What do Q3 earnings hold for Microsoft’s stock? – Stock Markets

Microsoft earnings to be released after market close on October 24

Both earnings and revenue expected to jump on an annual basis

Valuation remains stretched against its tech peers

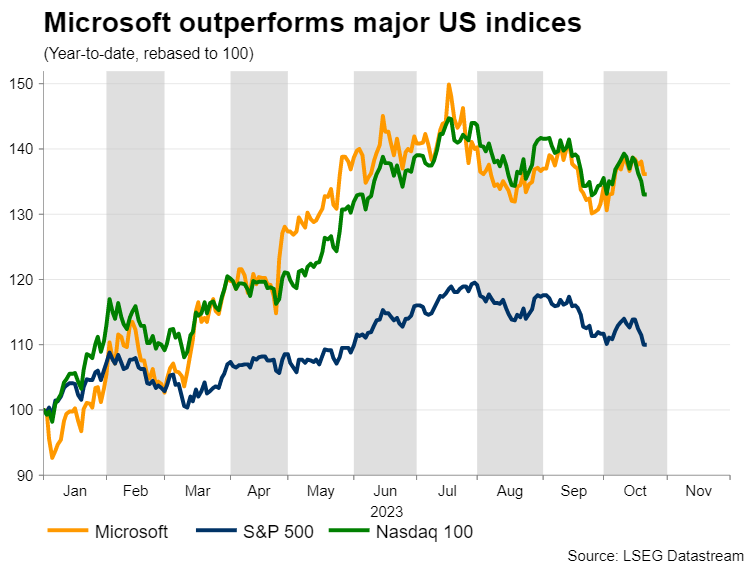

Microsoft has fared relatively well in 2023 amid a broader tech rally driven by the Artificial Intelligence (AI) hype. The second most valuable publicly traded company in the world is considered to be the leader in the AI race due to its close partnership with OpenAI, ChatGPT’s parent.

Besides that, Microsoft has taken actions to diversify its income stream, with its investments in intelligent Cloud and Azure segments attempting to offset the pullback in consumer spending towards its personal computing and gaming consoles products. Therefore, in the Q3 earnings call, investor attention is likely to fall on how the firm’s secondary segments have performed as well as on the guidance for future AI projects.

Meanwhile, in October, Microsoft completed the long-anticipated $69 billion takeover of Activision Blizzard. Although this might be the biggest deal in the gaming industry and solidifies Microsoft’s diversification plan, its financial benefits will be evident from the next earnings report.

Poised for solid fundamentalsMicrosoft is set to post a strong third quarter financial performance despite the weakness in its flagship personal computing division. The latter is forecast to extend its streak of contracting quarters, with analysts projecting a 3.86% drop on an annual basis. However, a 16% growth in the same time horizon for the Intelligent Cloud segment is anticipated to save the day.

Overall, the software giant is projected to report revenue of $54.49 billion, according to consensus estimates by Refinitiv IBES, which would represent a year-on-year growth of 8.73%. Earnings per share (EPS) are estimated to jump to $2.65, producing an increase of 12.82% compared to the same quarter a year ago.

Meanwhile, investors will be closely eyeing the firm’s profit margins, which are projected to decline slightly due to higher capital expenditure for the research and development of new products in the AI field.

