Daily Market Comment – US inflation report awaited for direction as stocks, dollar drift

- Nerves kick in as debt ceiling talks drag on, uncertainty builds ahead of US CPI

- Dollar pares some gains, euro bounces off lows but lacks momentum

- Wall Street slides as bank stocks remain under pressure, default risks rise

Caution sets in before inflation data

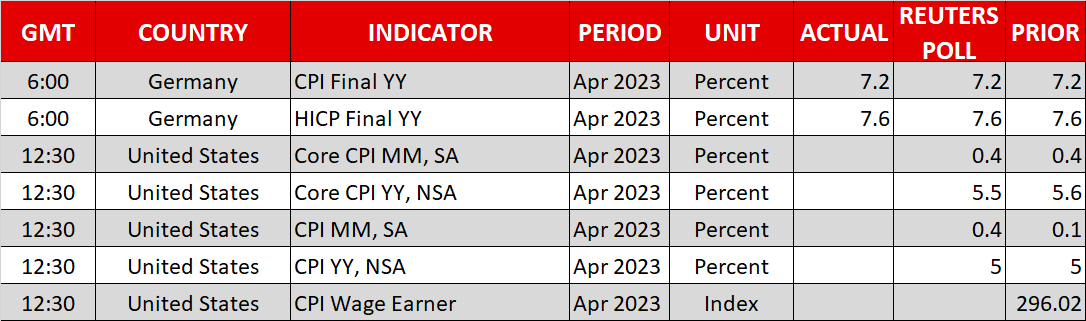

Caution sets in before inflation dataMarkets continued to struggle for direction on Wednesday amid some anxiety ahead of the April inflation report out of the United States later in the day and an ongoing stalemate in Congress over raising the debt ceiling. With the Fed clearly signalling that it remains in data-dependent mode, a pause in June hangs in the balance and today’s CPI figures could be what tips the odds in either direction.

The consumer price index is expected to have risen by 5.0% over the year to April, which would signal a stall in the progress to bring inflation down following an uninterrupted decline from the peak of 9.1% in June 2022. However, there may be some good news from the core CPI front, as it is projected to have dipped slightly to 5.5%.

If the latest PMI surveys and the Cleveland Fed’s Nowcast inflation tracker are to be believed, the risks are tilted towards an upside surprise.

After Friday’s robust NFP numbers, a hot CPI reading would cast further doubt on market bets that the Fed will begin cutting rates in the second half of the year. It is those bets that have been propping up shares on Wall Street during what has been an uninspiring earnings season, while the US dollar has been hammered against currencies like the euro and pound due to the divergence in the monetary policies.

Debt ceiling drama rumbles onAnother source of concern lately is the growing risk of a US debt default as Democrats and Republicans remain far apart on reaching a deal to raise the debt ceiling. The White House is trying to up the pressure by warning that the government could run out of cash as early as June 1, but Republicans are not giving any ground in the negotiations.

House speaker and Republican majority leader Kevin McCarthy told reporters he “didn’t see any new movement” after his meeting with President Biden yesterday. But Congressional leaders are due to meet again on Friday and this is providing some relief for traders.

Disney earnings eyed amid banking gloomUS stock futures started Wednesday in the red, extending yesterday’s losses. Bank stocks staged a modest but unconvincing rebound on Tuesday after coming under renewed pressure on Monday. The Fed’s latest loan officer survey did not point to anything too alarming in credit conditions in the aftermath of the banking turmoil and profitability in the sector hit an all-time high in the first quarter.

Nevertheless, confidence in smaller regional banks remains very low amid worries that there are more failures to come.

Disappointing earnings forecasts from PayPal and Skyworks also weighed on the broader market on Tuesday, while Disney will come under the spotlight today when it announces its results.

