RBNZ meeting unlikely to rattle the kiwi – Forex News Preview

Quite a lot has happened since the RBNZ last met in February, but since developments have been both positive and negative, they will likely cancel each other out in the central bank's eyes.

On the bright side, the island remains virtually virus-free. Because of this, Australia and New Zealand agreed to establish a 'travel bubble' between them, so there is some relief coming for the struggling tourism sector. Additionally, the government will raise the minimum wage by roughly one kiwi dollar to $20 per hour, which will hopefully boost spending in the economy.

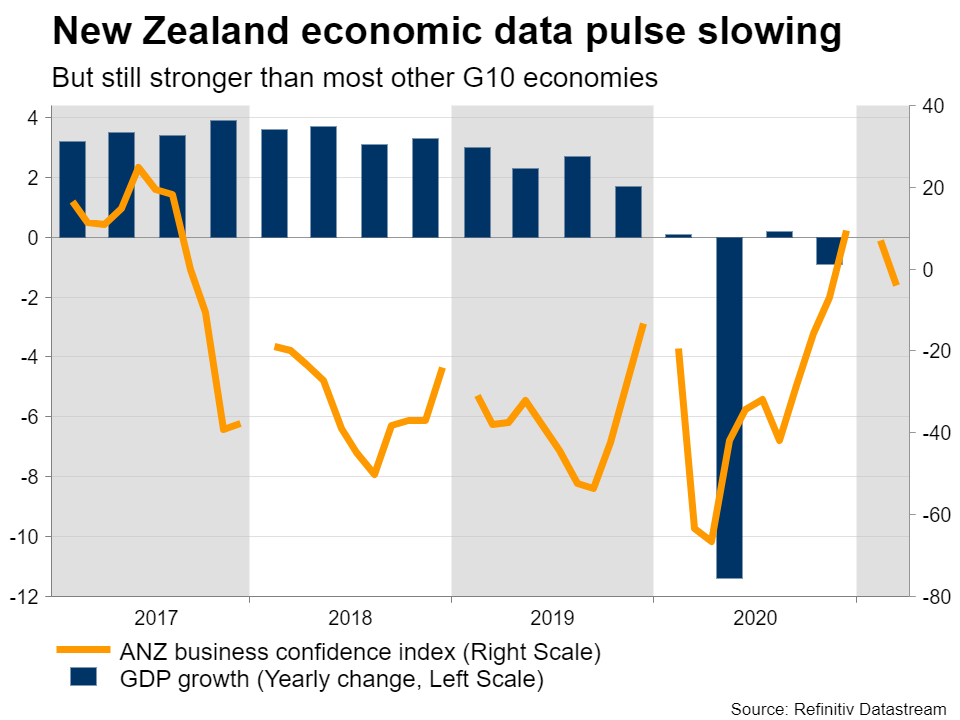

However, the data pulse has started to slow. Retail sales and business confidence both declined lately, while economic growth disappointed in Q4. That said, the RBNZ already expected a gradual slowdown in its latest economic forecasts, so this won't be any huge surprise.

