US airlines heading for an earnings crash; can bailouts save them? - Stock Market News

The travel industry has been the hardest hit by the global outbreak of the coronavirus, bringing the sector to a near standstill as countries around the world have shuttered their borders to protect their citizens from the deadly pandemic. Among the worst affected from the travel restrictions are passenger air carriers as most flights have ground to a halt. With airport tarmacs resembling aircraft graveyards than busy transport hubs as rows of empty planes lie idle, airline companies have been brought to the brink of collapse, with their share prices nosediving.

It was a huge relief therefore for US airline companies when Congress allocated $50 billion in assistance to the industry from the $2 trillion virus stimulus it approved in late March. What investors now want to know is, will this be enough to stave off mass-scale bankruptcies?

Not all hope is lost for airlinesJudging by Delta’s results, there may be hope yet for avoiding a complete collapse of the sector. On the face of it, Delta’s earnings are dreadful. Its revenues sank by 18% year-on-year in Q1 and its earnings per share (EPS) plunged to a loss of 51 cents, down from earnings of 96 cents a year ago but better than Refinitiv I/B/E/S estimates of a loss of 61 cents. The company expects the second quarter to be even more painful, with revenue projected to fall by as much as 90%.

However, markets saw a silver lining as Delta says it’s on track to cut expenses by 50% in Q2, which would help halve its cash burn to just $50 million a day. It is also confident it will be able to boost its liquidity from $6 billion to $10 billion. That, together with the $5.4 billion it will receive from the taxpayer in virus relief funds could be enough to keep the company afloat during the crisis. It also puts the focus on whether Delta’s rivals will be able to make similar reductions in their expenses as income dries up.

Slipping into lossesNext to come under scrutiny is Southwest Airlines’ earnings. Southwest is expected to report a 15.3% annual drop in revenue to $4.36 billion in Q1 and an EPS loss of 47 cents versus a profit of 70 cents a year ago. American Airlines is not anticipated to do any better. Its revenues are forecast to have fallen by 15.8% to $8.91 billion in Q1 and its EPS to plummet to a loss of $2.21 compared with a profit of 52 cents in Q1 last year.

Finally, United Airlines’ revenue is estimated to have declined by 13.9% to $8.26 billion. This is largely in line with the company’s preliminary report announced on Monday, which put Q1 revenue at $8 billion. Looking at the EPS, it is estimated to crash to a loss of $3.09 from earnings of $1.15 a year ago.

Like Delta, all three airlines are lined up to receive government support. Southwest is set to get $3.2 billion, American Airlines will receive $5.8 billion and United Airlines has said it expects its bailout to amount to $5 billion. Most airlines have also been busy raising funds via other sources such as from share sales and securing credit facilities.

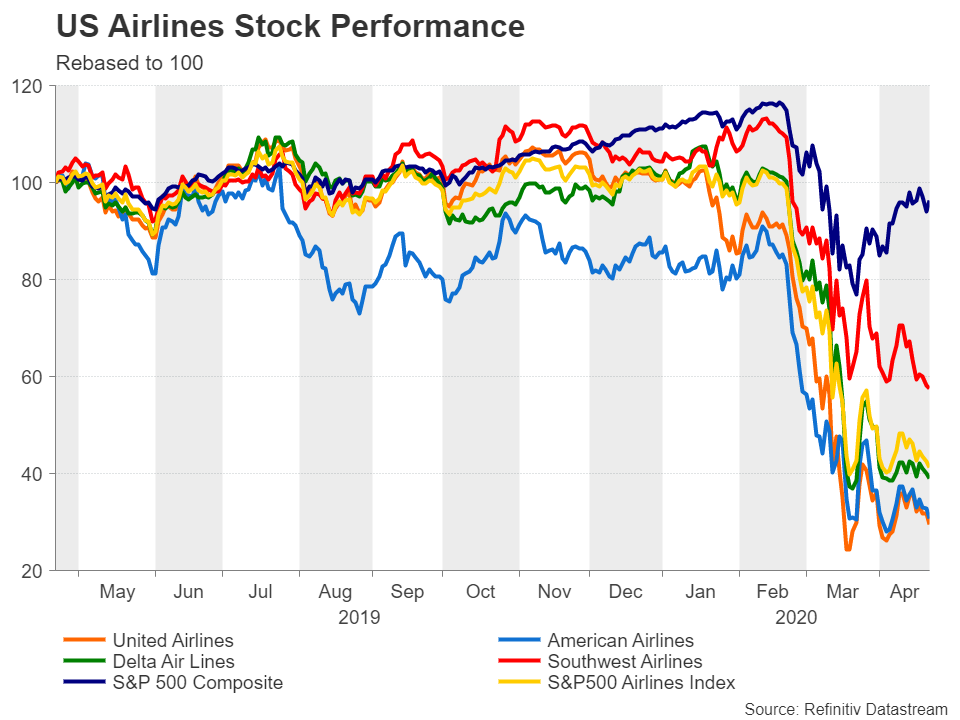

Low cash flow and high debt are concernsBut investors remain worried and this is reflected in the share prices. All the above airlines have been underperforming the S&P 500 by a wide margin since the virus fallout began in late February, with United Airlines seeing its shares fall the most. This could be down to the fact that United has quite a high debt-to-equity ratio of 1.29 versus an industry average of 0.64. Heavily indebted airlines are more at risk of going out of business from the virus turmoil as their creditors will be less keen to lend to them. Another metric investors will be looking at is free cash flow. American Airlines comes out the weakest here as it’s been struggling to retain positive cash flow since 2017.

