Will Australia’s labor data tempt the RBA to hike again? – Forex News Preview

At its latest gathering, the RBA raised interest rates by 25bps, stunning investors who were expecting officials to stay sidelined for the second time in a row. Policymakers decided to hike due to stubbornly high services inflation and faster-than-expected rental increases, adding that more hikes may be required depending on how the economy and the inflation outlook evolve.

In the minutes of that meeting, released today, it was revealed that board members were considering staying sidelined for another month, but the inflation risks convinced them that a hike was a more appropriate decision.

Having said all that though, despite officials saying that more hikes may be required, and despite Australia’s consumer prices increasing 6.3% year-on-year in March, market participants are currently assigning an 87% probability for no change at the upcoming meeting in June, with the remaining 13% pointing to another quarter-point hike.

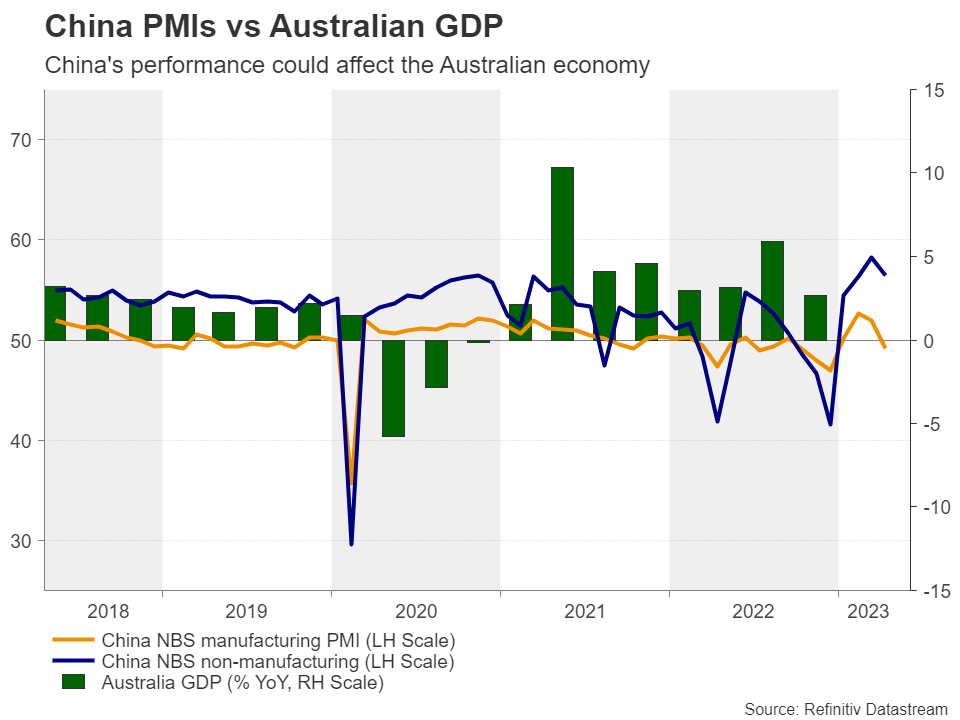

Perhaps that’s due to inflation being in a downtrend since December, when it hit 8.4% y/y, and due to Chinese data suggesting that after the post-reopening boost, the world’s second largest economy and Australia’s main trading partner is losing momentum.

Will the jobs data increase the chances of another hike?

Will the jobs data increase the chances of another hike?Beyond June, investors are pricing in around a 30% chance for a quarter-point hike in July, while they are evenly split for August and September. So, as they try to better understand how the RBA could proceed later this year, they may pay attention to the wage price index for Q1 and the employment report for April, due out during the Asian sessions Wednesday and Thursday, respectively.

