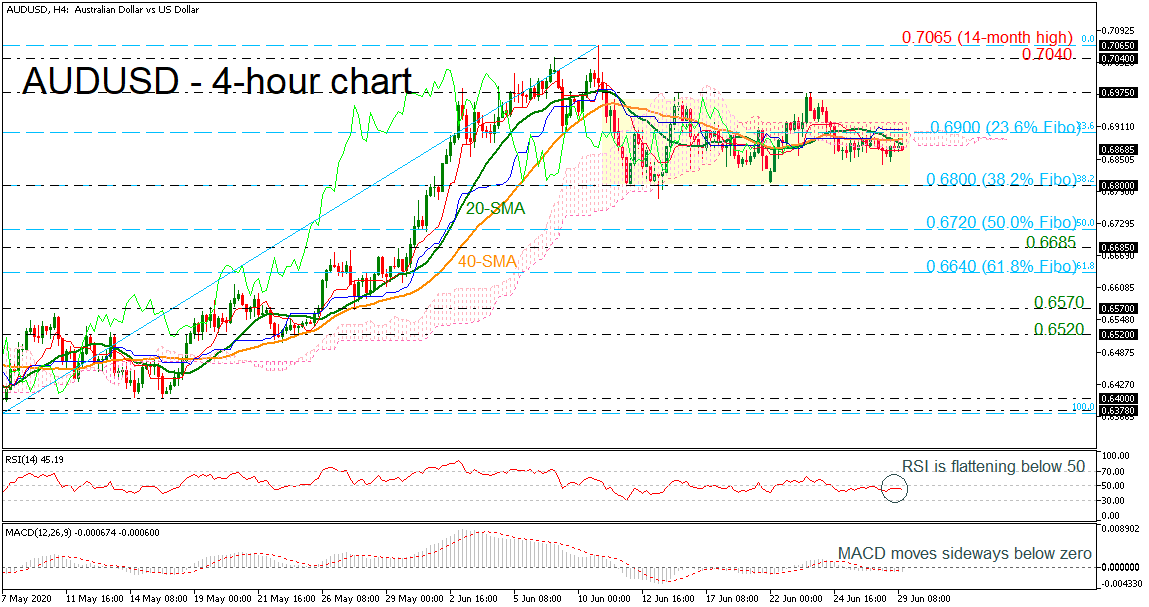

Technical Analysis – AUDUSD moves sideways below 0.6900; positive momentum in medium term

Posted on June 29, 2020 at 9:57 am GMTAUDUSD has been on the sidelines over the last two weeks as the 0.6975 resistance and the 0.6800 handle seem to be a real struggle for traders. Technically, the price could lose some ground in the short-term as the RSI is flattening below 50, while the MACD is flirting with its trigger and zero lines. A pullback on bearish cross within the 20- and 40-period simple moving averages (SMAs) and the lower surface of the Ichimoku cloud could keep the pair [..]