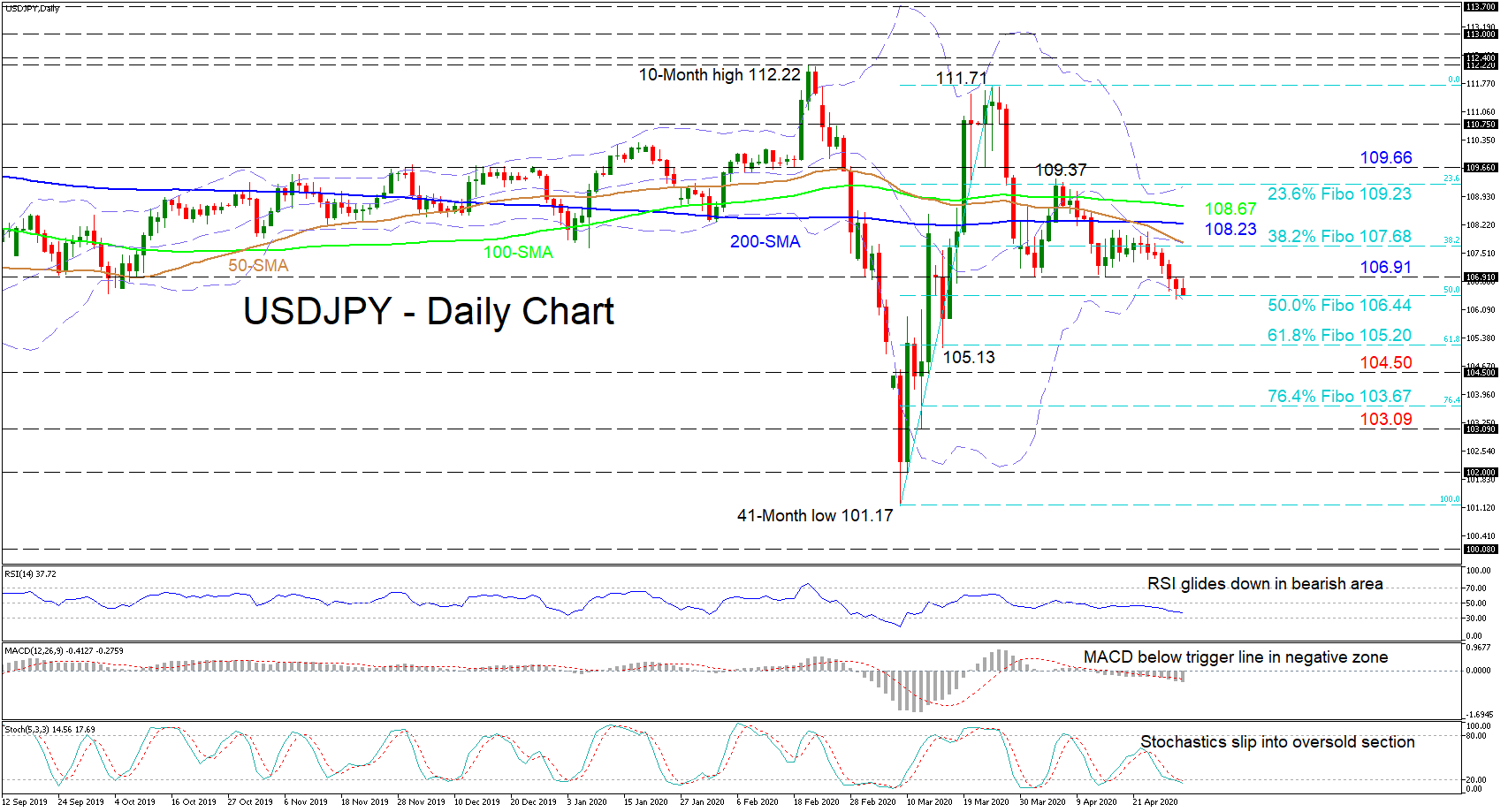

Technical Analysis – USDJPY acquires some negative fuel; upside corrections dwindle

Posted on April 30, 2020 at 7:00 am GMTUSDJPY has lost extra ground past the lows of 106.91 after having failed to overcome the mid-Bollinger band last week. Presently the price is resting at the 106.44 level, that being the 50.0% Fibonacci retracement of the up leg from the 41-month low of 101.17 to the 111.71 high and where the lower Bollinger band is located. The short-term oscillators appear to be confirming the new-found negative move within the price as does the downward sloping 50-day simple moving average [..]