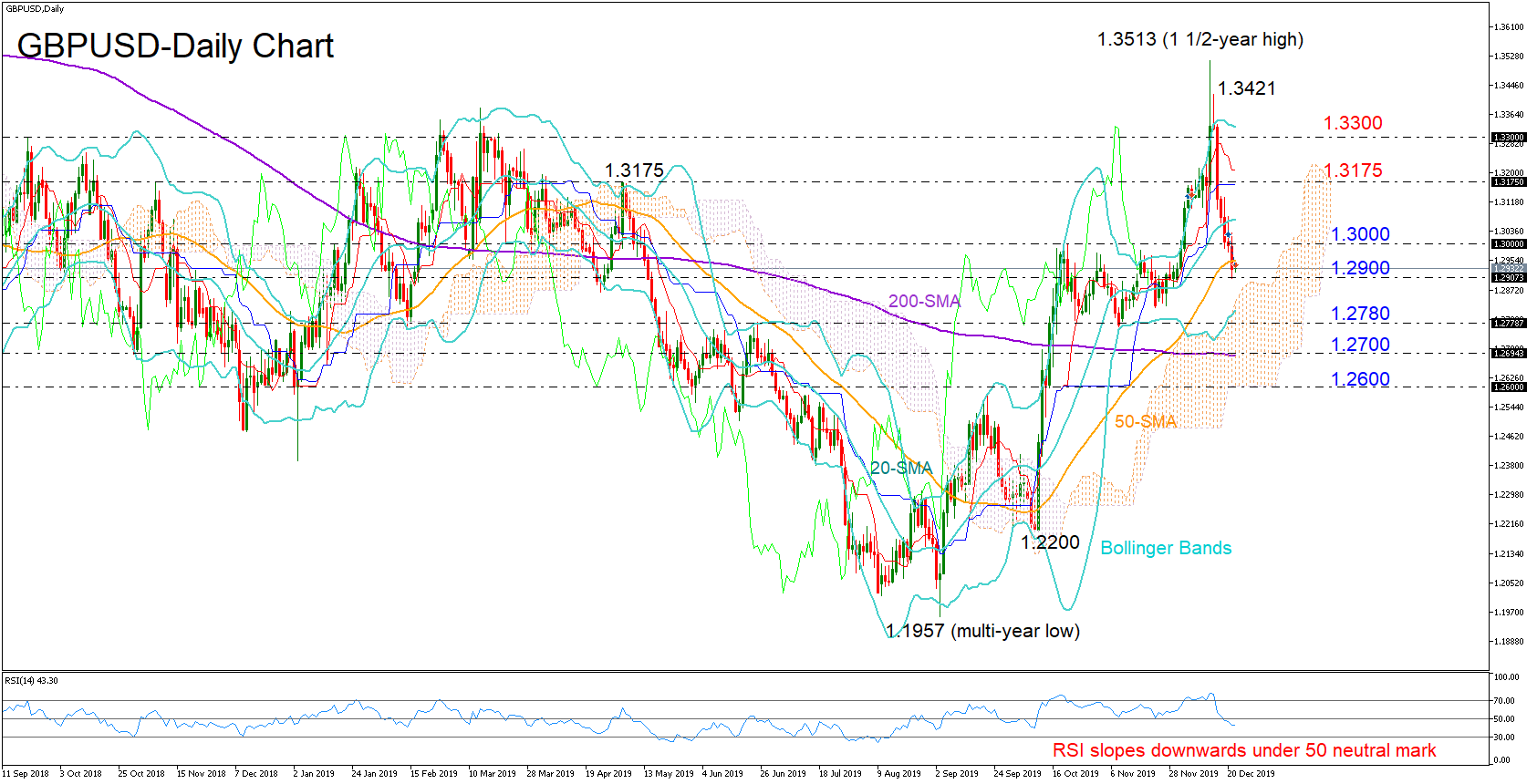

Technical Analysis – GBPUSD bears may keep ruling in short-term

Posted on December 24, 2019 at 8:19 am GMTGBPUSD plummeted back to the 1.2900 territory and below its 20- and 50-day simple moving averages (SMAs), erasing all the election gains that drove the pair to a 1 ½ -year high of 1.3513. The short-term outlook keeps looking cloudy as the price has crossed below the middle Bollinger band but has yet to touch the lower band, while the RSI is also making its way down below its 50 neutral mark. Should the sell-off strengthen beneath the 1.2900 level that acted as support on Monday, the [..]