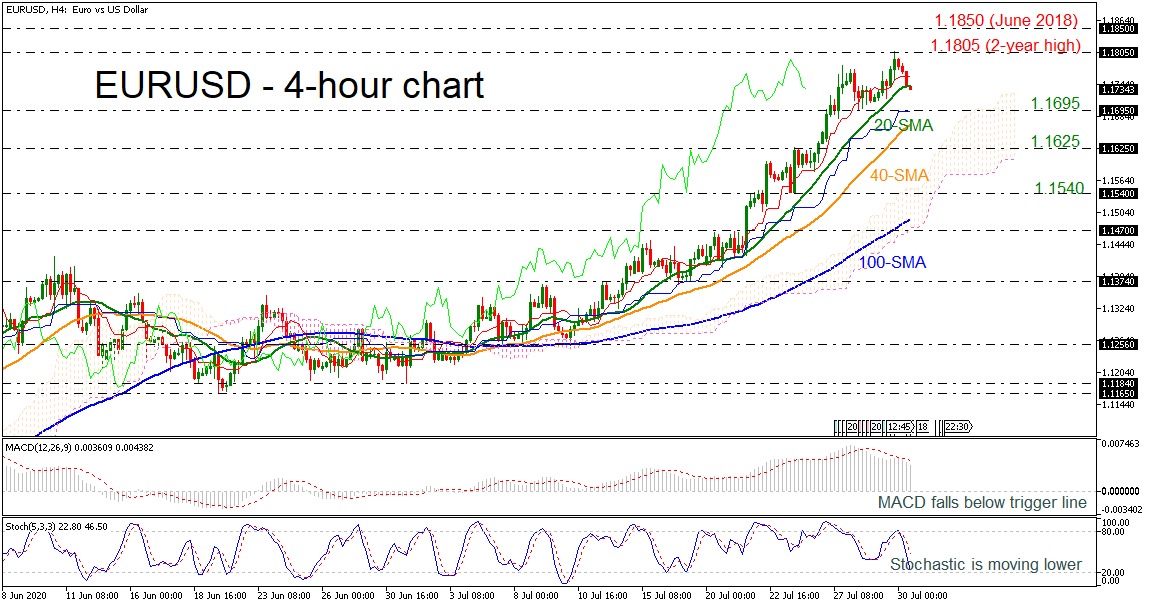

Technical Analysis – EURUSD pivots from 26½-month high; bullish signals intact

Posted on August 3, 2020 at 7:43 am GMTEURUSD retreated abruptly from the recent multi-year high of 1.1908 with sellers attempting to cement further negative moves. This can be viewed in the pause of the blue Kijun-sen line and the latest weakening of the short-term oscillators. Despite the stochastic oscillator having turned bearish and the current stalling in the MACD and the RSI, positive signals are still present, as the MACD, in the positive region, remains above its red trigger line and the RSI holds above 70. Moreover, [..]