Artificial Intelligence: Is the ‘baby bubble’ ready to pop?

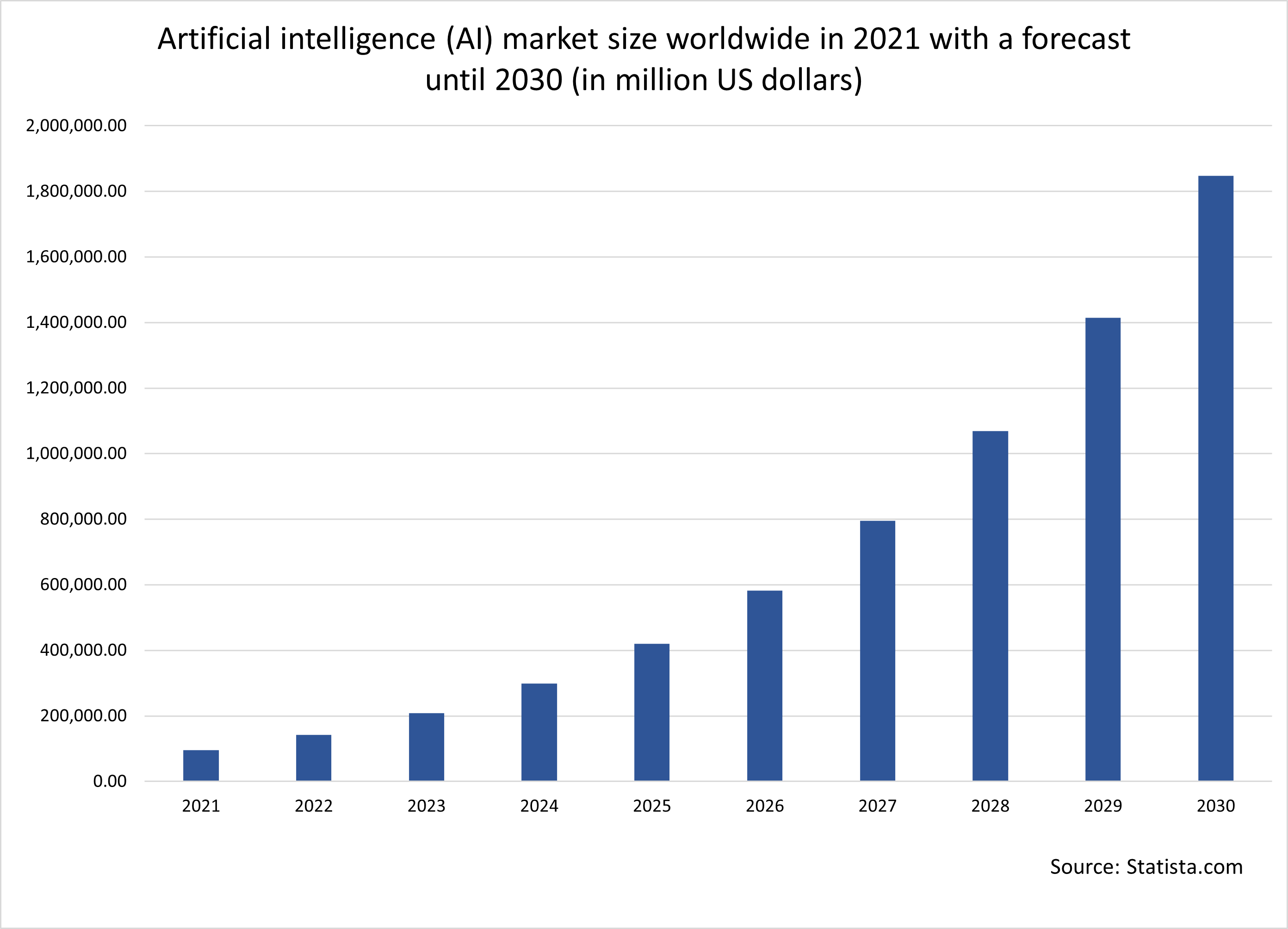

According to Statista, the AI market is expected to experience massive growth in the coming years, with its value of $100bn dollars in 2021 seen growing twentyfold by 2030, to around two trillion dollars. And what may have prompted many participants to jump into the AI bandwagon may have been the release of ChatGPT 3.0 in 2022, which opened the pandora box regarding the possibilities of generative AI.