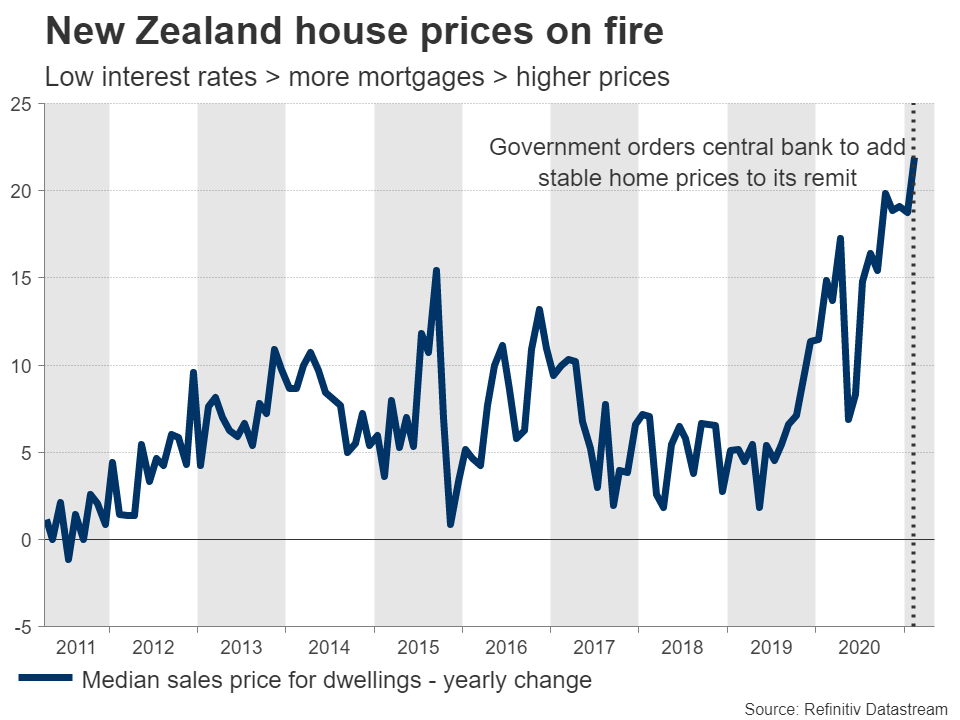

The other piece of news is that the RBNZ's mandate has been changed to also consider the impact on home prices when formulating decisions, in addition to keeping inflation stable and promoting full employment. House prices in New Zealand have been on fire lately as low interest rates encouraged more borrowing for mortgages. This change essentially makes it harder for the RBNZ to cut rates again.

RBNZ to 'hold the line'Turning to the upcoming meeting, no policy changes are on the cards. Given the mixed developments lately, it is also difficult to envision the RBNZ changing its language either. Policymakers will likely repeat that they are 'on hold' for the foreseeable future.

There is no real need to push back against market pricing for future rate hikes. Markets are currently pricing in around a 30% probability for a rate increase by this time next year, which seems fair given the solid shape of the overall economy. Plus, this probability declined substantially lately, so the market itself is having doubts.

If the RBNZ simply reaffirms its wait-and-see stance, any reaction in the kiwi is likely to be minor.

Bigger picture positive, but mind the US dollarOverall, the kiwi's fortunes will depend mostly on how the economy performs, the speed of vaccinations globally, commodity prices, and risk sentiment in the markets. All of these factors seem to be improving, so it is difficult to be pessimistic on the currency.

New Zealand is almost virus-free and the economy is stronger than most other regions thanks to fewer lockdowns, global vaccinations are moving forward, dairy prices are elevated, and America is about to unleash a landslide of stimulus that could keep market happy for a while.

The 'catch' is that the outlook for the US dollar seems promising too with the American vaccination program firing on all cylinders, so any future gains in the kiwi might not be reflected in dollar/kiwi.

