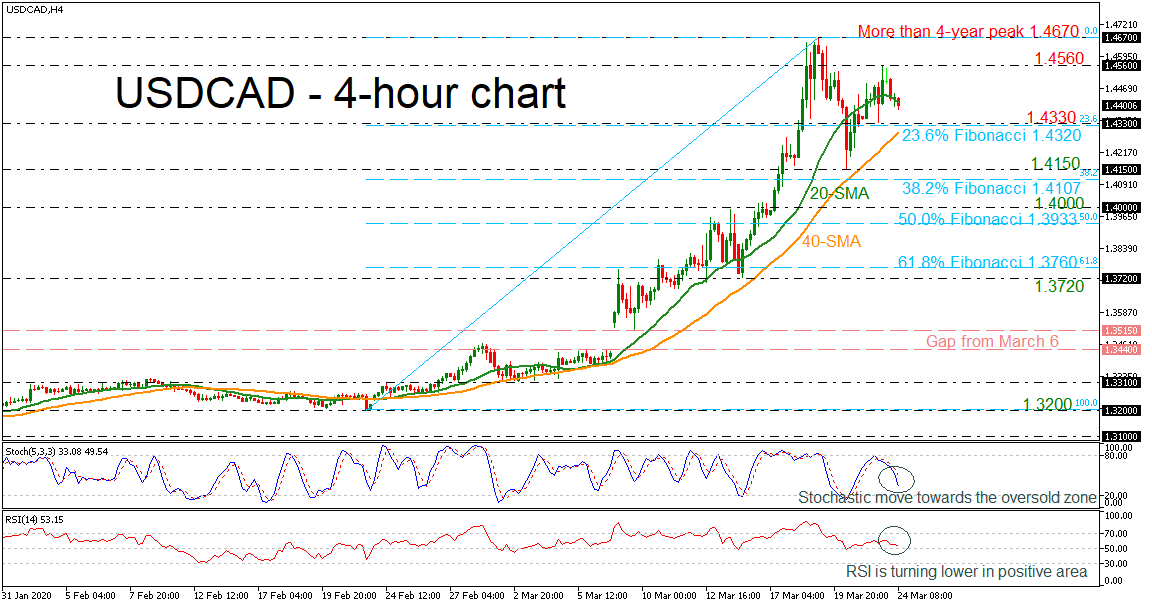

Technical Analysis – USDCAD flirts with 20-SMA, signaling some losses in near term

Posted on March 24, 2020 at 7:54 am GMTUSDCAD is on course to slip beneath the short-term 20-period simple moving average (SMA) creating a neutral mode after the sell-off from the more than four-year high of 1.4670. According to the momentum indicators, the stochastic oscillator is diving towards the oversold zone, while the RSI is turning lower in the positive area. Immediate support is being provided by the 23.6% Fibonacci retracement level of the up leg from 1.3200 to 1.4670, around 1.4320, which stands near the 1.4330 support [..]