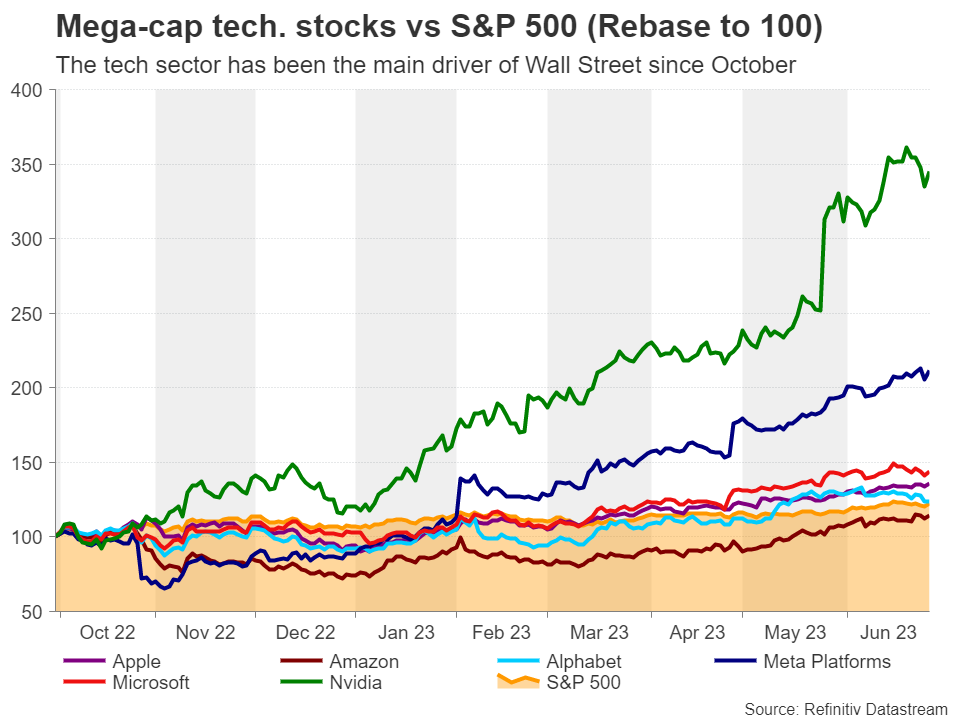

One way to bet on AI may be through chipmakers, as AI requires massive computer power and strong computing power means powerful microchips. The fact that Nvidia’s stock has surged more than 300% since its October lows is not an accident as this firm’s chips are the brains behind most of the AI chatbots we know, while the firm holds around 95% of the market share of machine learning chips. Other chipmakers, like AMD (Advanced Micro Devices) and Intel, also enjoyed massive gains, with the former surging by more than 100% since October and the latter around 50%.

But valuations suggest they are very expensiveSo, the bubble question is popping up on everyone’s mind and rightfully so. Looking at valuations, Nvidia is trading around 45 times the estimated earnings for next year, while just two weeks ago, that forward price-to-earnings (PE) ratio was almost at 60x. That’s well above the forward PE ratio of the S&P 500, which is at around 19x. So, the AI market can be considered overvalued and such numbers may discourage new investors from joining the action. Maybe that’s why there was a pullback in the stock market recently.

Geopolitics also constitute a risk

Geopolitics also constitute a riskOne other risk to the AI euphoria is geopolitics. For the construction of their chips, most chipmakers are reliant on one company in Taiwan, called TSMC (Taiwan Semiconductor Manufacturing Company). Thus, with China not recognizing Taiwan as a sovereign state, any tensions between the two countries could well affect the semiconductor market and thereby weigh on the AI bull market. Yes, due to those geopolitical risks, TSMC is trying to expand and diversify its business in other countries, including the US, but that’s not a plan that can be completed overnight.

