Daily Market Comment – US inflation dips below 5% but dollar quickly bounces back

- US CPI eases to two-year low, fuelling Fed rate cut expectations

- Yields decline but dollar advances after limited selloff

- Pound in the spotlight today as BoE expected to hike again

Fed pause looking more likely after CPI dip

Fed pause looking more likely after CPI dipDespite some concerns that inflation would quicken in April, the latest CPI readings signalled continued progress for the Fed in its fight to restore price stability. The US consumer price index rose by 4.9% y/y last month, missing expectations that the rate would stay unchanged at 5.0%. The core CPI rate also moderated slightly, but it was in line with forecasts of 5.5%.

There had been some speculation that inflation would come in hotter than expected. So the fact that the headline rate has fallen to the lowest since April 2021 is good news not just for the Fed but also for risk sentiment, which has been somewhat subdued lately.

The Fed signalled last week that it is close to hitting the pause button, but one final rate hike cannot be completely ruled out in June should the incoming data continue to raise concerns that the labour market and price pressures are not cooling fast enough.

However, a June pause is looking almost certain following the softer-than-expected CPI report, while traders have also ramped up their bets of rate cuts from July onwards. A 25-basis-point rate cut is almost fully priced in for September and Treasury yields have come under renewed pressure.

The 10-year Treasury yield is heading back towards 3.4%, while the two-year yield has slipped below 4.0% again.

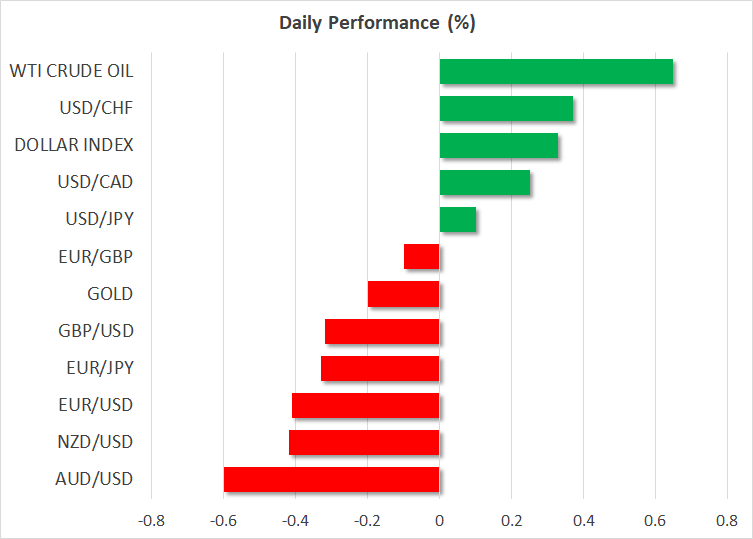

Dollar in surprise rebound as euro and aussie struggleHowever, after a knee-jerk tumble from the data, the US dollar has delinked from Treasuries today, more than recouping yesterday’s losses. The dollar index brushed a one-week high earlier in the session as the euro slid to three-week lows. Hawkish language from ECB policymakers does not seem to be helping the euro much after a worrying batch of German indicators in recent days sparked fresh recession fears.

The ECB has been very resolute in its message that several more rate hikes are in the pipeline. But despite confounding expectations in 2022, the German economy may not be so resilient after all and this is troubling investors. A weak economic recovery in China is worsening those jitters as it doesn’t bode well for European exporters.