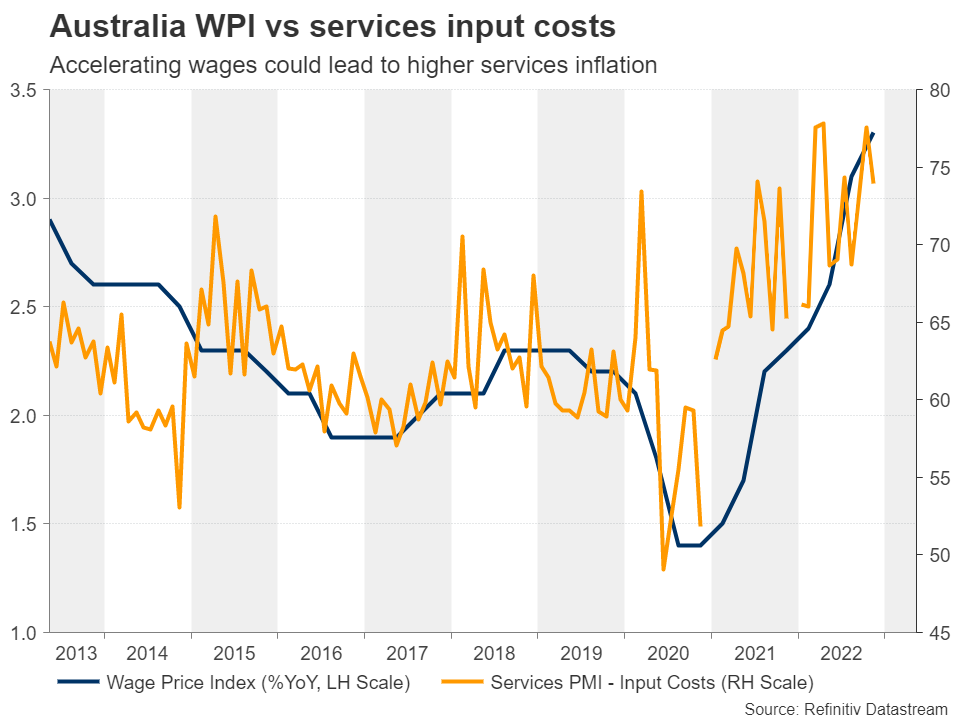

Wages are forecast to have continued to accelerate for the 9th consecutive quarter, which could add to concerns about inflation staying elevated, and although the employment change is expected to show that the economy added less than half the jobs it gained in March, the unemployment rate is seen holding steady at 3.5%, just a tick above its record low of 3.4%.

A tight labor market and rising wage growth, which according to the S&P Global services PMI, is contributing to accelerating price pressures for firms in Australia, could prompt investors to price in a higher probability for a hike during the summer months.

