Daily Market Comment – Crude oil powers higher, dollar quiet after ISM data

OPEC kicks the can down the road

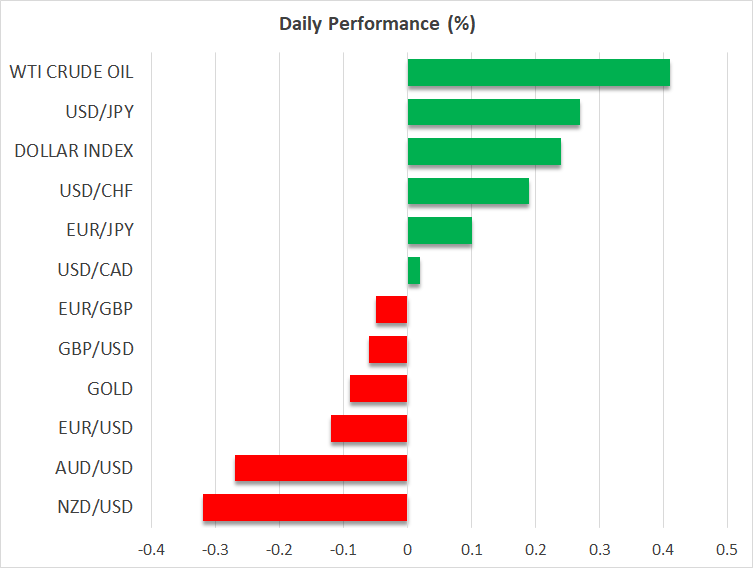

OPEC kicks the can down the roadCrude oil prices stormed higher yesterday to touch levels not seen since late 2018 after the world's most powerful oil cartel did not signal any further increases to its production levels beyond July, as some feared. The producers apparently didn't even discuss any future supply boost, postponing any decisions until the next meeting in early July.

At that point the OPEC+ alliance will have more clarity around the demand side of the equation, and more crucially, whether there's a breakthrough in the US-Iran nuclear negotiations that ultimately brings an overflow of lost supply back online.

Oil's fortunes now hang on diplomatic forces. If there is a deal with Iran, prices will likely suffer a deep correction but perhaps not a trend reversal. OPEC could help balance things out by slowing its own production increases to prevent Iranian barrels from flooding the market.

The Canadian dollar initially rode the crude oil wave higher, climbing to its best levels since 2015, before pulling back. The fundamental story for Canada is still bright, with a solid domestic economy, a central bank that's taking its foot off the gas, and beneficial spillovers from US federal spending. That said, the psychological zone of $1.20 has been a fortress for dollar/loonie lately.

Dollar and stocks drift sidewaysIn the broader market, it was a rather quiet session. The dollar couldn't capitalize on a stronger-than-expected ISM manufacturing report, as the details were mixed. On the bright side, new orders surged and inflationary pressures seem to have stabilized, albeit at an extreme level.

However, supply chain issues are still raging and employment fell as manufacturers report difficulty in finding staff. That's a bad sign for Friday's nonfarm payrolls report. It implies that many people aren't motivated to look for a job while they can claim generous unemployment benefits. Those benefits expire in September, at which point a swarm of workers could return.

The stock market didn't love the news either, with the S&P 500 erasing some early gains to close virtually unchanged as traders tempered their expectations for the upcoming jobs report. Of course, even a massive NFP disappointment wouldn't necessarily tank the market as it would imply more Fed liquidity for longer, which is a tremendously powerful force for equities.

Sterling tumbles, Erdogan sinks liraThe British pound came under pressure this week, amid some rumors that the government might delay the final stage of the reopening, in fear of the Indian covid variant spreading. A setback could hit the pound, but the pain will likely be short-lived. Any delay would simply reflect an abundance of caution from health authorities, which is ultimately positive from a risk-reward perspective.

Finally, the Turkish lira hit a new record low today after President Erdogan said he asked the central bank's new governor for a rate cut. Turkey's inflation problem has escalated in recent months with the annual CPI rate exceeding 17% in April, so maintaining high interest rates is infinitely important. As long as the central bank's hands are tied by politics, it's difficult to see the bottom in the lira's multi-decade downtrend.

