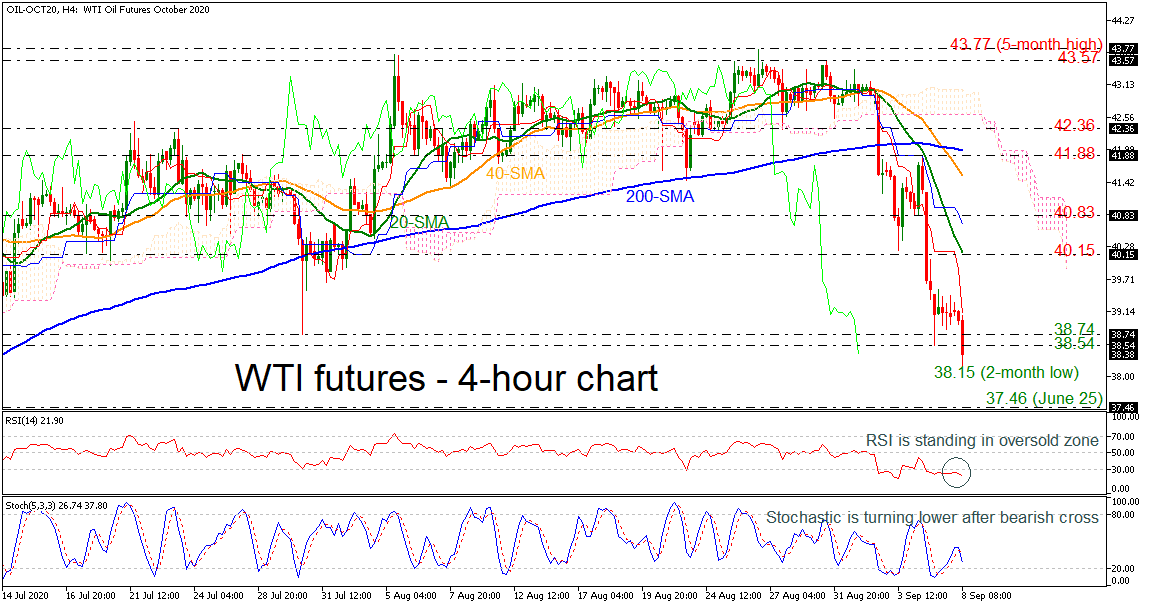

Technical Analysis – WTI futures plunge to new 2-month low

Posted on September 8, 2020 at 9:13 am GMTSince its deep fall towards a two-month low of 38.15 earlier today, WTI crude oil futures have been trading within a descending movement after the pullback from 43.77. The technical picture supports a bearish structure in the short-term timeframe. Looking at momentum indicators, the RSI is holding in the oversold zone with weak momentum, while the stochastic oscillator posted a bearish crossover within its %K and %D lines and is moving lower towards the 20 line. In the wake [..]