Despite the industry’s troubles, however, analysts are not shouting ‘sell’ just yet. Delta and United stocks have a mean recommendation of ‘buy’ and Southwest and American have a ‘hold’ rating, though United was recently downgraded from ‘strong buy’ and American was demoted from ‘buy’. Their relatively low price/earnings (PE) ratios might have something to do with avoiding sharper downgrades. The PE ratios of the major airlines have been running below the average of the S&P 500 since at least 2016, and the recent stock market crash that pummelled airline stocks only amplified the comparative low ratios.

Airline stocks have stabilized, but…

Airline stocks have stabilized, but…The share prices of all four carriers have since stabilized and are off their lows, except for Southwest Airlines, which had not fallen as much to begin with. But given the uncertain economic outlook against the backdrop of the pandemic, the likelihood of further losses remains high.

Although many countries, including the United States, are gearing towards removing some of the lockdown controls, it is unclear as to when all restrictions will be lifted, especially for international travel. Without a workable vaccine on the horizon, travel curbs are likely to stay in place indefinitely, and if or when one is developed, air travel will probably be in the very last phase of easing the lockdown measures.

Will air travel ever recover?In the short term, the slump in oil prices may provide some relief to airlines, and in the US, the large domestic market may help the local air carriers to recoup a sizeable passenger base if several states go ahead with relaxing some of the lockdown rules as they intend to do.

But amidst all the uncertainty, one thing that is increasingly being questioned is whether passenger numbers can ever return to pre-crisis levels once the pandemic has ended. That prospect looks set to weigh on airline stocks for some time with the only caveat being that weaker rivals will probably not survive the impending economic downturn and a large-scale consolidation within the industry appears inevitable.Neueste News

Rechtlicher Hinweis: Die Unternehmen der XM Group bieten Dienstleistungen ausschließlich zur Ausführung an sowie Zugang zu unserer Online-Handelsplattform. Durch diese können Personen die verfügbaren Inhalte auf oder über die Internetseite betrachten und/oder nutzen. Eine Änderung oder Erweiterung dieser Regelung ist nicht vorgesehen und findet nicht statt. Der Zugang wird stets geregelt durch folgende Vorschriften: (i) Allgemeine Geschäftsbedingungen; (ii) Risikowarnungen und (iii) Vollständiger rechtlicher Hinweis. Die bereitgestellten Inhalte sind somit lediglich als allgemeine Informationen zu verstehen. Bitte beachten Sie, dass die Inhalte auf unserer Online-Handelsplattform keine Aufforderung und kein Angebot zum Abschluss von Transaktionen auf den Finanzmärkten darstellen. Der Handel auf Finanzmärkten birgt ein hohes Risiko für Ihr eingesetztes Kapital.

Sämtliche Materialien, die auf unserer Online-Handelsplattform veröffentlicht sind, dienen ausschließlich dem Zweck der Weiterbildung und Information. Die Materialien beinhalten keine Beratung und Empfehlung im Hinblick auf Finanzen, Anlagesteuer oder Handel und sollten nicht als eine dahingehende Beratung und Empfehlung aufgefasst werden. Zudem enthalten die Materialien keine Aufzeichnungen unserer Handelspreise sowie kein Angebot und keine Aufforderung für jegliche Transaktionen mit Finanzinstrumenten oder unverlangte Werbemaßnahmen für Sie zum Thema Finanzen. Die Materialien sollten auch nicht dahingehend aufgefasst werden.

Alle Inhalte von Dritten und die von XM bereitgestellten Inhalte sowie die auf dieser Internetseite zur Verfügung gestellten Meinungen, Nachrichten, Forschungsergebnisse, Analysen, Kurse, sonstigen Informationen oder Links zu Seiten von Dritten werden ohne Gewähr bereitgestellt. Sie sind als allgemeine Kommentare zum Marktgeschehen zu verstehen und stellen keine Anlageberatung dar. Soweit ein Inhalt als Anlageforschung aufgefasst wird, müssen Sie beachten und akzeptieren, dass der Inhalt nicht in Übereinstimmung mit gesetzlichen Bestimmungen zur Förderung der Unabhängigkeit der Anlageforschung erstellt wurde. Somit ist der Inhalt als Werbemitteilung unter Beachtung der geltenden Gesetze und Vorschriften anzusehen. Bitte stellen Sie sicher, dass Sie unseren Hinweis auf die nicht unabhängige Anlageforschung und die Risikowarnung im Hinblick auf die vorstehenden Informationen gelesen und zur Kenntnis genommen haben, die Sie hier finden.