Daily Market Comment – Wall Street hits record before earnings kickoff, dollar holds firm

- Earnings optimism drives US equities to fresh record highs ahead of bank results

- Risk appetite still shaky in FX markets, dollar and yen resist deeper selloff

- US inflation data and Powell testimony will be key in directing sentiment

Wall Street rallies as reopening boost eyed

Wall Street rallies as reopening boost eyedIt’s the start of the second quarter earnings season and optimism is running high that the reopening of the US economy will power corporate earnings to new peaks. The new season will properly kick off today when JPMorgan Chase and Goldman Sachs report their results before the market open. More big bank earnings will follow in the coming days.

But there’s already plenty of buzz on Wall Street that Q2 earnings will beat the consensus estimates on expectations that the vaccine-led recovery boosted companies’ bottom lines as the reopening of the world’s largest economy gathered pace. The three leading indices – S&P 500, Dow Jones Industrial Average and Nasdaq Composite – all closed at new all-time highs for a second consecutive day on Monday.

Tesla stocks (+4.4%) led the charge as the company rolled out a software update, adding full self-driving capabilities to paid subscribers.

E-mini futures tracking the three indices were trading slightly lower as European shares opened mixed on Tuesday. But Asian stocks had another strong session, lifted by better-than-expected trade figures out of China, which eased concerns about slowing growth.

Dollar, yields brace for US CPI and PowellReports that progress is being made in the US Congress on both the partisan and bipartisan bills of Biden’s infrastructure plan may also be supporting sentiment in equity markets. But in the currency sphere, traders are mainly focused on this week’s US data releases and Fed Chair Powell’s congressional hearing on Wednesday.

Powell is unlikely to say anything that would rattle investors but nevertheless markets will be hypersensitive to any remarks that suggest tapering could begin soon. Ahead of Powell’s appearance tomorrow, all eyes will be on the June consumer price index due today at 12:30 GMT.

Expectations for the headline CPI rate are for a reading of 4.9% y/y. However, there’s probably a slightly greater risk of a weaker number this time, which could spark another spending spree into US Treasury bonds, sending yields tumbling again.

The 10-year Treasury yield stabilized late last week and has recovered to around 1.36%, holding steady during yesterday’s auctions. But if yields were to dip again, it’s unclear which way the US dollar would go following the recent breakdown of their positive correlation.

Kiwi crawls higher ahead of RBNZWhat is evident, however, is that riskier currencies have been struggling to make much headway against the greenback lately during both risk-on and risk-off days. Even the New Zealand dollar has been unable to capitalize on growing expectations that the RBNZ will raise rates as early as November this year.

The RBNZ is due to announce its latest monetary policy decision early on Wednesday and the kiwi could come under pressure if policymakers hint that they disagree with the markets’ timetable for rate hikes.

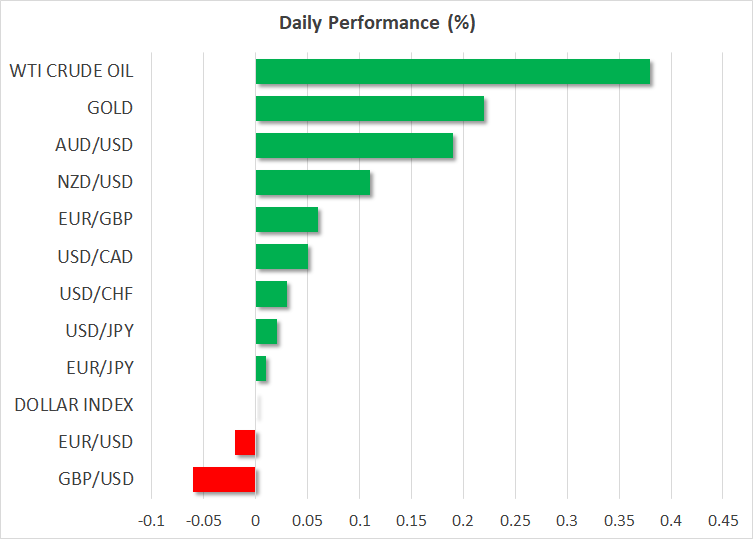

The US dollar was last trading slightly firmer against a basket of currencies but flat versus the safe-haven yen. The aussie and kiwi inched up against both the greenback and yen, while the euro and pound were weaker across the board.

In commodities, oil futures were trading about 0.8% higher despite no sign yet that Saudi Arabia and UAE are close to resolving their differences over how to ease the output restrictions. Gold, meanwhile, held within its recent range, hovering just above $1,800/oz.

Ultime news

Disclaimer: le entità di XM Group forniscono servizi di sola esecuzione e accesso al nostro servizio di trading online, che permette all'individuo di visualizzare e/o utilizzare i contenuti disponibili sul sito o attraverso di esso; non ha il proposito di modificare o espandere le proprie funzioni, né le modifica o espande. L'accesso e l'utilizzo sono sempre soggetti a: (i) Termini e condizioni; (ii) Avvertenza sui rischi e (iii) Disclaimer completo. Tali contenuti sono perciò forniti a scopo puramente informativo. Nello specifico, ti preghiamo di considerare che i contenuti del nostro servizio di trading online non rappresentano un sollecito né un'offerta ad operare sui mercati finanziari. Il trading su qualsiasi mercato finanziario comporta un notevole livello di rischio per il tuo capitale.

Tutto il materiale pubblicato sul nostro servizio di trading online è unicamente a scopo educativo e informativo, e non contiene (e non dovrebbe essere considerato come contenente) consigli e raccomandazioni di carattere finanziario, di trading o fiscale, né informazioni riguardanti i nostri prezzi di trading, offerte o solleciti riguardanti transazioni che possano coinvolgere strumenti finanziari, oppure promozioni finanziarie da te non richieste.

Tutti i contenuti di terze parti, oltre ai contenuti offerti da XM, siano essi opinioni, news, ricerca, analisi, prezzi, altre informazioni o link a siti di terzi presenti su questo sito, sono forniti "così com'è", e vanno considerati come commenti generali sui mercati; per questo motivo, non possono essere visti come consigli di investimento. Dato che tutti i contenuti sono intesi come ricerche di investimento, devi considerare e accettare che non sono stati preparati né creati seguendo i requisiti normativi pensati per promuovere l'indipendenza delle ricerche di investimento; per questo motivo, questi contenuti devono essere considerati come comunicazioni di marketing in base alle leggi e normative vigenti. Assicurati di avere letto e compreso pienamente la nostra Notifica sulla ricerca di investimento non indipendente e la nostra Informativa sul rischio riguardante le informazioni sopra citate; tali documenti sono consultabili qui.