Daily Market Comment – Dollar’s woes deepen ahead of US retail sales data, stocks rejoice

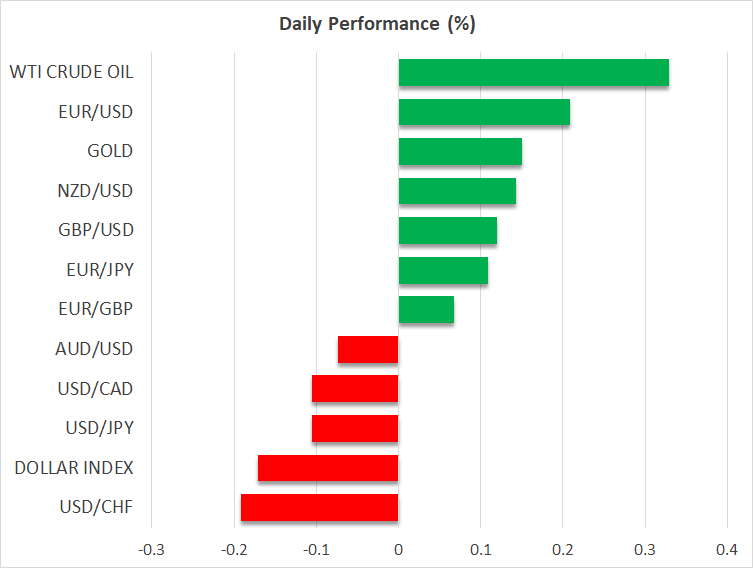

- US dollar slumps to one-year low as soft data bolsters case for Fed pause

- Wall Street rallies on Fed bets, but bank earnings pose a downside risk

- Fed-ECB divergence pushes euro towards $1.11, yen selloff eases

Fed pause seen more likely after latest US data batch

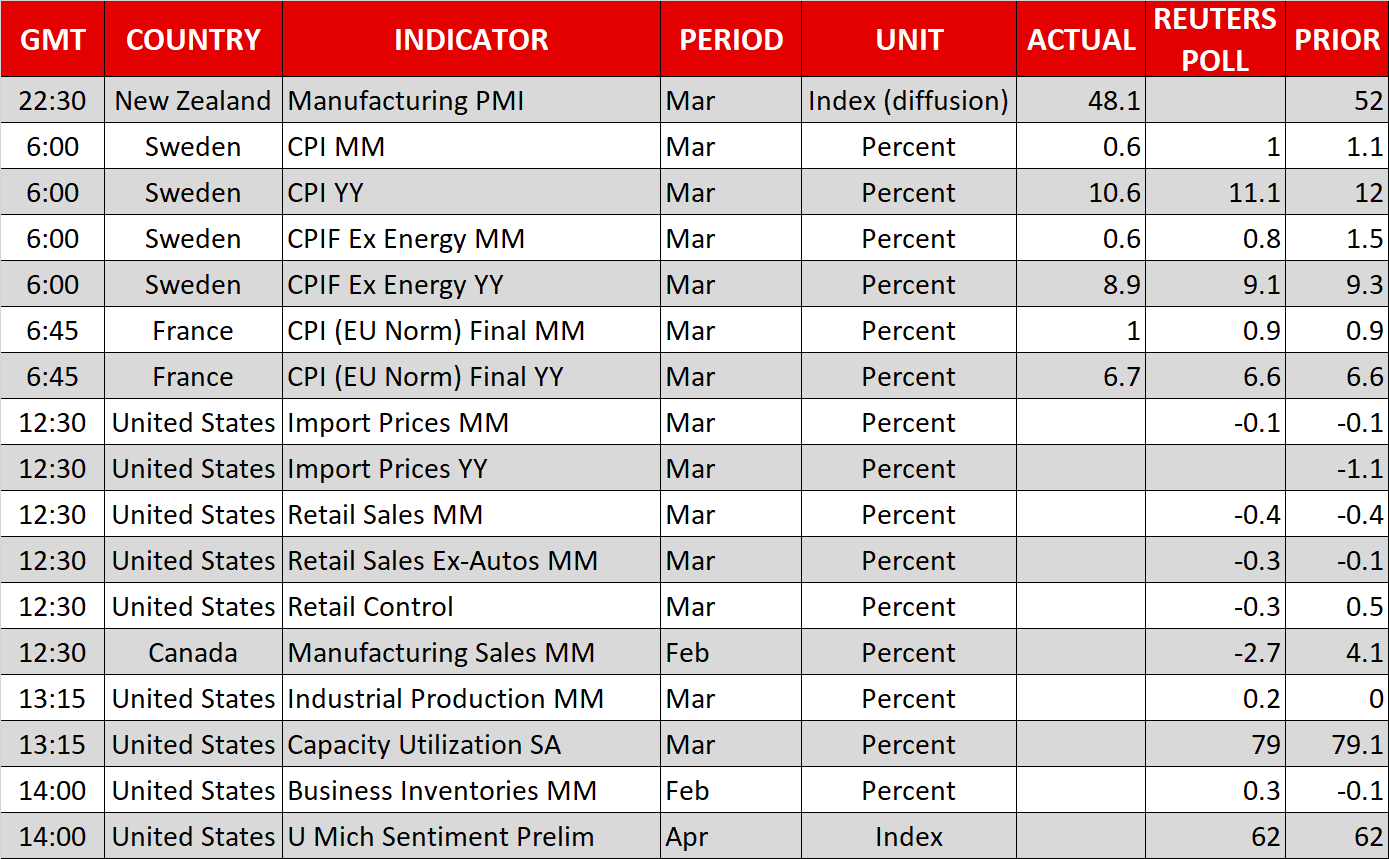

Fed pause seen more likely after latest US data batchIt’s been another week of underwhelming data releases out of the United States, and after the latest figures on consumer and producer prices added to the softening economic picture highlighted by last week’s ISM PMIs, the upbeat March jobs report is now seen as the outlier. Wednesday’s weaker-than-expected CPI data was followed by similarly weak PPI numbers on Thursday.