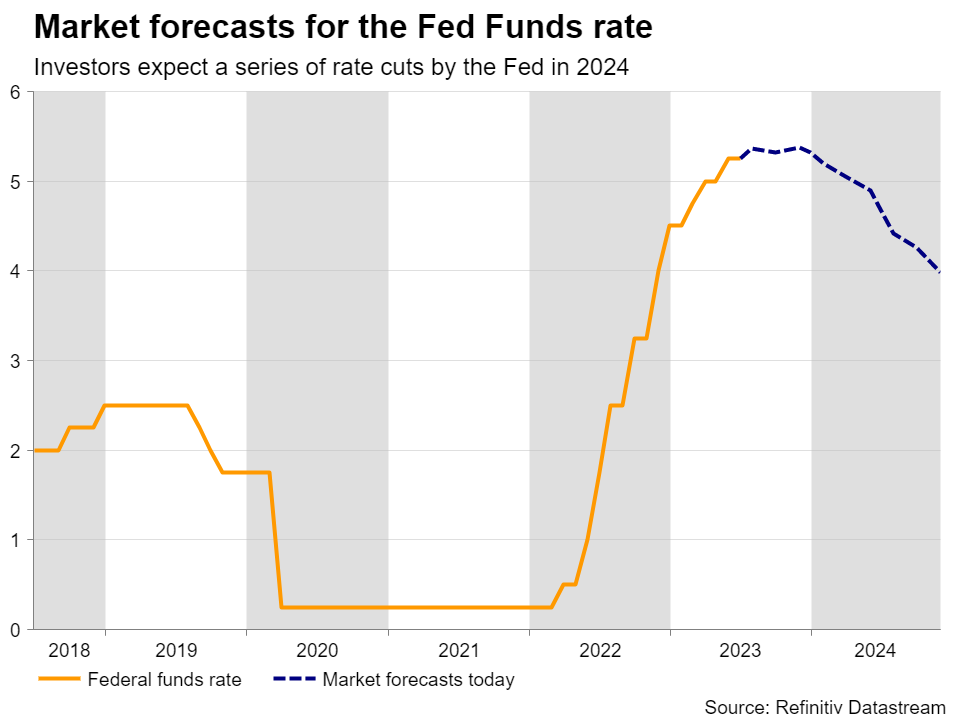

Expectations of growth and Fed cuts may keep losses limitedHaving said that though, even if there is a further pullback in the stock market, it could still be considered as a corrective phase rather than the beginning of a full-scale bear market. After all, most high-growth tech firms are valued by discounting expected cash flows for the quarters and years ahead. So, with Nvidia’s and other chipmakers’ cash-flow-per-share expected to continue accelerating in the foreseeable future, and also bearing in mind market expectations of several rate cuts by the Fed next year, present values have the potential to continue rising.

Even if geopolitical tensions rise and leave their mark, a potential episode of market risk-aversion could prompt AI investors to increase their exposure to mega-cap, more established, tech stocks, like Alphabet, Amazon, Apple, Meta, and Microsoft, which are also expanding their business in the AI field. Along with Nvidia, these giants are responsible for most of the gains in the S&P 500 since October.

For investors to start fleeing out of the stock market, not only does the Fed have to convince them that there are no rate cuts on the table for next year, but growth estimates for big tech firms in the upcoming earnings seasons may need to start disappointing. The Fed has already signaled that two more quarter-point hikes are on the table before it ends this tightening crusade and Fed Chair Powell said that rate reductions are ‘a couple of years out’. And yet, the market is penciling in only around 35bps worth of additional hikes, and several reductions in 2024. So, until the Fed or the data convince them to scale back those cut bets, investors may see the current retreat, or any near-term extensions of it, as an opportunity to buy at more attractive levels.

For investors to start fleeing out of the stock market, not only does the Fed have to convince them that there are no rate cuts on the table for next year, but growth estimates for big tech firms in the upcoming earnings seasons may need to start disappointing. The Fed has already signaled that two more quarter-point hikes are on the table before it ends this tightening crusade and Fed Chair Powell said that rate reductions are ‘a couple of years out’. And yet, the market is penciling in only around 35bps worth of additional hikes, and several reductions in 2024. So, until the Fed or the data convince them to scale back those cut bets, investors may see the current retreat, or any near-term extensions of it, as an opportunity to buy at more attractive levels.Activos relacionados

Últimas noticias

Descargo de responsabilidades: Cada una de las entidades de XM Group proporciona un servicio de solo ejecución y acceso a nuestra plataforma de trading online, permitiendo a una persona ver o usar el contenido disponible en o a través del sitio web, sin intención de cambiarlo ni ampliarlo. Dicho acceso y uso están sujetos en todo momento a: (i) Términos y Condiciones; (ii) Advertencias de riesgo; y (iii) Descargo completo de responsabilidades. Por lo tanto, dicho contenido se proporciona exclusivamente como información general. En particular, por favor tenga en cuenta que, los contenidos de nuestra plataforma de trading online no son ni solicitud ni una oferta para entrar a realizar transacciones en los mercados financieros. Operar en cualquier mercado financiero implica un nivel de riesgo significativo para su capital.

Todo el material publicado en nuestra plataforma de trading online tiene únicamente fines educativos/informativos y no contiene –y no debe considerarse que contenga– asesoramiento ni recomendaciones financieras, tributarias o de inversión, ni un registro de nuestros precios de trading, ni una oferta ni solicitud de transacción con instrumentos financieros ni promociones financieras no solicitadas.

Cualquier contenido de terceros, así como el contenido preparado por XM, como por ejemplo opiniones, noticias, investigaciones, análisis, precios, otras informaciones o enlaces a sitios de terceros que figuran en este sitio web se proporcionan “tal cual”, como comentarios generales del mercado y no constituyen un asesoramiento en materia de inversión. En la medida en que cualquier contenido se interprete como investigación de inversión, usted debe tener en cuenta y aceptar que dicho contenido no fue concebido ni elaborado de acuerdo con los requisitos legales diseñados para promover la independencia en materia de investigación de inversiones y, por tanto, se considera como una comunicación comercial en virtud de las leyes y regulaciones pertinentes. Por favor, asegúrese de haber leído y comprendido nuestro Aviso sobre investigación de inversión no independiente y advertencia de riesgo en relación con la información anterior, al que se puede acceder aquí.