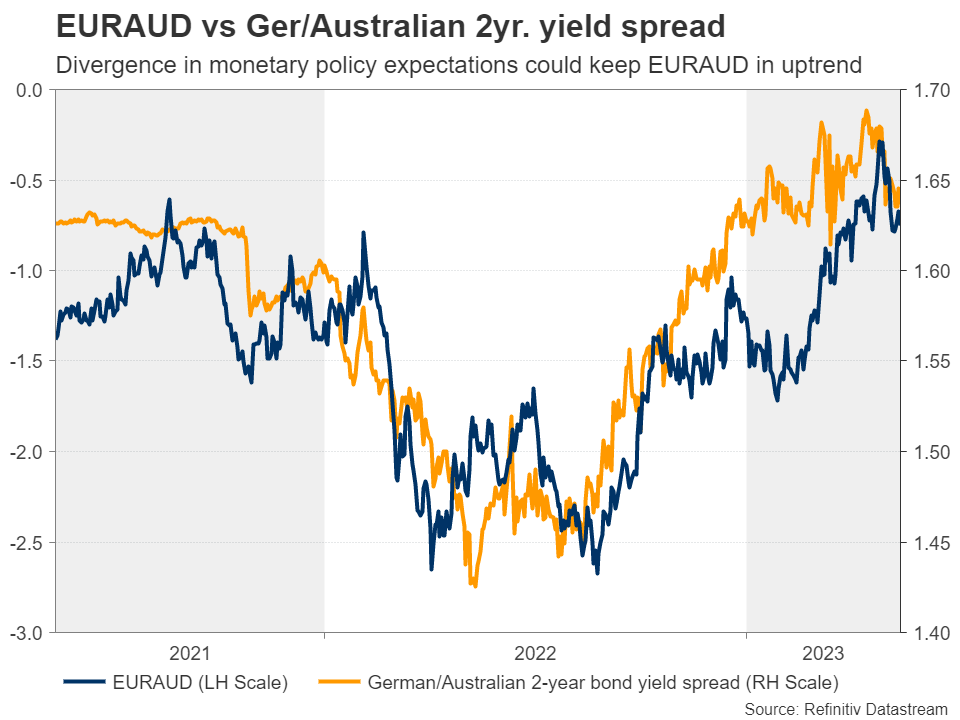

Aussie may be destined to stay weak for a while longerThis could prove positive for the Australian dollar, but its upside may be capped by market participants’ concerns over the outlook of the Chinese economy. With the Fed expected to proceed with nearly three quarter-point cuts by the end of the year, the picture in ausie/dollar may not be so clear, but with the ECB seen hiking by another 50bps, euro/aussie may be destined to continue its uptrend for a while longer, even if the Australian currency temporarily benefits by this week’s data.

