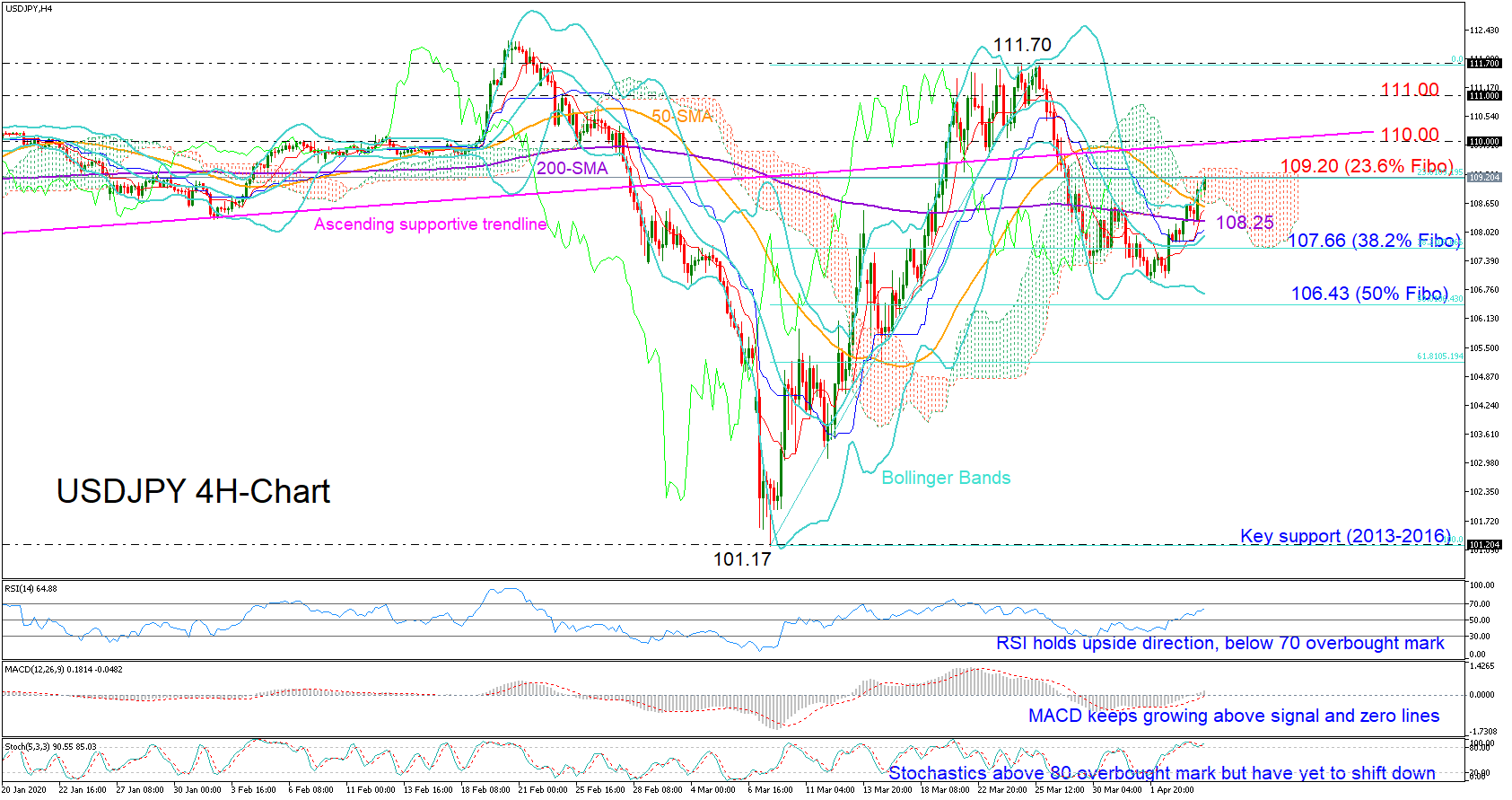

Technical Analysis – USDJPY awaits nearby barrier to let the bulls out

Posted on April 6, 2020 at 7:39 am GMTUSDJPY restored positive momentum on Monday and pierced the 109.00 level on the upside after stepping on the 200-period simple moving average (SMA) on the four-hour chart. While some stabilization cannot be ruled out since the 23.6% Fibonacci of the 101.17-111.70 upleg is in the neighborhood and the fast Stochastics are fluctuating in the overbought territory, the price could soon resume upside direction as the MACD is growing in the positive area and the RSI keeps pointing up. Should the [..]