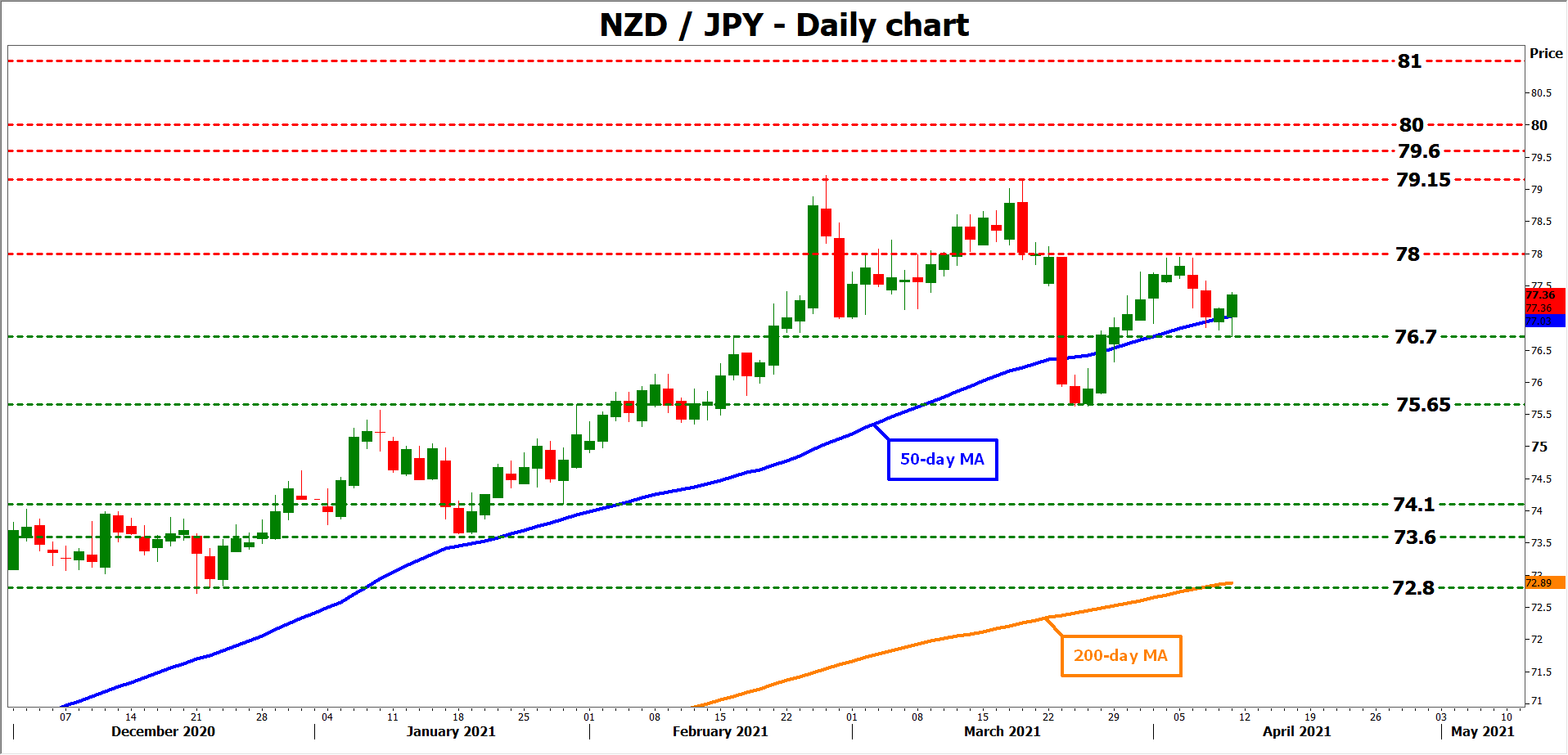

Instead, euro/kiwi or kiwi/yen might be better candidates. Despite the latest rebound, the prospects for the euro remain bleak, with the region still partially locked down, behind in stimulus, and unlikely to catch up in vaccinations. It's a similar story for the yen, which is likely to suffer as the global economy heals its wounds, thanks to the BoJ keeping a ceiling on Japanese bond yields.

Taking a technical look at kiwi/yen, immediate resistance to advances could come from the 78.00 region, before the recent top of 79.15 comes into play.

On the downside, preliminary support may be found near the 76.70 zone, a break of which would turn the focus to the latest low of 75.65.Últimas noticias

Descargo de responsabilidades: Cada una de las entidades de XM Group proporciona un servicio de solo ejecución y acceso a nuestra plataforma de trading online, permitiendo a una persona ver o usar el contenido disponible en o a través del sitio web, sin intención de cambiarlo ni ampliarlo. Dicho acceso y uso están sujetos en todo momento a: (i) Términos y Condiciones; (ii) Advertencias de riesgo; y (iii) Descargo completo de responsabilidades. Por lo tanto, dicho contenido se proporciona exclusivamente como información general. En particular, por favor tenga en cuenta que, los contenidos de nuestra plataforma de trading online no son ni solicitud ni una oferta para entrar a realizar transacciones en los mercados financieros. Operar en cualquier mercado financiero implica un nivel de riesgo significativo para su capital.

Todo el material publicado en nuestra plataforma de trading online tiene únicamente fines educativos/informativos y no contiene –y no debe considerarse que contenga– asesoramiento ni recomendaciones financieras, tributarias o de inversión, ni un registro de nuestros precios de trading, ni una oferta ni solicitud de transacción con instrumentos financieros ni promociones financieras no solicitadas.

Cualquier contenido de terceros, así como el contenido preparado por XM, como por ejemplo opiniones, noticias, investigaciones, análisis, precios, otras informaciones o enlaces a sitios de terceros que figuran en este sitio web se proporcionan “tal cual”, como comentarios generales del mercado y no constituyen un asesoramiento en materia de inversión. En la medida en que cualquier contenido se interprete como investigación de inversión, usted debe tener en cuenta y aceptar que dicho contenido no fue concebido ni elaborado de acuerdo con los requisitos legales diseñados para promover la independencia en materia de investigación de inversiones y, por tanto, se considera como una comunicación comercial en virtud de las leyes y regulaciones pertinentes. Por favor, asegúrese de haber leído y comprendido nuestro Aviso sobre investigación de inversión no independiente y advertencia de riesgo en relación con la información anterior, al que se puede acceder aquí.