Factory gate inflation decelerated sharply in March, with almost all readings coming in both below the forecasts and the prior month’s figures. In addition, weekly jobless claims ticked back up to 239k towards recent revised highs, in a further sign that the US economy appears to have lost some steam.

This puts the spotlight on today’s retail sales report. The forecasts are already quite grim as retail sales are projected to have fallen by 0.4% for the second straight month. However, the downbeat expectations make an upside surprise more likely so there is a danger that traders might get wrong footed amid the growing market consensus of a Fed pause after May.

Dollar licks its wounds at one-year lowsThe US dollar has taken quite a beating since the banking crisis, which increased the risk of a recession in America on the expectation that the turmoil would tighten credit conditions across the economy.

Although the panic has subsided and Fed officials appear less worried about a downturn than they were at the March meeting, which took place at the height of the crisis, most of the data now seems to be pointing to declining momentum in both growth and price pressures, potentially due to the effects of the Fed’s previous rate hikes starting to kick in.

Subsequently, the greenback has been under increasing pressure over the past month and the dollar index just brushed a one-year low, having retreated about 12% from the peaks of last September.

The US currency is looking somewhat vulnerable to upside corrections against major pairs such as the euro, pound and the Australian dollar. Though, not so much against the Japanese yen, which is contending with its own bout of weakness.

However, even if there are some gains in store for the greenback from a positive retail sales print, any rebound is likely to be short-lived given that markets seem convinced about the Fed cutting rates towards the end of the year.

Euro extends uptrend as monetary divergence in focusThe euro is perhaps the best example why Fed expectations are weighing so heavily on the dollar. In quite a turnaround from where things stood at the start of the global tightening cycle, the ECB is now in a position to be the last hawk standing. Slovenia’s central bank head Bostjan Vasle yesterday suggested that the ECB’s May policy decision will be between a 25- or 50-bps rate hike.

The euro is extending its gains today, climbing to a fresh one-year high of $1.1075. Sterling is steady around $1.2510, while the aussie is paring some of yesterday’s advances.

The Australian dollar has been boosted this week from stronger-than-expected employment numbers out of the country, as well as encouraging trade figures from China.

It’s been a tougher period for the yen, however, as the Bank of Japan’s new chief Kazuo Ueda once again downplayed the likelihood of any significant policy tightening despite faster wage growth, as he predicted that inflation would fall back below 2% later this year. Nevertheless, the Japanese currency was broadly firmer on Friday and the dollar slipped slightly to around 132.30 yen.

Tech stocks fly again but some caution ahead of bank earningsOn Wall Street, hopes that a Fed pause is just around the corner are lifting spirits even as recession risks remain elevated. The S&P 500 closed up 1.3% on Thursday, hitting a two-month high.

Tech stocks also rallied, led by Netflix (4.6%), pushing the Nasdaq Composite up by 2.0%. Netflix is due to report its earnings next week and investors are optimistic that its new ad-tier subscription model will have boosted revenue.

In the meantime, however, all eyes will be on today’s bank earnings, with JPMorgan, Wells Fargo and Citigroup due to report their Q1 financial results. Markets will be watching to see whether the major lenders were affected at all from the stress within the regional banking sector consisting mainly of small- and medium-sized banks. E-mini futures are trading marginally lower ahead of the earnings releases.

If there’s an indication that lending standards have tightened significantly, that could spoil the latest rally on Wall Street.

Activos relacionados

Últimas noticias

Descargo de responsabilidades: Cada una de las entidades de XM Group proporciona un servicio de solo ejecución y acceso a nuestra plataforma de trading online, permitiendo a una persona ver o usar el contenido disponible en o a través del sitio web, sin intención de cambiarlo ni ampliarlo. Dicho acceso y uso están sujetos en todo momento a: (i) Términos y Condiciones; (ii) Advertencias de riesgo; y (iii) Descargo completo de responsabilidades. Por lo tanto, dicho contenido se proporciona exclusivamente como información general. En particular, por favor tenga en cuenta que, los contenidos de nuestra plataforma de trading online no son ni solicitud ni una oferta para entrar a realizar transacciones en los mercados financieros. Operar en cualquier mercado financiero implica un nivel de riesgo significativo para su capital.

Todo el material publicado en nuestra plataforma de trading online tiene únicamente fines educativos/informativos y no contiene –y no debe considerarse que contenga– asesoramiento ni recomendaciones financieras, tributarias o de inversión, ni un registro de nuestros precios de trading, ni una oferta ni solicitud de transacción con instrumentos financieros ni promociones financieras no solicitadas.

Cualquier contenido de terceros, así como el contenido preparado por XM, como por ejemplo opiniones, noticias, investigaciones, análisis, precios, otras informaciones o enlaces a sitios de terceros que figuran en este sitio web se proporcionan “tal cual”, como comentarios generales del mercado y no constituyen un asesoramiento en materia de inversión. En la medida en que cualquier contenido se interprete como investigación de inversión, usted debe tener en cuenta y aceptar que dicho contenido no fue concebido ni elaborado de acuerdo con los requisitos legales diseñados para promover la independencia en materia de investigación de inversiones y, por tanto, se considera como una comunicación comercial en virtud de las leyes y regulaciones pertinentes. Por favor, asegúrese de haber leído y comprendido nuestro Aviso sobre investigación de inversión no independiente y advertencia de riesgo en relación con la información anterior, al que se puede acceder aquí.