Bank Q3 earnings could ring recession alarm bells – Stock Market

US banks kick of earnings parade on Friday before market opens

Poised for negative results as high interest rates become a headwind

Historical low valuations cap downside

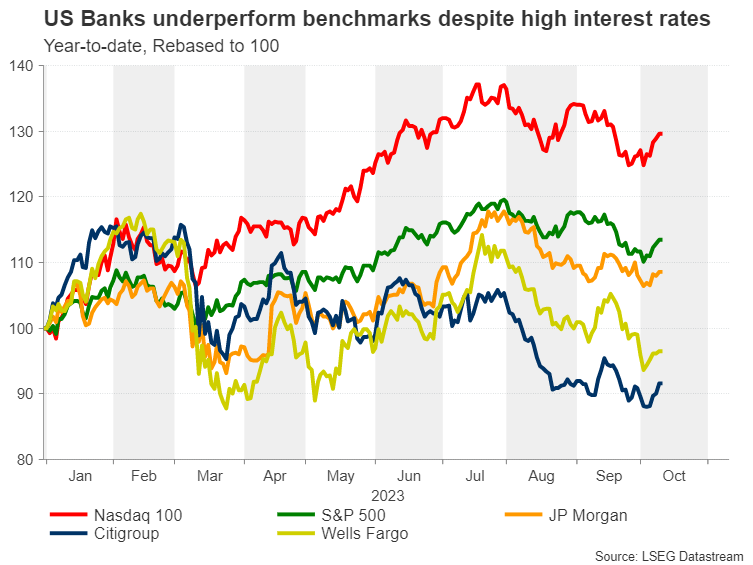

Banks underperform in 2023

This year started with the best possible omens for banks as they were expected to continue capitalising on higher net interest margins, which are essentially the difference between the interest income generated by long-term assets such as loans and the interest expense paid to short-term liabilities such as deposits. Meanwhile, the US economy has been exhibiting signs of resilience, allowing consumers to keep up with loan payments so far, but the third quarter exposed some risks in the sector.

Interest rates have now surpassed a level that could be considered beneficial for banks, increasing fears for an impulsive wave of defaults and forcing them to set aside more reserves to withstand an adverse scenario. The situation could get even worse for institutions that might need to sell assets to cover losses as surging bond yields in the third quarter have triggered huge unrealised losses in their bond portfolios.

At the same time, credit card delinquencies are rising at a historically rapid pace, corporate bankruptcies are piling up at levels similar to 2020, deposits are getting squeezed from persistent inflation, while student loan repayments are scheduled to resume after a three-year break. All the above paint a rather gloomy picture for the financial sector, with the only bright spot being the resurgence of tech IPOs after a two-year drought.

JP Morgan retains crown

JP Morgan has been the best performer among the US investment banks in 2023 as its reputable status attracted significant inflows from regional banks at risk amid the turbulence in March. That cash buffer enabled the banking behemoth to take full advantage of elevated interest rates through its loan business.

The bank is anticipated to record revenue of $39.57 billion, according to consensus estimates by Refinitiv IBES, which would represent a year-on-year increase of 18.15%. Additionally, Earnings per share (EPS) are estimated to rise 16% on an annual basis to $3.90.

From a technical perspective, JP Morgan’s stock has been undergoing a downside correction since July, which came to a halt at the 200-day simple moving average (SMA). Even though the price has recouped some losses ahead of the earnings report, its structure of lower highs and lower lows remains intact.

From a technical perspective, JP Morgan’s stock has been undergoing a downside correction since July, which came to a halt at the 200-day simple moving average (SMA). Even though the price has recouped some losses ahead of the earnings report, its structure of lower highs and lower lows remains intact.

Citigroup under pressure amid major restructuring

Citigroup will face another tough earnings season, exhibiting major underperformance compared to the other two examined banks. The main reason behind this weakness is that its costly restructuring has not come to fruition yet.

The investment bank giant is set to post an annual revenue jump of 4.38% to $19.31 billion. However, its EPS is projected at $1.21, a 19.45% decrease relative to the same quarter last year.

Wells Fargo exhibits diverging signals

For Wells Fargo the picture remains blurry as on the one hand revenue continues to grow but earnings drop as the bank’s net interest margin is getting squeezed.