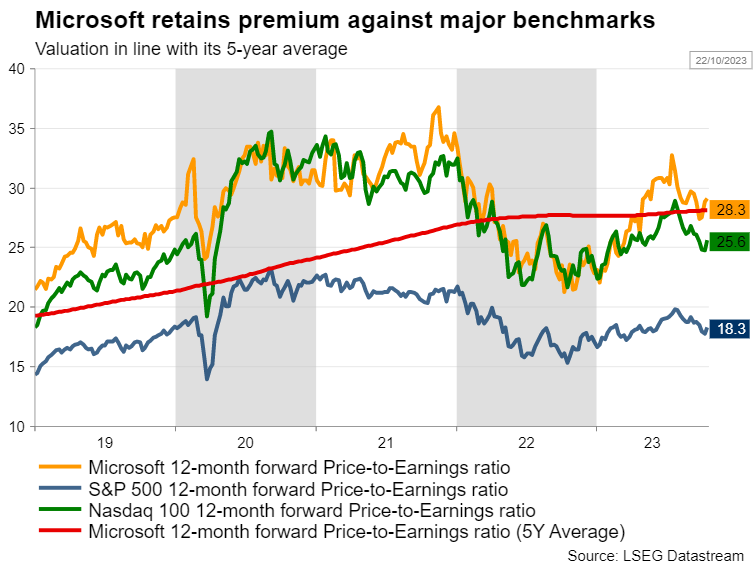

Valuation looks pricey against benchmarksFrom a valuation perspective, Microsoft appears to be trading with a premium against its major tech competitors, which could have two different interpretations. On the one hand, investors might be confident that the firm has an edge regarding the adoption of AI technology relative to its peers, but it could also mean that the share price is currently overvalued.

Specifically, its forward 12-month P/E ratio is currently at 28.3x, with most of its major competitors and relative benchmarks retaining significantly lower figures. This aggressive pricing opens the door for significant downside in the case that Microsoft fails to live up to its expectations within the AI sector.

In Microsoft’s defence though, it is clear that the valuation has corrected from its 2020-2021 exorbitant levels, with the forward P/E ratio hovering around its five-year average.

Key technical levels to watchIn 2023, Microsoft’s stock surged to a fresh all-time high of $367.00 before experiencing a pullback alongside broader stock markets. In the near-term, the price remains supported by the 50-day simple moving average (SMA) ahead of the Q3 earnings report.

To the upside, upbeat financials could propel the price towards the September high of $341.00. Even higher, the June peak of $351.00 could be targeted.

Alternatively, should earnings disappoint, the price could descend towards the September low of $310.00. A violation of that zone could open the door for the $295.00 hurdle.Actifs liés

Dernières actualités

Avertissement : Les entités de XM Group proposent à notre plateforme de trading en ligne un service d'exécution uniquement, autorisant une personne à consulter et/ou à utiliser le contenu disponible sur ou via le site internet, qui n'a pas pour but de modifier ou d'élargir cette situation. De tels accès et utilisation sont toujours soumis aux : (i) Conditions générales ; (ii) Avertissements sur les risques et (iii) Avertissement complet. Un tel contenu n'est par conséquent fourni que pour information générale. En particulier, sachez que les contenus de notre plateforme de trading en ligne ne sont ni une sollicitation ni une offre de participation à toute transaction sur les marchés financiers. Le trading sur les marchés financiers implique un niveau significatif de risques pour votre capital.

Tout le matériel publié dans notre Centre de trading en ligne est destiné à des fins de formation / d'information uniquement et ne contient pas – et ne doit pas être considéré comme contenant – des conseils et recommandations en matière de finance, de fiscalité des investissements ou de trading, ou un enregistrement de nos prix de trading ou une offre, une sollicitation, une transaction à propos de tout instrument financier ou bien des promotions financières non sollicitées à votre égard.

Tout contenu tiers, de même que le contenu préparé par XM, tels que les opinions, actualités, études, analyses, prix, autres informations ou liens vers des sites tiers contenus sur ce site internet sont fournis "tels quels", comme commentaires généraux sur le marché et ne constituent pas des conseils en investissement. Dans la mesure où tout contenu est considéré comme de la recherche en investissement, vous devez noter et accepter que le contenu n'a pas été conçu ni préparé conformément aux exigences légales visant à promouvoir l'indépendance de la recherche en investissement et, en tant que tel, il serait considéré comme une communication marketing selon les lois et réglementations applicables. Veuillez vous assurer que vous avez lu et compris notre Avis sur la recherche en investissement non indépendante et notre avertissement sur les risques concernant les informations susdites, qui peuvent consultés ici.