Will a slowdown in UK inflation change the BoE’s plans? – Forex News Preview

Just last week, the BoE decided to hike rates by another 25bps as was widely anticipated, keeping its forward guidance more or less unchanged, namely that should inflation pressures persist, they will not hesitate to raise rates further. However, the spotlight was thrown on the upside revisions in the economic and inflation projections, with the Bank abandoning its call for a recession.

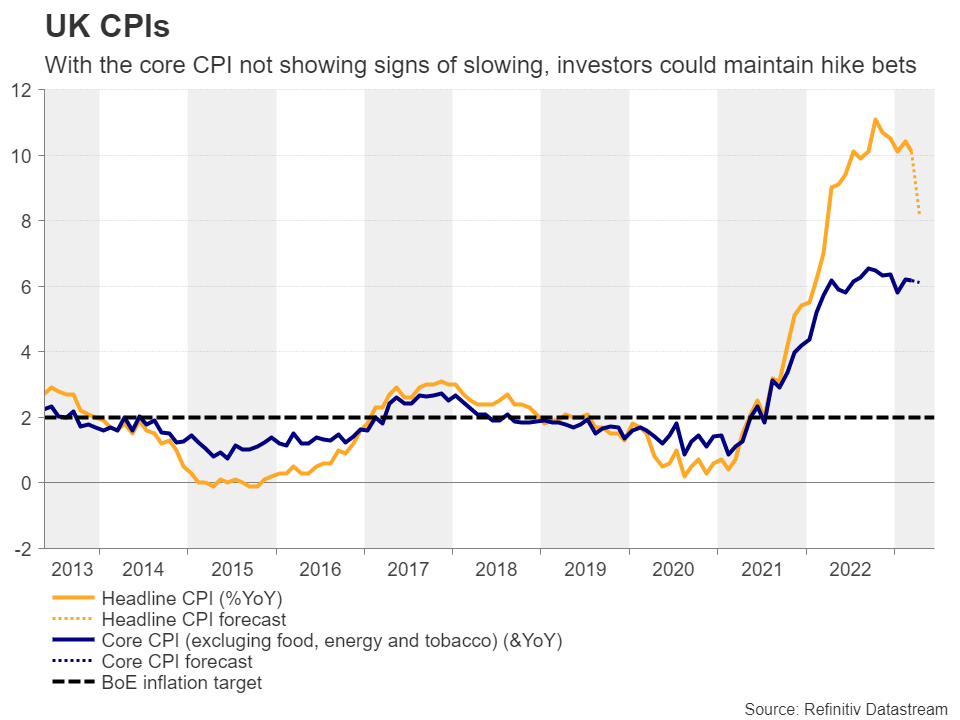

Blending this with Governor Bailey’s remarks that they must “stay the course” to ensure that inflation falls back to the 2% objective, investors were allowed to maintain bets of more rate increases in the months to come. Currently, they are assigning a nearly 80% probability for another quarter-point hike at the June meeting and expect almost one more by the end of the year.

Will the data alter those expectations?

Will the data alter those expectations?Although the manufacturing PMI remained subdued around 2 points below its equilibrium 50 barrier, pointing to contraction for the ninth consecutive month in April, the services index has been expanding for three months now, with April revealing a strong acceleration. This took the composite PMI up to 54.9 from 52.2. Further improvement in the May numbers could increase confidence that the UK economy has dodged a recession and thus, investors will remain convinced that more hikes are coming.

However, they are unlikely to play all their cards just a day ahead of the CPI data, as bringing inflation to heel is the BoE’s top priority. Both the headline and core CPI rates are expected to have declined in April, with the former slipping back below 10%, to 8.2% year-on-year from 10.1%, and the latter ticking down to 6.1% y/y from 6.2%.

That said, according to the April PMIs, price-charged inflation accelerated during the month as private sector firms once again sought to defend margins from rapidly increasing staff costs. This likely tilts the risks surrounding Wednesday’s data to the upside. That said, even if the forecasts are met, inflation would still be well above the BoE’s 2% target, with the core metric not showing signs of sufficient slowdown. For market participants to start scaling back their hike bets, a downside surprise may be needed.

On Friday, retail sales are expected to have contracted again in April, but at a slower pace than in March, which adds to the narrative that inflation may not have cooled down as the forecasts suggest.

Pound could stay in uptrend, especially against aussieThis could further convince investors that another hike is in the BoE’s chamber and that at least another one is likely to follow. Thus, even if the pound corrects lower next week, it could remain in a broader uptrend mode. Nonetheless, exploiting further pound gains against the dollar, which has been receiving massive support from US data and hawkish Fed rhetoric, may not be the wisest choice. With the RBA seen maintaining a soft stance after the disappointment in Australia’s employment report for April and stepping back to the sidelines in June, pound/aussie may be a better option.

Pound/aussie has been in a sliding mode today, after it hit resistance nearly the 1.8830 level on Thursday. However, even if the pair extends its retreat below last week’s lows of 1.8585, the bulls will still have the opportunity to jump back into the action from above the uptrend line drawn from the low of February 2.

If so, they may push for another test at around 1.8830, the break of which could pave the way for the peak of April 28 at around 1.9035. If they are not willing to stop there either, they would then enter territories last seen in February 2022, with the next resistance perhaps being the high of January 28 of that year at 1.9220.

For a bearish trend reversal to start being examined, pound/aussie may need to fall below the 1.8400 zone, which offered support last month. Such a slide may also take the pair below the aforementioned uptrend line and perhaps allow declines towards the low of March 31 at 1.8245.

Actifs liés

Dernières actualités

Avertissement : Les entités de XM Group proposent à notre plateforme de trading en ligne un service d'exécution uniquement, autorisant une personne à consulter et/ou à utiliser le contenu disponible sur ou via le site internet, qui n'a pas pour but de modifier ou d'élargir cette situation. De tels accès et utilisation sont toujours soumis aux : (i) Conditions générales ; (ii) Avertissements sur les risques et (iii) Avertissement complet. Un tel contenu n'est par conséquent fourni que pour information générale. En particulier, sachez que les contenus de notre plateforme de trading en ligne ne sont ni une sollicitation ni une offre de participation à toute transaction sur les marchés financiers. Le trading sur les marchés financiers implique un niveau significatif de risques pour votre capital.

Tout le matériel publié dans notre Centre de trading en ligne est destiné à des fins de formation / d'information uniquement et ne contient pas – et ne doit pas être considéré comme contenant – des conseils et recommandations en matière de finance, de fiscalité des investissements ou de trading, ou un enregistrement de nos prix de trading ou une offre, une sollicitation, une transaction à propos de tout instrument financier ou bien des promotions financières non sollicitées à votre égard.

Tout contenu tiers, de même que le contenu préparé par XM, tels que les opinions, actualités, études, analyses, prix, autres informations ou liens vers des sites tiers contenus sur ce site internet sont fournis "tels quels", comme commentaires généraux sur le marché et ne constituent pas des conseils en investissement. Dans la mesure où tout contenu est considéré comme de la recherche en investissement, vous devez noter et accepter que le contenu n'a pas été conçu ni préparé conformément aux exigences légales visant à promouvoir l'indépendance de la recherche en investissement et, en tant que tel, il serait considéré comme une communication marketing selon les lois et réglementations applicables. Veuillez vous assurer que vous avez lu et compris notre Avis sur la recherche en investissement non indépendante et notre avertissement sur les risques concernant les informations susdites, qui peuvent consultés ici.