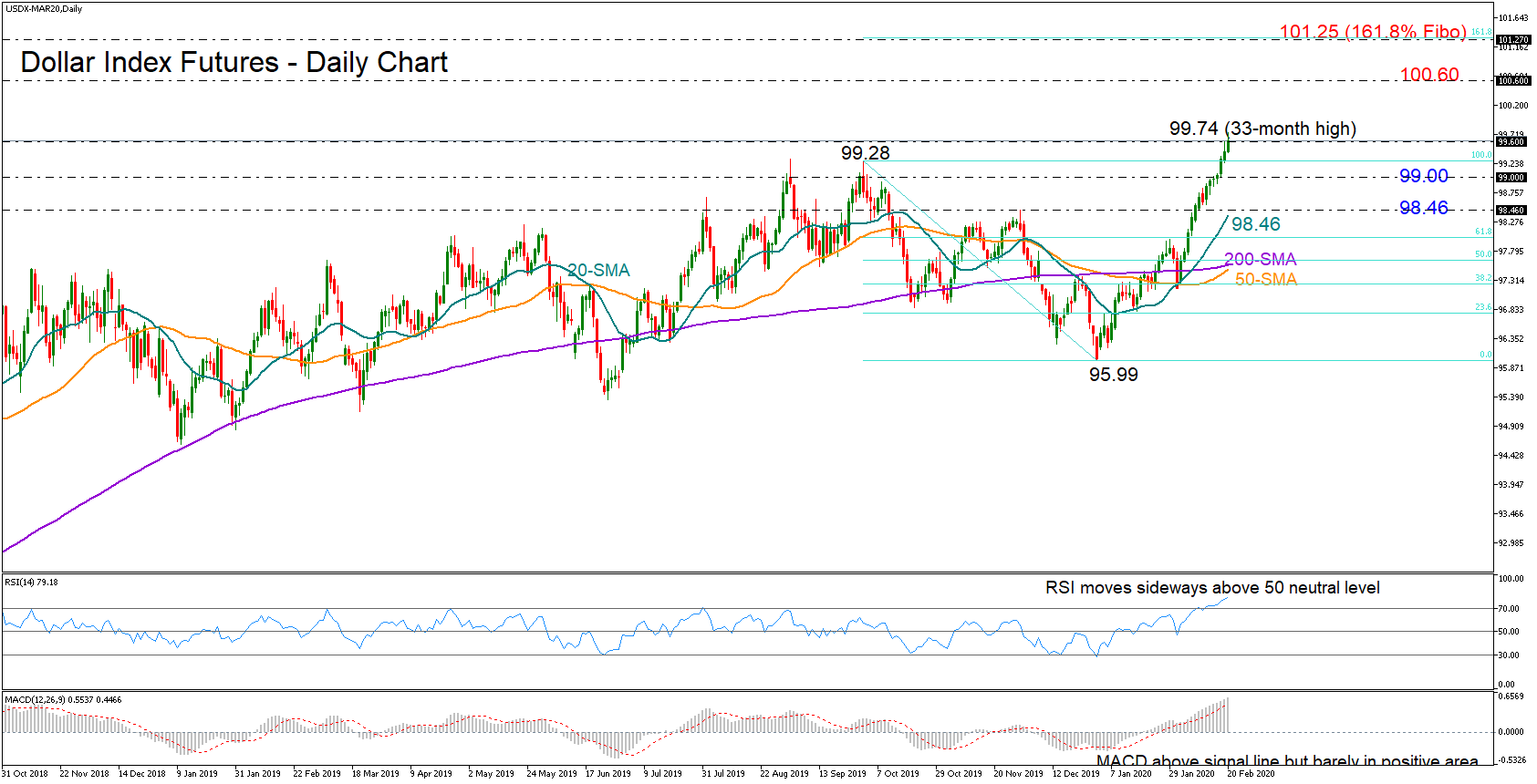

Technical Analysis – Dollar index reactivates 2-year old uptrend in overbought zone

Posted on February 20, 2020 at 9:27 am GMTThe US dollar index futures cleared the tough ceiling around 99.30 and spiked to a 33-month high of 99.74 on Thursday, re-activating the two-year old upward pattern off 88.13. If the bulls manage to close decisively above the former resistance level of 99.60 from 2015, the next key obstacle is expected to pop up around 100.60. Since the RSI and the MACD have yet to show signs of weakness, the odds for such a case are currently looking high. If [..]