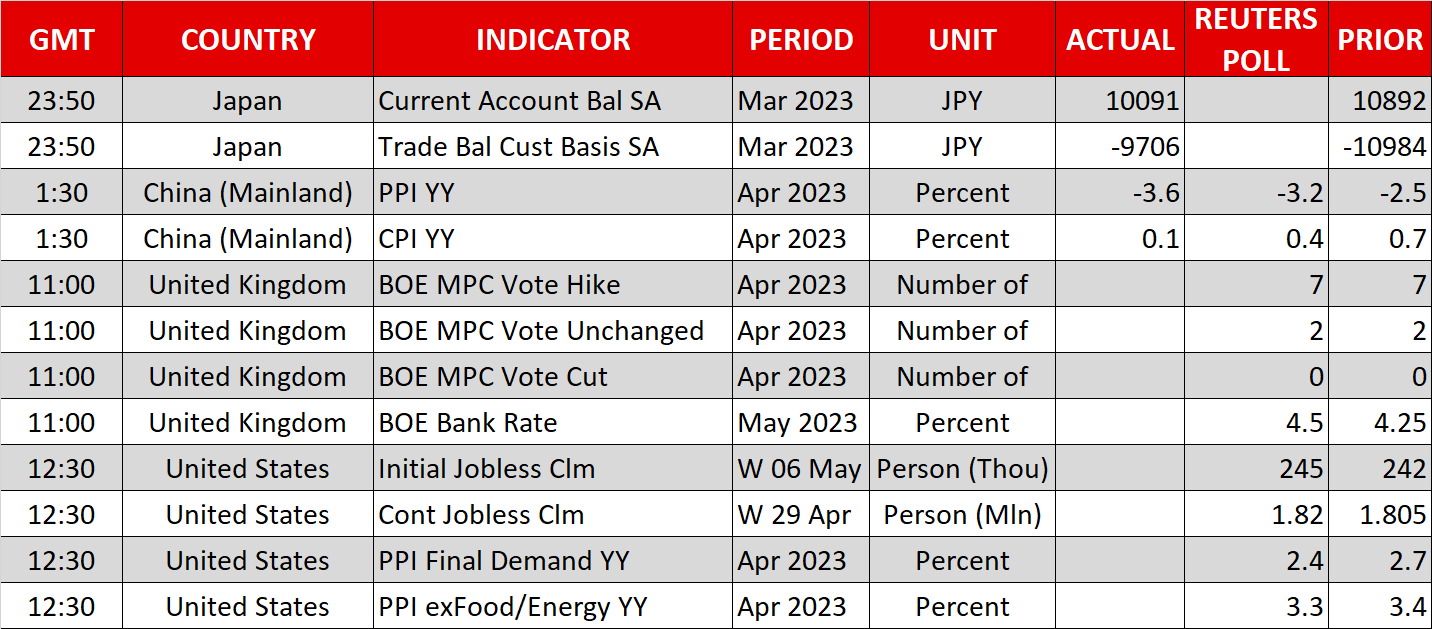

Consumer prices in China rose by less than forecast in April, while producer prices fell deeper into negative territory. Today’s data follows equally disappointing trades figures on Tuesday, adding to concerns about China’s post-pandemic growth prospects.

The Australian dollar is the worst performing currency so far on Thursday, plunging to around $0.6730.

Pound losses kept under check ahead of BoE decisionThe pound is down too but is keeping a lid on its losses as the Bank of England is anticipated to hike interest rates for the 12th straight meeting today as inflation in the UK remains in double-digit figures. However, there is a risk that policymakers may flag a shallower rate path than what markets have priced in based on predictions that inflation will fall rapidly in the coming months.

The Bank is due to announce its decision at 11:00 GMT with Governor Bailey set to give his press conference 30 minutes later.

Investors will also be on standby for any comments on monetary policy from Fed Governor Christopher Waller who is scheduled to speak at 14:15 GMT.

Stocks cheer CPI report but no euphoriaShares on Wall Street closed mostly higher on Wednesday, with the Nasdaq Composite (+1.0%) leading the gains and the Dow Jones (-0.1%) bucking the trend to close in the red. The tech-focused- Nasdaq got a major boost from Alphabet after the company provided more details about its AI ambitions and on how it plans to integrate AI into its various Google services.

E-mini futures are following European indices higher today. Strong European earnings results are helping to lift sentiment amid a number of uncertainties weighing on investors’ minds, the latest being the debt ceiling standoff in the US.

That could have been one of the factors putting a cap on gains on Wall Street yesterday. Given that underneath the pleasing headline CPI figure there were other encouraging signs, such as shelter costs increasing at a more tepid pace, one would have expected a much more resounding positive reaction in equities.

It’s likely that lingering fears about the banking sector are also holding some investors back. Today, it could be Walt Disney stock that drags US equities lower after the company announced it lost four million subscribers in the last quarter.

Actifs liés

Dernières actualités

Avertissement : Les entités de XM Group proposent à notre plateforme de trading en ligne un service d'exécution uniquement, autorisant une personne à consulter et/ou à utiliser le contenu disponible sur ou via le site internet, qui n'a pas pour but de modifier ou d'élargir cette situation. De tels accès et utilisation sont toujours soumis aux : (i) Conditions générales ; (ii) Avertissements sur les risques et (iii) Avertissement complet. Un tel contenu n'est par conséquent fourni que pour information générale. En particulier, sachez que les contenus de notre plateforme de trading en ligne ne sont ni une sollicitation ni une offre de participation à toute transaction sur les marchés financiers. Le trading sur les marchés financiers implique un niveau significatif de risques pour votre capital.

Tout le matériel publié dans notre Centre de trading en ligne est destiné à des fins de formation / d'information uniquement et ne contient pas – et ne doit pas être considéré comme contenant – des conseils et recommandations en matière de finance, de fiscalité des investissements ou de trading, ou un enregistrement de nos prix de trading ou une offre, une sollicitation, une transaction à propos de tout instrument financier ou bien des promotions financières non sollicitées à votre égard.

Tout contenu tiers, de même que le contenu préparé par XM, tels que les opinions, actualités, études, analyses, prix, autres informations ou liens vers des sites tiers contenus sur ce site internet sont fournis "tels quels", comme commentaires généraux sur le marché et ne constituent pas des conseils en investissement. Dans la mesure où tout contenu est considéré comme de la recherche en investissement, vous devez noter et accepter que le contenu n'a pas été conçu ni préparé conformément aux exigences légales visant à promouvoir l'indépendance de la recherche en investissement et, en tant que tel, il serait considéré comme une communication marketing selon les lois et réglementations applicables. Veuillez vous assurer que vous avez lu et compris notre Avis sur la recherche en investissement non indépendante et notre avertissement sur les risques concernant les informations susdites, qui peuvent consultés ici.