Daily Market Comment – Dollar set for big monthly losses, stocks struggle for direction again

- Dollar steadier but month-long rout probably not over yet, yen firmer too

- S&P 500 closes at another record high but stocks slip today amid some jitters

- Copper soars past $10,000 a tonne, oil moderates after boost from upbeat US GDP

Don’t fight the dovish Fed

Don’t fight the dovish FedThe US dollar is on track for its worst 4-week run since last July and looks set to end the month with losses of at least 2.5%. An uptick in the growth outlook for some of America’s competitors along with an unquestionably dovish Federal Reserve have offset a string of positive indicators for the US economy.

The advance GDP report released yesterday printed a preliminary estimate of 6.4% annualized growth in Q1, beating expectations of 6.1%, led by massive federal spending.

Treasury yields, which have been steadily climbing in the past week and maintained posture even after Wednesday’s predictably dovish FOMC meeting, appear to be giving up, with the 10-year yield pulling back from yesterday’s spike to 1.69% to around 1.64% today.

As other countries catch up with the US in the vaccination race and exit from lockdown, the dollar is likely to be pressured as yield differentials narrow. This could be a recurring theme until at least June, which is the earliest that the Fed is likely to signal any shift in its current policy stance.

Dollar and yen inch higher on mixed moodBut dollar bears were taking a breather today and the greenback advanced moderately against the euro and pound. The aussie fell back slightly after failing to break resistance in the $0.7815 region but the Canadian dollar held near three-year highs.

The yen also paused its recent slide amid some souring of the positive mood. A worrying escalation in virus cases in Japan has been weighing on the yen all week after the Bank of Japan warned consumption is likely to take a hit. But with infections surging in other places too like India, some of the vaccine-led optimism has faded, giving way to slight risk-off moves and helping the yen edge off lows.

In commodities, copper futures (3-month LME contract) raced above $10,000 a tonne on rising demand for electric vehicles and other technology products. But oil prices slipped on Friday, paring back some of yesterday’s strong gains on the back of the robust US growth figures.

Fresh record for S&P 500, but chip shortage starts to worrySentiment in equity markets was similarly mixed as investors were caught between rising optimism about the outlook in many parts of the world and a reminder that the Covid crisis is far from over.

But other concerns have also started to creep into the markets lately. A growing global shortage of chips, which are increasingly being used by the auto industry and most electronic devices these days, could hurt production of not only car manufacturers but also major tech companies such as Apple and Samsung.

Apple shares pulled back from their post-earnings jump yesterday, finishing the day in the red. Nevertheless, strong gains by Amazon and Facebook pushed the S&P 500 to a new record high on Thursday, though neither the Dow Jones and Nasdaq were able to replicate that feat.

US futures were last trading between 0.2%-0.4% lower, following declines across Asia today. However, European shares opened mostly in positive territory, hinting that risk appetite is alive and could strengthen further during the course of the day.

It might be somewhat quieter on the earnings front without any of the Big Tech reporting on Friday, but announcements from Exxon Mobil and Chevron before the market open should make for high volumes.

