Market Comment – Dollar climbs above 150 yen as Treasury yields rebound

Treasury yields rebound, lift the dollar ahead of US GDP data

Dollar/yen rises past 150, rings intervention alarm bells

ECB to take the sidelines, focus to fall on forward guidance

Wall Street tumbles as Alphabet disappoints

Will US GDP data add more fuel to the dollar’s engines?

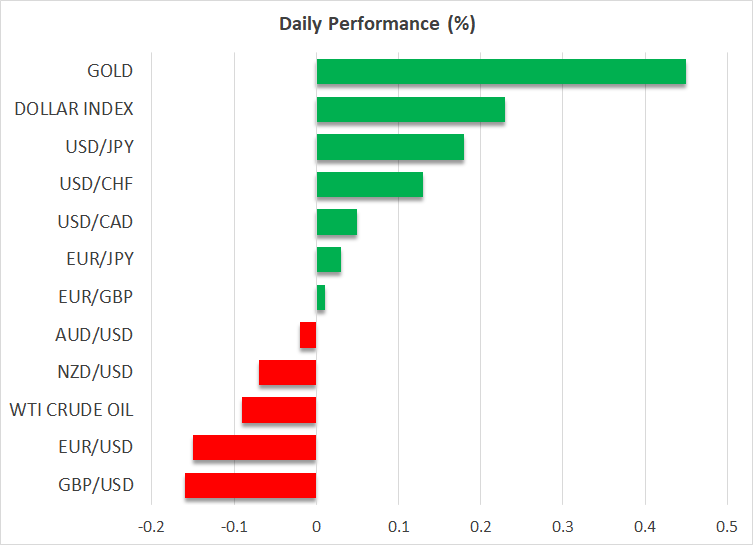

Will US GDP data add more fuel to the dollar’s engines?The US dollar extended its gains as US Treasury yields rebounded, with the 10-year benchmark rate resuming a move towards the psychological zone of 5.0%, briefly breached on Monday.

Yet, Fed funds futures point to a virtually unchanged implied rate path, with a 40% probability for one last 25bps hike by January and around 75bps worth of rate cuts for next year. This means that there is room for upside adjustment should upcoming data corroborate the view that the US economy is faring well, which could add further fuel to the dollar’s engines and perhaps propel the 10-year yield above 5.0%. Should this happen, the next territory that could tempt investors to jump into the bond market may be at around 5.3%, a zone that halted further advances in yields back in June 2006 and June 2007.

