RBA could opt for a stronger aussie at Tuesday’s rate decision – Forex News Preview

With the market enjoying a quieter April, compared to the hyped March, the next month starts on a high note with an RBA meeting. The market is currently assigning a 70% probability for no change on Tuesday morning with the remaining 30% pointing to a 25bps rate hike. Last month’s rate decision somewhat surprised the evenly split analysts’ polls and there is a good chance of another surprise at this meeting. Based on both the April meeting statement and accompanying minutes, the RBA has kept the door open for further rate hike(s) ahead, if given sufficient evidence.

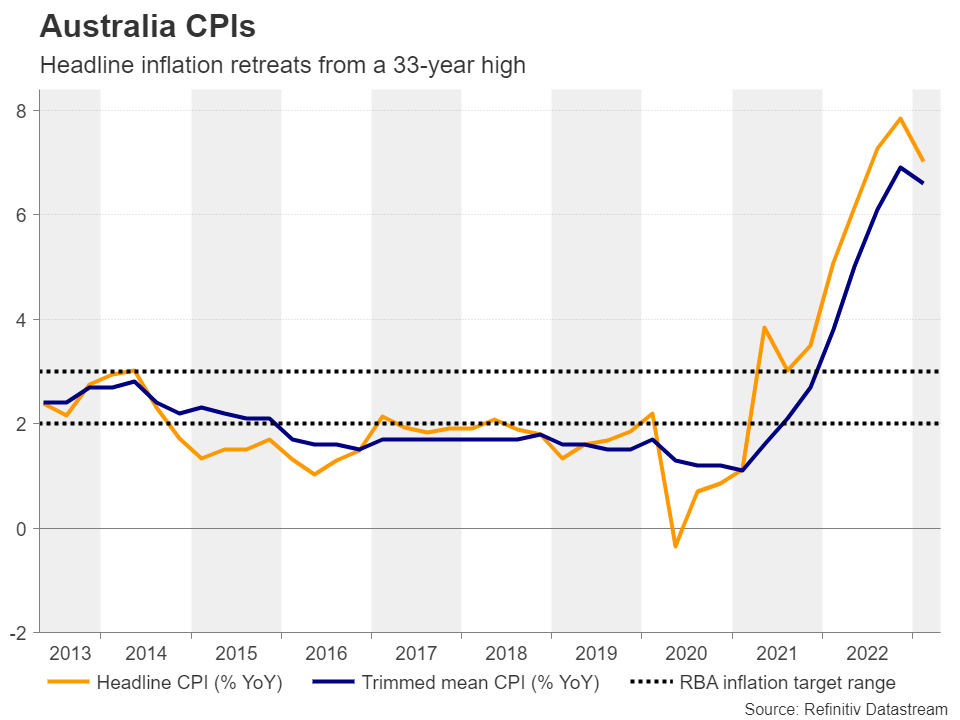

The situation on the ground remains on the positive side. The unemployment rate is at a record-low level, trade balances have edged higher again, and inflation continues its downward path from extremely elevated levels. On the other hand, business surveys and particularly the S&P Global Manufacturing PMI are flashing red, the housing sector is crying out loud for some support from the RBA and the authorities, and the recent encouraging set of data from China are clearly causing heated discussions at the RBA.

Luckily for the market, next week also brings the quarterly Statement of Monetary Policy. This will be released on Friday and will contain the usual economic forecasts. All eyes will be on the headline and trimmed mean inflation forecasts, which at the February edition of this publication, were projected at 3% on a 2-year horizon. A possible pause on Tuesday would most likely be justified by lower projections on Friday at both the inflation figures and the wage price index.

Changes coming at the RBAIt is worth nothing that there is an ongoing process of updating the remit and the structure of the RBA. There seems to be a push for modernization, closer to the standards set by the top-3 central banks. For example, the RBA looks poised to get a much-wanted post-decision press conference and just eight meetings in each calendar year. But they might try to avoid the BoE’s approach of publishing the respective rate decision, the meeting minutes, and the quarterly bulletin on the same day.

Other data in the calendarApart from the RBA meeting and the Statement of Monetary policy, the calendar next week is pretty full. The final prints of the S&P Global PMIs and the March trade balance are expected to shed more light on China’s impact, while a strong print at Wednesday’s retail sales could point to more durable consumer spending ahead on the back of stronger wage increases. Unsurprisingly, the RBA will probably have an early peek at this data to have a fuller understanding of the underlying economic conditions.

Aussie: possible reaction to the RBA decision

Aussie: possible reaction to the RBA decisionThe aussie has been having a bad year against both the yen and US dollar. A rate hike announcement from the RBA on Tuesday is poised to result in some aussie outperformance, especially if the post-meeting statement points to a strong possibility of further hikes. On the other hand, no change at the cash rate would not shock the market, but the aussie would show some degree of abandonment from the RBA. Hence, the risk is asymmetric with the market reacting more forcefully in case of a surprise rate hike.

Aussie/yen at a crossroadsThe rally that started in March 2020 reached its peak on September 13, 2022. Since then, aussie/yen has entered a correction phase and it is currently trading around the 50% Fibonacci retracement of the August 20, 2021 – September 13, 2022 uptrend at 88.19. The overall technical picture is rather mixed at this stage with the momentum indicators sending a message of caution.

An upside surprise on Tuesday morning could push this pair towards the 90.29-90.29 range, defined by the September 21, 2017 high and the 38.2% Fibonacci retracement respectively.

On the other hand, an unchanged RBA rate along with dovish rhetoric will probably open the door for a lower print in aussie/yen with the 61.8% Fibonacci retracement at 86.76 looking like a decent area for aussie bulls to set up their defense.

Actifs liés

Dernières actualités

Avertissement : Les entités de XM Group proposent à notre plateforme de trading en ligne un service d'exécution uniquement, autorisant une personne à consulter et/ou à utiliser le contenu disponible sur ou via le site internet, qui n'a pas pour but de modifier ou d'élargir cette situation. De tels accès et utilisation sont toujours soumis aux : (i) Conditions générales ; (ii) Avertissements sur les risques et (iii) Avertissement complet. Un tel contenu n'est par conséquent fourni que pour information générale. En particulier, sachez que les contenus de notre plateforme de trading en ligne ne sont ni une sollicitation ni une offre de participation à toute transaction sur les marchés financiers. Le trading sur les marchés financiers implique un niveau significatif de risques pour votre capital.

Tout le matériel publié dans notre Centre de trading en ligne est destiné à des fins de formation / d'information uniquement et ne contient pas – et ne doit pas être considéré comme contenant – des conseils et recommandations en matière de finance, de fiscalité des investissements ou de trading, ou un enregistrement de nos prix de trading ou une offre, une sollicitation, une transaction à propos de tout instrument financier ou bien des promotions financières non sollicitées à votre égard.

Tout contenu tiers, de même que le contenu préparé par XM, tels que les opinions, actualités, études, analyses, prix, autres informations ou liens vers des sites tiers contenus sur ce site internet sont fournis "tels quels", comme commentaires généraux sur le marché et ne constituent pas des conseils en investissement. Dans la mesure où tout contenu est considéré comme de la recherche en investissement, vous devez noter et accepter que le contenu n'a pas été conçu ni préparé conformément aux exigences légales visant à promouvoir l'indépendance de la recherche en investissement et, en tant que tel, il serait considéré comme une communication marketing selon les lois et réglementations applicables. Veuillez vous assurer que vous avez lu et compris notre Avis sur la recherche en investissement non indépendante et notre avertissement sur les risques concernant les informations susdites, qui peuvent consultés ici.