AMD reports earnings; What’s on the cards? – Stock Market News

Advanced Micro Devices (AMD) will release its latest earnings on Tuesday, August 1, after Wall Street’s closing bell. Earnings are expected to have declined from last year, amid a sharp slowdown in gaming demand. Nonetheless, AMD shares have risen 76% so far this year, as investors are razer-focused on the company’s future prospects in the AI revolution.

AMD shares storm higher

It has been a magnificent year for AMD shareholders. With the hype surrounding artificial intelligence (AI) reaching fever pitch, investors have rushed to increase their exposure to AMD, as it is essentially the only chip designer that can currently compete with Nvidia in the AI wars.

Although AMD was late to join the AI party, it is trying to make a grand entrance. Last month, the company unveiled its MI300 chip, which has been touted as the world’s most advanced accelerator for generative AI. That means the chip is ideal for training large language models such as ChatGPT, which have burst into the scene lately.

Similarly, AMD has become a bigger player in cloud computing and data centers. While Nvidia currently dominates this market, AMD has been taking market share, and is releasing new variations of chips specialized for data centers. In fact, some recent reports suggest Amazon’s cloud unit is considering using AMD chips, which would be huge since Amazon is the world’s largest cloud provider.

Similarly, AMD has become a bigger player in cloud computing and data centers. While Nvidia currently dominates this market, AMD has been taking market share, and is releasing new variations of chips specialized for data centers. In fact, some recent reports suggest Amazon’s cloud unit is considering using AMD chips, which would be huge since Amazon is the world’s largest cloud provider.

Earnings decline

Even though AMD’s future seems bright, the present is challenging. Over the last year there has been a sharp slowdown in demand for gaming components, such as processors and graphics cards, which are still the company’s bread and butter.

As such, the upcoming results are expected to be ugly. For the second quarter of 2023, analysts expect revenue to have declined by 19% and earnings to have fallen by 45.5% compared to the same quarter last year.

Normally, these would be terrible results and a major source of concern for investors. However, most of this weakness is essentially a post-pandemic hangover as many clients over-ordered during the lockdown shortages, which essentially pulled demand forward. The company is now dealing with the aftershocks.

In general, investors are much more interested about any AI plans, viewing that as a much bigger market than gaming could ever be. The stock’s stellar performance this year suggests that as long as the AI dream is alive, traders are willing to overlook any short-term obstacles such as this one.

Therefore, the subsequent conference call with the company’s management might be even more important than the earnings numbers themselves. The guidance provided by CEO Lisa Su for the next quarters will likely overshadow everything else in terms of market impact.

Therefore, the subsequent conference call with the company’s management might be even more important than the earnings numbers themselves. The guidance provided by CEO Lisa Su for the next quarters will likely overshadow everything else in terms of market impact.

From a chart perspective, AMD shares have been in a clear uptrend since bottoming out in October, recording a series of higher highs and higher lows. The most important level to watch on the upside is the 121.5 zone, while on the downside, any declines below the 107 region could signal that the uptrend is unraveling.

Valuation is pricey

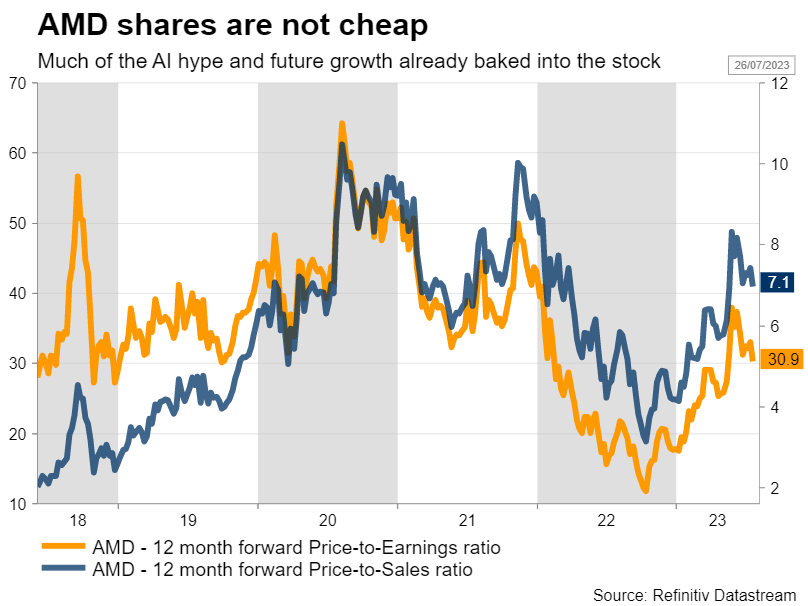

Turning to AMD’s valuation, the stock is not cheap. Shares are trading for 30 times what analysts expect earnings to be over the next year, which suggests that a lot of future growth is already baked into the cake.

This valuation has nearly tripled since October, as the share price rallied but earnings declined, making the stock increasingly more expensive. AMD shares have been even more expensive in recent years, but that was during a period of booming profit growth.

In other words, the shares already reflect investor expectations that the AI-driven growth will help AMD boost its profits in the future. Hence, for the share price to move even higher and aim for new record highs, the company will need to exceed these rosy expectations.

Overall, even though the stock’s valuation is pricey, AMD seems well positioned to grow over the coming years. It has managed to surpass Intel in processors and is rivaling Nvidia in graphics cards for gaming. If it manages to pull off a similar feat in the space of AI chips, that could be a game changer both for the company and the stock.

Activos relacionados

Últimas noticias

Descargo de responsabilidades: Cada una de las entidades de XM Group proporciona un servicio de solo ejecución y acceso a nuestra plataforma de trading online, permitiendo a una persona ver o usar el contenido disponible en o a través del sitio web, sin intención de cambiarlo ni ampliarlo. Dicho acceso y uso están sujetos en todo momento a: (i) Términos y Condiciones; (ii) Advertencias de riesgo; y (iii) Descargo completo de responsabilidades. Por lo tanto, dicho contenido se proporciona exclusivamente como información general. En particular, por favor tenga en cuenta que, los contenidos de nuestra plataforma de trading online no son ni solicitud ni una oferta para entrar a realizar transacciones en los mercados financieros. Operar en cualquier mercado financiero implica un nivel de riesgo significativo para su capital.

Todo el material publicado en nuestra plataforma de trading online tiene únicamente fines educativos/informativos y no contiene –y no debe considerarse que contenga– asesoramiento ni recomendaciones financieras, tributarias o de inversión, ni un registro de nuestros precios de trading, ni una oferta ni solicitud de transacción con instrumentos financieros ni promociones financieras no solicitadas.

Cualquier contenido de terceros, así como el contenido preparado por XM, como por ejemplo opiniones, noticias, investigaciones, análisis, precios, otras informaciones o enlaces a sitios de terceros que figuran en este sitio web se proporcionan “tal cual”, como comentarios generales del mercado y no constituyen un asesoramiento en materia de inversión. En la medida en que cualquier contenido se interprete como investigación de inversión, usted debe tener en cuenta y aceptar que dicho contenido no fue concebido ni elaborado de acuerdo con los requisitos legales diseñados para promover la independencia en materia de investigación de inversiones y, por tanto, se considera como una comunicación comercial en virtud de las leyes y regulaciones pertinentes. Por favor, asegúrese de haber leído y comprendido nuestro Aviso sobre investigación de inversión no independiente y advertencia de riesgo en relación con la información anterior, al que se puede acceder aquí.