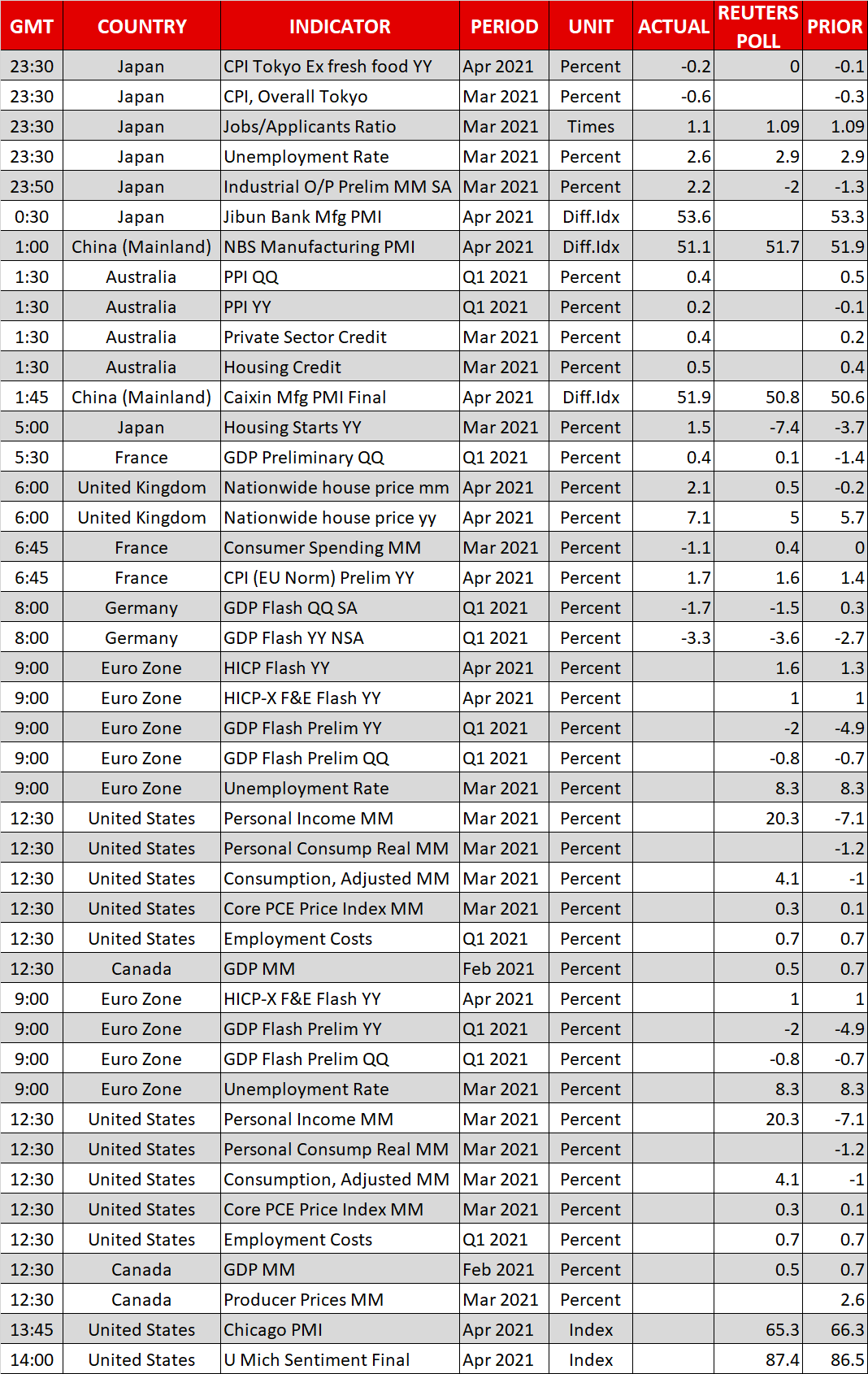

US data could also set the mood as personal income and consumption numbers are due later today, along with the core PCE price index, which may provide further clues about potentially brewing inflationary pressures.

Últimas noticias

Descargo de responsabilidades: Cada una de las entidades de XM Group proporciona un servicio de solo ejecución y acceso a nuestra plataforma de trading online, permitiendo a una persona ver o usar el contenido disponible en o a través del sitio web, sin intención de cambiarlo ni ampliarlo. Dicho acceso y uso están sujetos en todo momento a: (i) Términos y Condiciones; (ii) Advertencias de riesgo; y (iii) Descargo completo de responsabilidades. Por lo tanto, dicho contenido se proporciona exclusivamente como información general. En particular, por favor tenga en cuenta que, los contenidos de nuestra plataforma de trading online no son ni solicitud ni una oferta para entrar a realizar transacciones en los mercados financieros. Operar en cualquier mercado financiero implica un nivel de riesgo significativo para su capital.

Todo el material publicado en nuestra plataforma de trading online tiene únicamente fines educativos/informativos y no contiene –y no debe considerarse que contenga– asesoramiento ni recomendaciones financieras, tributarias o de inversión, ni un registro de nuestros precios de trading, ni una oferta ni solicitud de transacción con instrumentos financieros ni promociones financieras no solicitadas.

Cualquier contenido de terceros, así como el contenido preparado por XM, como por ejemplo opiniones, noticias, investigaciones, análisis, precios, otras informaciones o enlaces a sitios de terceros que figuran en este sitio web se proporcionan “tal cual”, como comentarios generales del mercado y no constituyen un asesoramiento en materia de inversión. En la medida en que cualquier contenido se interprete como investigación de inversión, usted debe tener en cuenta y aceptar que dicho contenido no fue concebido ni elaborado de acuerdo con los requisitos legales diseñados para promover la independencia en materia de investigación de inversiones y, por tanto, se considera como una comunicación comercial en virtud de las leyes y regulaciones pertinentes. Por favor, asegúrese de haber leído y comprendido nuestro Aviso sobre investigación de inversión no independiente y advertencia de riesgo en relación con la información anterior, al que se puede acceder aquí.