The leading financial institution is on track for a 3.08% annual increase in its revenue figure, which could reach $20.10 billion. Meanwhile, EPS is forecast to decline from $1.25 last quarter to $1.22, also marking a 6.03% drop in annual terms.

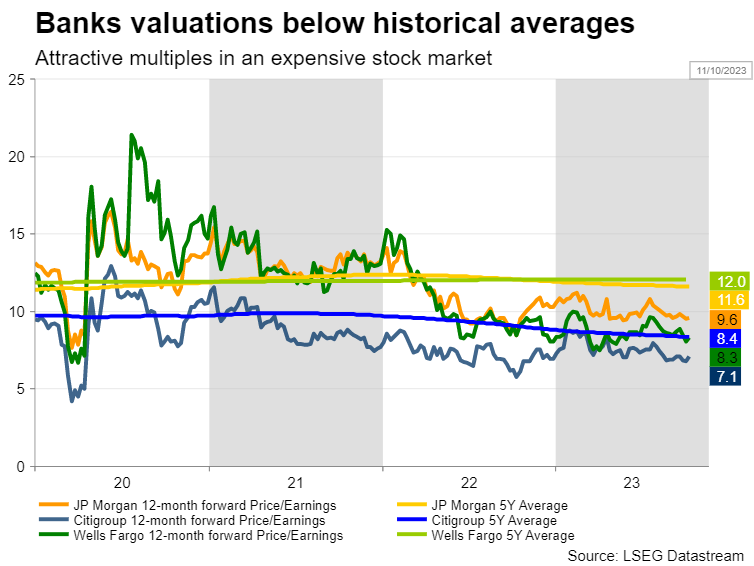

Valuations look cheap

Despite underperforming major benchmarks in 2023, US banks’ valuations appear rather compressed when compared both to the broader market and their historical averages. This is particularly strange as banks have historically outperformed in periods of high interest rates. Therefore, it seems that investors are pricing in difficult times ahead, while others could argue that this is an attractive entry point for long-term investors.

Surely though, the risks are asymmetric at current levels as there is not much room to the downside even if we get a major negative surprise in upcoming earnings reports.

Activos relacionados

Últimas noticias

Descargo de responsabilidades: Cada una de las entidades de XM Group proporciona un servicio de solo ejecución y acceso a nuestra plataforma de trading online, permitiendo a una persona ver o usar el contenido disponible en o a través del sitio web, sin intención de cambiarlo ni ampliarlo. Dicho acceso y uso están sujetos en todo momento a: (i) Términos y Condiciones; (ii) Advertencias de riesgo; y (iii) Descargo completo de responsabilidades. Por lo tanto, dicho contenido se proporciona exclusivamente como información general. En particular, por favor tenga en cuenta que, los contenidos de nuestra plataforma de trading online no son ni solicitud ni una oferta para entrar a realizar transacciones en los mercados financieros. Operar en cualquier mercado financiero implica un nivel de riesgo significativo para su capital.

Todo el material publicado en nuestra plataforma de trading online tiene únicamente fines educativos/informativos y no contiene –y no debe considerarse que contenga– asesoramiento ni recomendaciones financieras, tributarias o de inversión, ni un registro de nuestros precios de trading, ni una oferta ni solicitud de transacción con instrumentos financieros ni promociones financieras no solicitadas.

Cualquier contenido de terceros, así como el contenido preparado por XM, como por ejemplo opiniones, noticias, investigaciones, análisis, precios, otras informaciones o enlaces a sitios de terceros que figuran en este sitio web se proporcionan “tal cual”, como comentarios generales del mercado y no constituyen un asesoramiento en materia de inversión. En la medida en que cualquier contenido se interprete como investigación de inversión, usted debe tener en cuenta y aceptar que dicho contenido no fue concebido ni elaborado de acuerdo con los requisitos legales diseñados para promover la independencia en materia de investigación de inversiones y, por tanto, se considera como una comunicación comercial en virtud de las leyes y regulaciones pertinentes. Por favor, asegúrese de haber leído y comprendido nuestro Aviso sobre investigación de inversión no independiente y advertencia de riesgo en relación con la información anterior, al que se puede acceder aquí.