Daily Market Comment – Dollar’s woes deepen ahead of US retail sales data, stocks rejoice

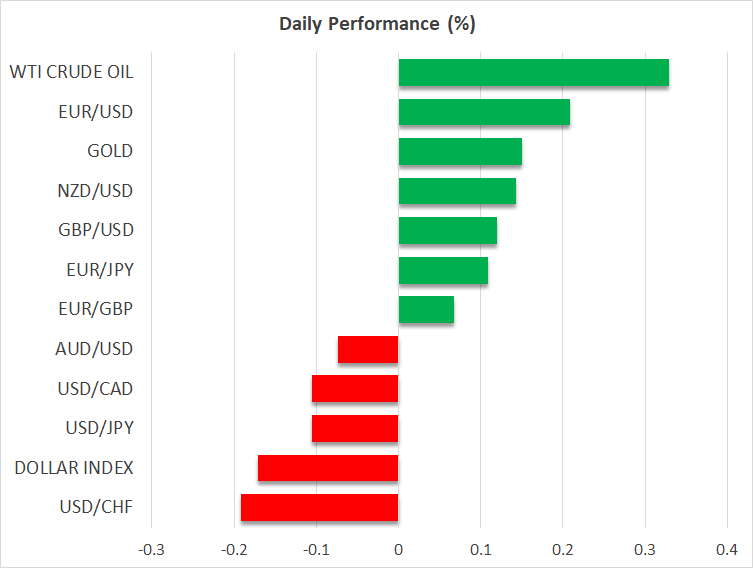

- US dollar slumps to one-year low as soft data bolsters case for Fed pause

- Wall Street rallies on Fed bets, but bank earnings pose a downside risk

- Fed-ECB divergence pushes euro towards $1.11, yen selloff eases

Fed pause seen more likely after latest US data batch

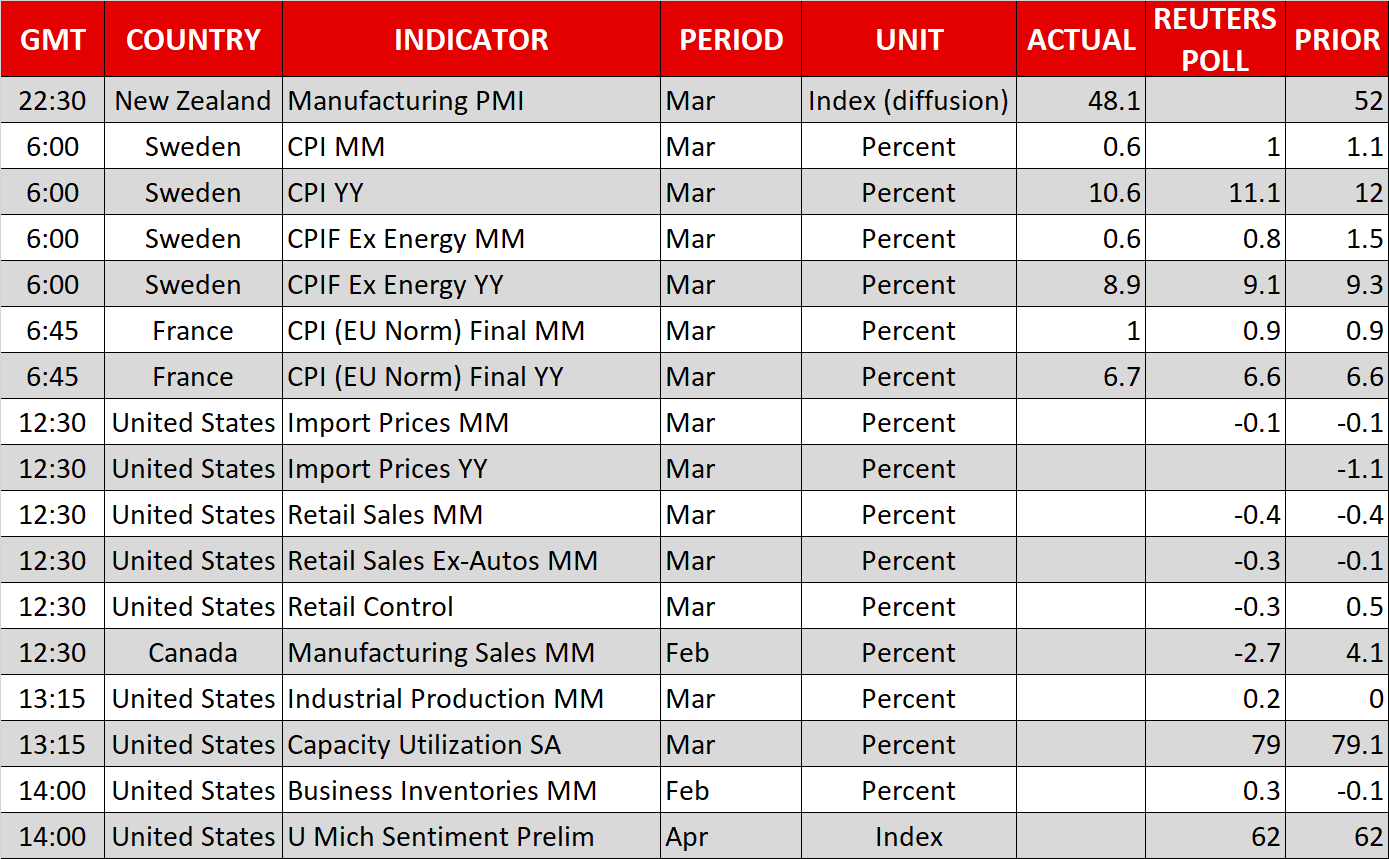

Fed pause seen more likely after latest US data batchIt’s been another week of underwhelming data releases out of the United States, and after the latest figures on consumer and producer prices added to the softening economic picture highlighted by last week’s ISM PMIs, the upbeat March jobs report is now seen as the outlier. Wednesday’s weaker-than-expected CPI data was followed by similarly weak PPI numbers on Thursday.

