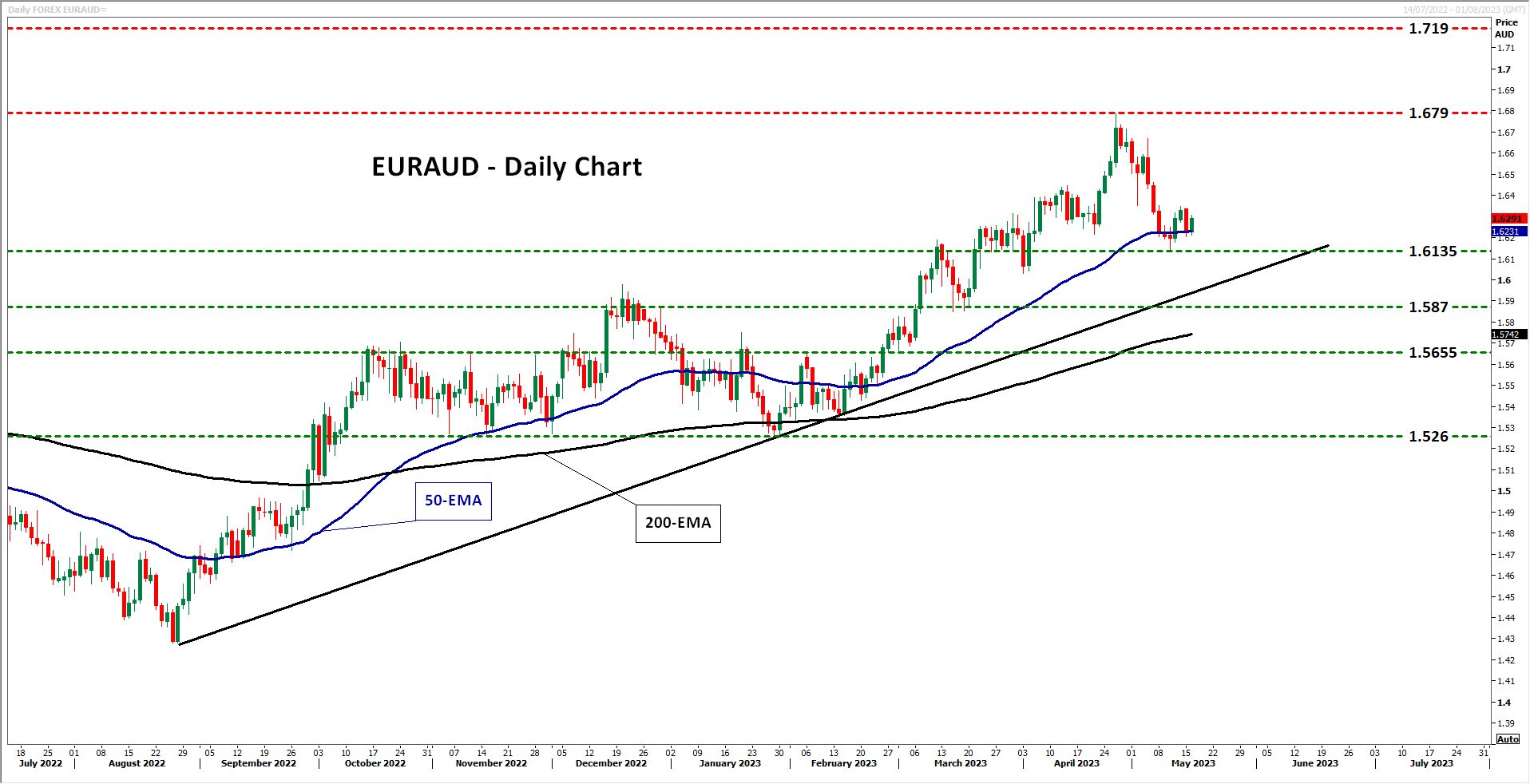

Euro/aussie has been in a sliding mode since April 26, when it hit resistance at 1.6790, a territory that threw the bulls out of the game back in October 2020 as well. Nonetheless, the pair remains above the uptrend line drawn from the low of August 26, which keeps the bigger picture positive.

Even if the slide extends beyond last week’s low of 1.6135, the buyers could still step back into the action from near the uptrend line and perhaps stage another march towards the 1.6790 zone. If they manage to break that zone, they could then put the 1.7190 area on their radar, which offered resistance back in early May 2020.

The outlook could start darkening if the bears are able to break the aforementioned uptrend line, but also the 1.5870 support. Should this happen, they may get encouraged to dive towards the 1.5655 territory, marked by the inside swing high of February 6, the break of which could see scope for extensions towards the 1.5260 area, which acted as a floor between November 4 and January 30.Asset collegati

Ultime news

Disclaimer: le entità di XM Group forniscono servizi di sola esecuzione e accesso al nostro servizio di trading online, che permette all'individuo di visualizzare e/o utilizzare i contenuti disponibili sul sito o attraverso di esso; non ha il proposito di modificare o espandere le proprie funzioni, né le modifica o espande. L'accesso e l'utilizzo sono sempre soggetti a: (i) Termini e condizioni; (ii) Avvertenza sui rischi e (iii) Disclaimer completo. Tali contenuti sono perciò forniti a scopo puramente informativo. Nello specifico, ti preghiamo di considerare che i contenuti del nostro servizio di trading online non rappresentano un sollecito né un'offerta ad operare sui mercati finanziari. Il trading su qualsiasi mercato finanziario comporta un notevole livello di rischio per il tuo capitale.

Tutto il materiale pubblicato sul nostro servizio di trading online è unicamente a scopo educativo e informativo, e non contiene (e non dovrebbe essere considerato come contenente) consigli e raccomandazioni di carattere finanziario, di trading o fiscale, né informazioni riguardanti i nostri prezzi di trading, offerte o solleciti riguardanti transazioni che possano coinvolgere strumenti finanziari, oppure promozioni finanziarie da te non richieste.

Tutti i contenuti di terze parti, oltre ai contenuti offerti da XM, siano essi opinioni, news, ricerca, analisi, prezzi, altre informazioni o link a siti di terzi presenti su questo sito, sono forniti "così com'è", e vanno considerati come commenti generali sui mercati; per questo motivo, non possono essere visti come consigli di investimento. Dato che tutti i contenuti sono intesi come ricerche di investimento, devi considerare e accettare che non sono stati preparati né creati seguendo i requisiti normativi pensati per promuovere l'indipendenza delle ricerche di investimento; per questo motivo, questi contenuti devono essere considerati come comunicazioni di marketing in base alle leggi e normative vigenti. Assicurati di avere letto e compreso pienamente la nostra Notifica sulla ricerca di investimento non indipendente e la nostra Informativa sul rischio riguardante le informazioni sopra citate; tali documenti sono consultabili qui.