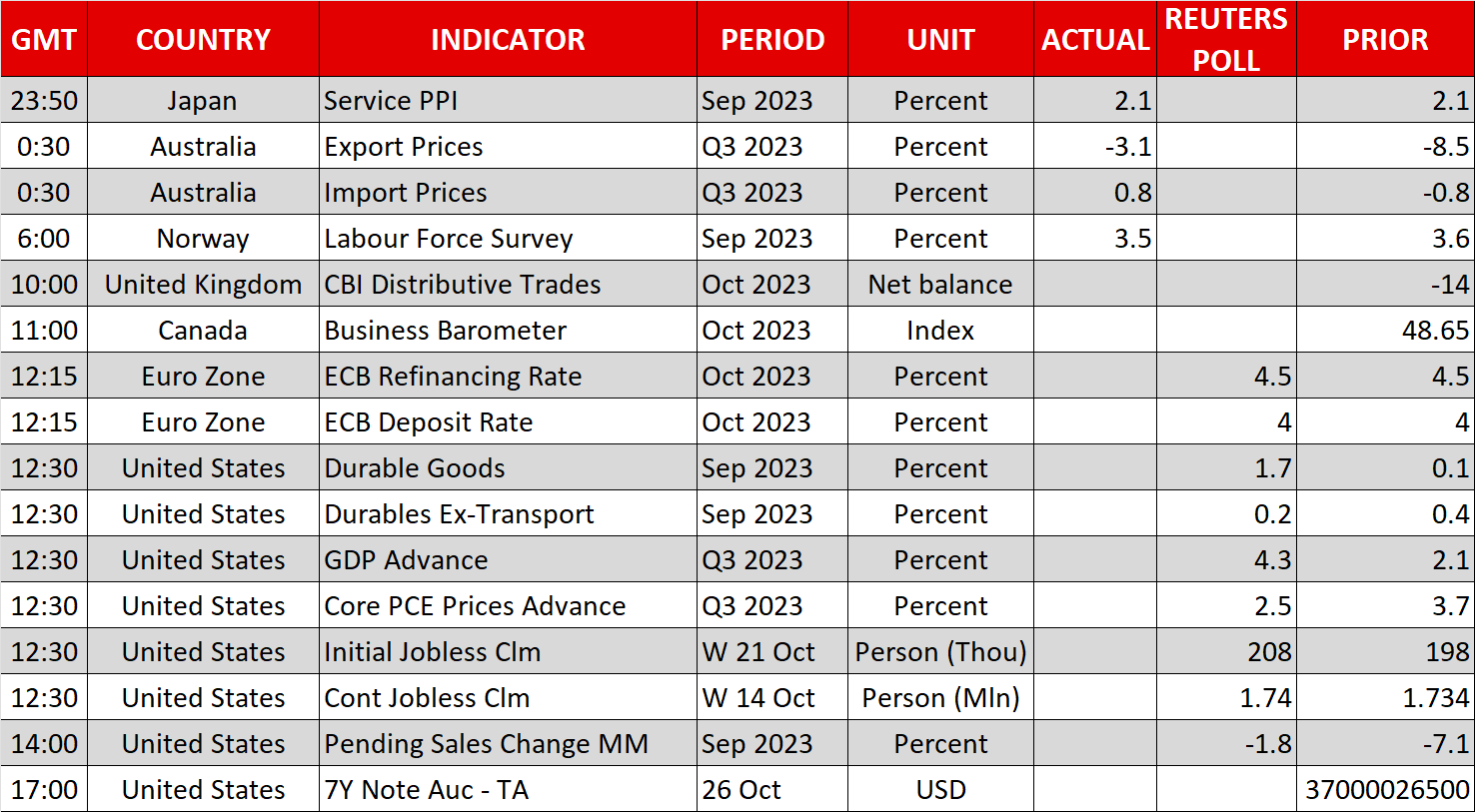

Today, dollar traders may keep their gaze locked on the US GDP data for Q3. Expectations are for the world’s largest economy to have enjoyed double the growth rate it posted in Q2, with the risk perhaps tilted to the upside as the Atlanta Fed GDPNow model estimates an even higher growth rate than the official forecast of 4.3%.

To intervene or not to intervene?The dollar pair that attracted the most attention was dollar/yen, which forcefully pierced through the psychological 150 zone yesterday, and with no interruption by Japanese authorities, it continues marching higher today, trading at around 150.60.

Nonetheless, that doesn’t mean intervention is not likely anymore. Perhaps officials are just considering a higher level at which they could step in. Indeed, earlier today, Japanese Finance Minister Suzuki warned against selling the yen, adding that they are watching market moves with a sense of urgency.

A positive reaction to a better-than-expected US GDP today could prove to be the intervention trigger, but with the BoJ maintaining a lid on Japanese government bond (JGB) yields and the rally in US Treasury yields showing no signs of abating, the pair may be destined to resume its prevailing uptrend at some point, even if Japanese officials act.

For the yen to stage a noteworthy and sustained recovery, the BoJ may need to alter its ultra-loose monetary policy soon. According to sources, officials have already discussed the possibility of a further yield cap hike.

ECB takes the central bank torchBesides the US GDP data, there is also an ECB meeting on today’s agenda. When they last met, ECB officials raised interest rates by 25bps, but they signaled that this was probably the last hike in this tightening crusade.

Since then, several officials have argued that inflation could return to their 2% objective even without any additional hikes, while economic data continues to point to a wounded euro area economy. This convinced market participants no more rate increases will be delivered and allowed them to price in around 65bps worth of cuts for next year.

Therefore, the attention will fall on clues and hints on whether policymakers are indeed considering the reduction of interest rates at some point next year, with anything validating this notion having the potential to further hurt the euro.

The Bank of Canada announced its own decision yesterday, refraining from pushing the hike button and forecasting weak growth, although it kept the door open to more hikes if deemed necessary. The loonie traded on the back foot against its US counterpart, perhaps as its traders continued seeing a very slim probability for another increase.

Alphabet’s cloud earnings miss drags Wall Street lowerWall Street tumbled yesterday, with the tech-heavy Nasdaq losing more than 2% after Alphabet reported disappointing cloud services revenue, even as rival Microsoft’s Azure took off. After Wednesday’s closing bell, Meta Platforms beat Wall Street’s high expectations, but its stock fell after the company warned of weakening advertising demand. This could result in a lower market open today. Amazon will take its turn in reporting results after today’s close.

Asset collegati

Ultime news

Disclaimer: le entità di XM Group forniscono servizi di sola esecuzione e accesso al nostro servizio di trading online, che permette all'individuo di visualizzare e/o utilizzare i contenuti disponibili sul sito o attraverso di esso; non ha il proposito di modificare o espandere le proprie funzioni, né le modifica o espande. L'accesso e l'utilizzo sono sempre soggetti a: (i) Termini e condizioni; (ii) Avvertenza sui rischi e (iii) Disclaimer completo. Tali contenuti sono perciò forniti a scopo puramente informativo. Nello specifico, ti preghiamo di considerare che i contenuti del nostro servizio di trading online non rappresentano un sollecito né un'offerta ad operare sui mercati finanziari. Il trading su qualsiasi mercato finanziario comporta un notevole livello di rischio per il tuo capitale.

Tutto il materiale pubblicato sul nostro servizio di trading online è unicamente a scopo educativo e informativo, e non contiene (e non dovrebbe essere considerato come contenente) consigli e raccomandazioni di carattere finanziario, di trading o fiscale, né informazioni riguardanti i nostri prezzi di trading, offerte o solleciti riguardanti transazioni che possano coinvolgere strumenti finanziari, oppure promozioni finanziarie da te non richieste.

Tutti i contenuti di terze parti, oltre ai contenuti offerti da XM, siano essi opinioni, news, ricerca, analisi, prezzi, altre informazioni o link a siti di terzi presenti su questo sito, sono forniti "così com'è", e vanno considerati come commenti generali sui mercati; per questo motivo, non possono essere visti come consigli di investimento. Dato che tutti i contenuti sono intesi come ricerche di investimento, devi considerare e accettare che non sono stati preparati né creati seguendo i requisiti normativi pensati per promuovere l'indipendenza delle ricerche di investimento; per questo motivo, questi contenuti devono essere considerati come comunicazioni di marketing in base alle leggi e normative vigenti. Assicurati di avere letto e compreso pienamente la nostra Notifica sulla ricerca di investimento non indipendente e la nostra Informativa sul rischio riguardante le informazioni sopra citate; tali documenti sono consultabili qui.