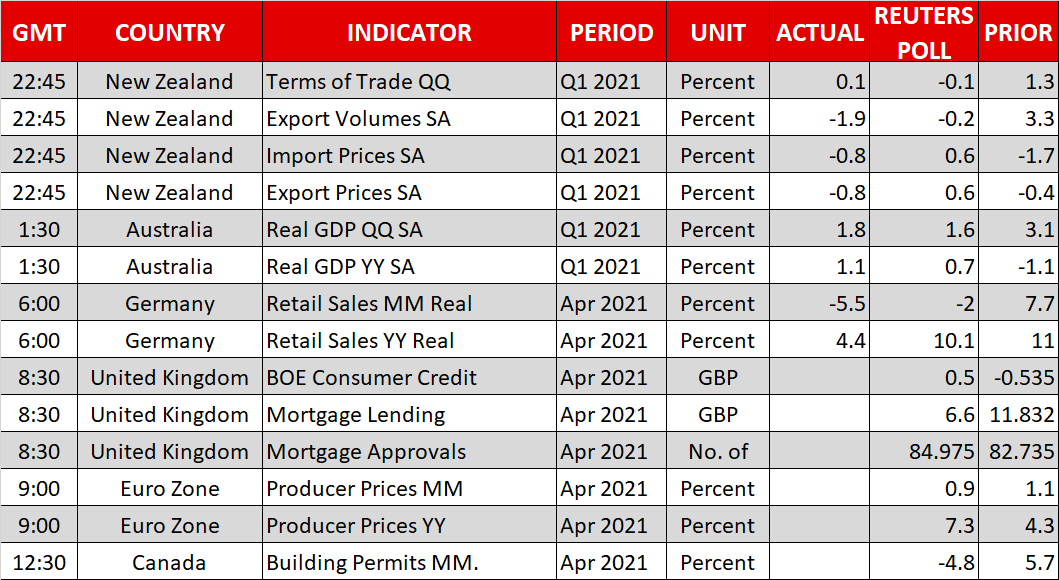

As for today, the economic calendar is low key. The spotlight will fall on some remarks by the Fed's Harker (16:00 GMT), Kashkari (18:00 GMT), and Bostic (19:25 GMT).

Dernières actualités

Avertissement : Les entités de XM Group proposent à notre plateforme de trading en ligne un service d'exécution uniquement, autorisant une personne à consulter et/ou à utiliser le contenu disponible sur ou via le site internet, qui n'a pas pour but de modifier ou d'élargir cette situation. De tels accès et utilisation sont toujours soumis aux : (i) Conditions générales ; (ii) Avertissements sur les risques et (iii) Avertissement complet. Un tel contenu n'est par conséquent fourni que pour information générale. En particulier, sachez que les contenus de notre plateforme de trading en ligne ne sont ni une sollicitation ni une offre de participation à toute transaction sur les marchés financiers. Le trading sur les marchés financiers implique un niveau significatif de risques pour votre capital.

Tout le matériel publié dans notre Centre de trading en ligne est destiné à des fins de formation / d'information uniquement et ne contient pas – et ne doit pas être considéré comme contenant – des conseils et recommandations en matière de finance, de fiscalité des investissements ou de trading, ou un enregistrement de nos prix de trading ou une offre, une sollicitation, une transaction à propos de tout instrument financier ou bien des promotions financières non sollicitées à votre égard.

Tout contenu tiers, de même que le contenu préparé par XM, tels que les opinions, actualités, études, analyses, prix, autres informations ou liens vers des sites tiers contenus sur ce site internet sont fournis "tels quels", comme commentaires généraux sur le marché et ne constituent pas des conseils en investissement. Dans la mesure où tout contenu est considéré comme de la recherche en investissement, vous devez noter et accepter que le contenu n'a pas été conçu ni préparé conformément aux exigences légales visant à promouvoir l'indépendance de la recherche en investissement et, en tant que tel, il serait considéré comme une communication marketing selon les lois et réglementations applicables. Veuillez vous assurer que vous avez lu et compris notre Avis sur la recherche en investissement non indépendante et notre avertissement sur les risques concernant les informations susdites, qui peuvent consultés ici.