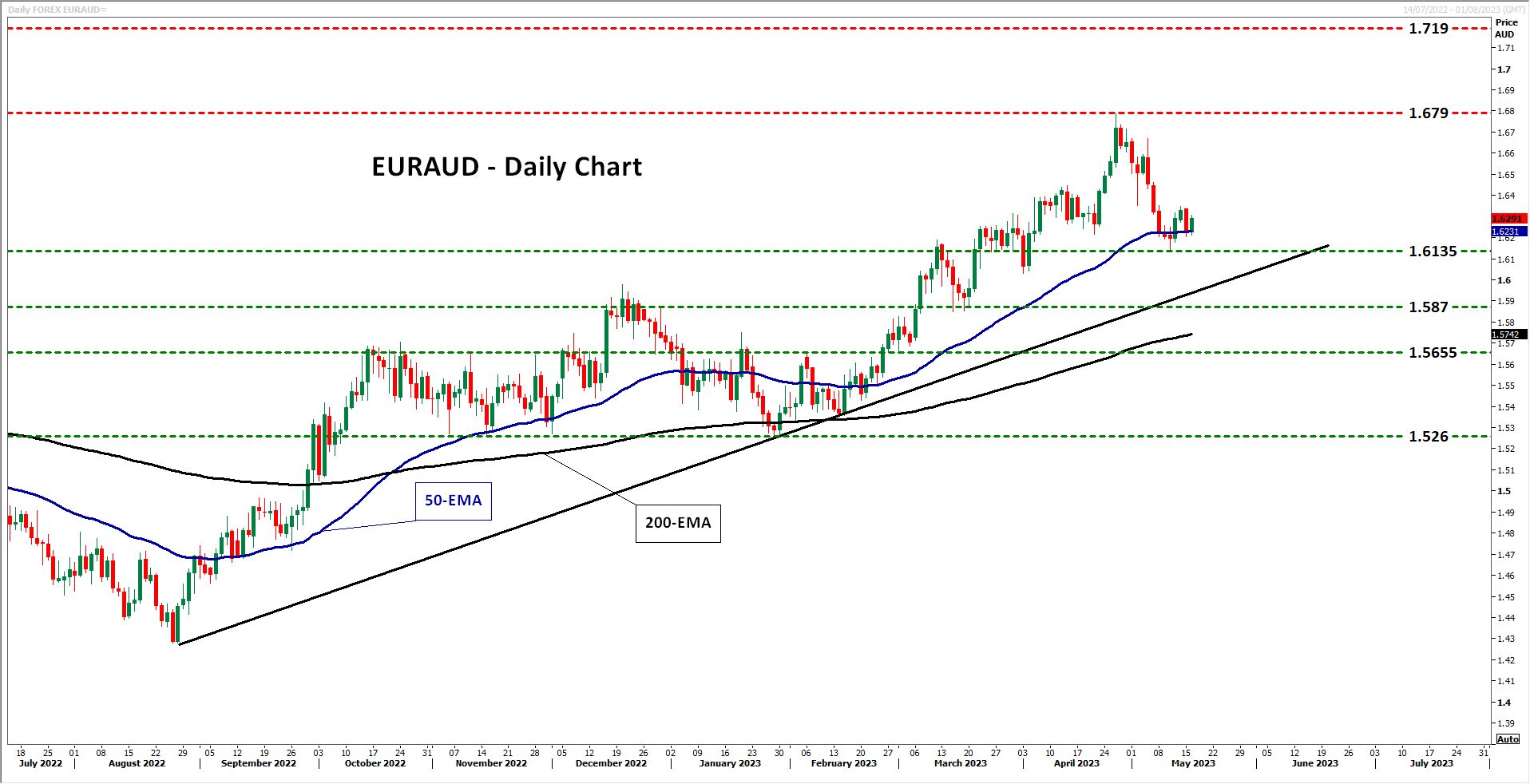

Euro/aussie has been in a sliding mode since April 26, when it hit resistance at 1.6790, a territory that threw the bulls out of the game back in October 2020 as well. Nonetheless, the pair remains above the uptrend line drawn from the low of August 26, which keeps the bigger picture positive.

Even if the slide extends beyond last week’s low of 1.6135, the buyers could still step back into the action from near the uptrend line and perhaps stage another march towards the 1.6790 zone. If they manage to break that zone, they could then put the 1.7190 area on their radar, which offered resistance back in early May 2020.

The outlook could start darkening if the bears are able to break the aforementioned uptrend line, but also the 1.5870 support. Should this happen, they may get encouraged to dive towards the 1.5655 territory, marked by the inside swing high of February 6, the break of which could see scope for extensions towards the 1.5260 area, which acted as a floor between November 4 and January 30.Actifs liés

Dernières actualités

Avertissement : Les entités de XM Group proposent à notre plateforme de trading en ligne un service d'exécution uniquement, autorisant une personne à consulter et/ou à utiliser le contenu disponible sur ou via le site internet, qui n'a pas pour but de modifier ou d'élargir cette situation. De tels accès et utilisation sont toujours soumis aux : (i) Conditions générales ; (ii) Avertissements sur les risques et (iii) Avertissement complet. Un tel contenu n'est par conséquent fourni que pour information générale. En particulier, sachez que les contenus de notre plateforme de trading en ligne ne sont ni une sollicitation ni une offre de participation à toute transaction sur les marchés financiers. Le trading sur les marchés financiers implique un niveau significatif de risques pour votre capital.

Tout le matériel publié dans notre Centre de trading en ligne est destiné à des fins de formation / d'information uniquement et ne contient pas – et ne doit pas être considéré comme contenant – des conseils et recommandations en matière de finance, de fiscalité des investissements ou de trading, ou un enregistrement de nos prix de trading ou une offre, une sollicitation, une transaction à propos de tout instrument financier ou bien des promotions financières non sollicitées à votre égard.

Tout contenu tiers, de même que le contenu préparé par XM, tels que les opinions, actualités, études, analyses, prix, autres informations ou liens vers des sites tiers contenus sur ce site internet sont fournis "tels quels", comme commentaires généraux sur le marché et ne constituent pas des conseils en investissement. Dans la mesure où tout contenu est considéré comme de la recherche en investissement, vous devez noter et accepter que le contenu n'a pas été conçu ni préparé conformément aux exigences légales visant à promouvoir l'indépendance de la recherche en investissement et, en tant que tel, il serait considéré comme une communication marketing selon les lois et réglementations applicables. Veuillez vous assurer que vous avez lu et compris notre Avis sur la recherche en investissement non indépendante et notre avertissement sur les risques concernant les informations susdites, qui peuvent consultés ici.