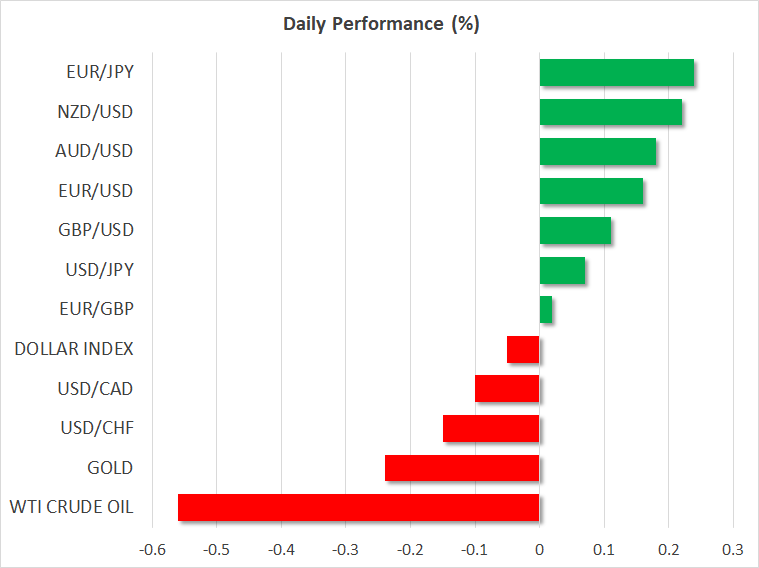

Dollar flat as euro lags and sterling climbs ahead of BoEIn currencies, the US dollar was more or less flat against a basket of currencies, with the euro slipping marginally and the pound crawling higher.

The euro has been underperforming over the past week following a batch of poor data out of the Eurozone’s powerhouse, Germany. The sudden deterioration of the German economy has prompted investors to scale back their rate hike expectations for the European Central Bank even though policymakers have not toned down their hawkish rhetoric.

The pound, meanwhile, has been benefiting from better-than-expected economic indicators as well as bets that the Bank of England will raise rates several more times this year, of which the next is anticipated to be announced tomorrow.

Actifs liés

Dernières actualités

Avertissement : Les entités de XM Group proposent à notre plateforme de trading en ligne un service d'exécution uniquement, autorisant une personne à consulter et/ou à utiliser le contenu disponible sur ou via le site internet, qui n'a pas pour but de modifier ou d'élargir cette situation. De tels accès et utilisation sont toujours soumis aux : (i) Conditions générales ; (ii) Avertissements sur les risques et (iii) Avertissement complet. Un tel contenu n'est par conséquent fourni que pour information générale. En particulier, sachez que les contenus de notre plateforme de trading en ligne ne sont ni une sollicitation ni une offre de participation à toute transaction sur les marchés financiers. Le trading sur les marchés financiers implique un niveau significatif de risques pour votre capital.

Tout le matériel publié dans notre Centre de trading en ligne est destiné à des fins de formation / d'information uniquement et ne contient pas – et ne doit pas être considéré comme contenant – des conseils et recommandations en matière de finance, de fiscalité des investissements ou de trading, ou un enregistrement de nos prix de trading ou une offre, une sollicitation, une transaction à propos de tout instrument financier ou bien des promotions financières non sollicitées à votre égard.

Tout contenu tiers, de même que le contenu préparé par XM, tels que les opinions, actualités, études, analyses, prix, autres informations ou liens vers des sites tiers contenus sur ce site internet sont fournis "tels quels", comme commentaires généraux sur le marché et ne constituent pas des conseils en investissement. Dans la mesure où tout contenu est considéré comme de la recherche en investissement, vous devez noter et accepter que le contenu n'a pas été conçu ni préparé conformément aux exigences légales visant à promouvoir l'indépendance de la recherche en investissement et, en tant que tel, il serait considéré comme une communication marketing selon les lois et réglementations applicables. Veuillez vous assurer que vous avez lu et compris notre Avis sur la recherche en investissement non indépendante et notre avertissement sur les risques concernant les informations susdites, qui peuvent consultés ici.