Factory gate inflation decelerated sharply in March, with almost all readings coming in both below the forecasts and the prior month’s figures. In addition, weekly jobless claims ticked back up to 239k towards recent revised highs, in a further sign that the US economy appears to have lost some steam.

This puts the spotlight on today’s retail sales report. The forecasts are already quite grim as retail sales are projected to have fallen by 0.4% for the second straight month. However, the downbeat expectations make an upside surprise more likely so there is a danger that traders might get wrong footed amid the growing market consensus of a Fed pause after May.

Dollar licks its wounds at one-year lowsThe US dollar has taken quite a beating since the banking crisis, which increased the risk of a recession in America on the expectation that the turmoil would tighten credit conditions across the economy.

Although the panic has subsided and Fed officials appear less worried about a downturn than they were at the March meeting, which took place at the height of the crisis, most of the data now seems to be pointing to declining momentum in both growth and price pressures, potentially due to the effects of the Fed’s previous rate hikes starting to kick in.

Subsequently, the greenback has been under increasing pressure over the past month and the dollar index just brushed a one-year low, having retreated about 12% from the peaks of last September.

The US currency is looking somewhat vulnerable to upside corrections against major pairs such as the euro, pound and the Australian dollar. Though, not so much against the Japanese yen, which is contending with its own bout of weakness.

However, even if there are some gains in store for the greenback from a positive retail sales print, any rebound is likely to be short-lived given that markets seem convinced about the Fed cutting rates towards the end of the year.

Euro extends uptrend as monetary divergence in focusThe euro is perhaps the best example why Fed expectations are weighing so heavily on the dollar. In quite a turnaround from where things stood at the start of the global tightening cycle, the ECB is now in a position to be the last hawk standing. Slovenia’s central bank head Bostjan Vasle yesterday suggested that the ECB’s May policy decision will be between a 25- or 50-bps rate hike.

The euro is extending its gains today, climbing to a fresh one-year high of $1.1075. Sterling is steady around $1.2510, while the aussie is paring some of yesterday’s advances.

The Australian dollar has been boosted this week from stronger-than-expected employment numbers out of the country, as well as encouraging trade figures from China.

It’s been a tougher period for the yen, however, as the Bank of Japan’s new chief Kazuo Ueda once again downplayed the likelihood of any significant policy tightening despite faster wage growth, as he predicted that inflation would fall back below 2% later this year. Nevertheless, the Japanese currency was broadly firmer on Friday and the dollar slipped slightly to around 132.30 yen.

Tech stocks fly again but some caution ahead of bank earningsOn Wall Street, hopes that a Fed pause is just around the corner are lifting spirits even as recession risks remain elevated. The S&P 500 closed up 1.3% on Thursday, hitting a two-month high.

Tech stocks also rallied, led by Netflix (4.6%), pushing the Nasdaq Composite up by 2.0%. Netflix is due to report its earnings next week and investors are optimistic that its new ad-tier subscription model will have boosted revenue.

In the meantime, however, all eyes will be on today’s bank earnings, with JPMorgan, Wells Fargo and Citigroup due to report their Q1 financial results. Markets will be watching to see whether the major lenders were affected at all from the stress within the regional banking sector consisting mainly of small- and medium-sized banks. E-mini futures are trading marginally lower ahead of the earnings releases.

If there’s an indication that lending standards have tightened significantly, that could spoil the latest rally on Wall Street.

Actifs liés

Dernières actualités

Avertissement : Les entités de XM Group proposent à notre plateforme de trading en ligne un service d'exécution uniquement, autorisant une personne à consulter et/ou à utiliser le contenu disponible sur ou via le site internet, qui n'a pas pour but de modifier ou d'élargir cette situation. De tels accès et utilisation sont toujours soumis aux : (i) Conditions générales ; (ii) Avertissements sur les risques et (iii) Avertissement complet. Un tel contenu n'est par conséquent fourni que pour information générale. En particulier, sachez que les contenus de notre plateforme de trading en ligne ne sont ni une sollicitation ni une offre de participation à toute transaction sur les marchés financiers. Le trading sur les marchés financiers implique un niveau significatif de risques pour votre capital.

Tout le matériel publié dans notre Centre de trading en ligne est destiné à des fins de formation / d'information uniquement et ne contient pas – et ne doit pas être considéré comme contenant – des conseils et recommandations en matière de finance, de fiscalité des investissements ou de trading, ou un enregistrement de nos prix de trading ou une offre, une sollicitation, une transaction à propos de tout instrument financier ou bien des promotions financières non sollicitées à votre égard.

Tout contenu tiers, de même que le contenu préparé par XM, tels que les opinions, actualités, études, analyses, prix, autres informations ou liens vers des sites tiers contenus sur ce site internet sont fournis "tels quels", comme commentaires généraux sur le marché et ne constituent pas des conseils en investissement. Dans la mesure où tout contenu est considéré comme de la recherche en investissement, vous devez noter et accepter que le contenu n'a pas été conçu ni préparé conformément aux exigences légales visant à promouvoir l'indépendance de la recherche en investissement et, en tant que tel, il serait considéré comme une communication marketing selon les lois et réglementations applicables. Veuillez vous assurer que vous avez lu et compris notre Avis sur la recherche en investissement non indépendante et notre avertissement sur les risques concernant les informations susdites, qui peuvent consultés ici.