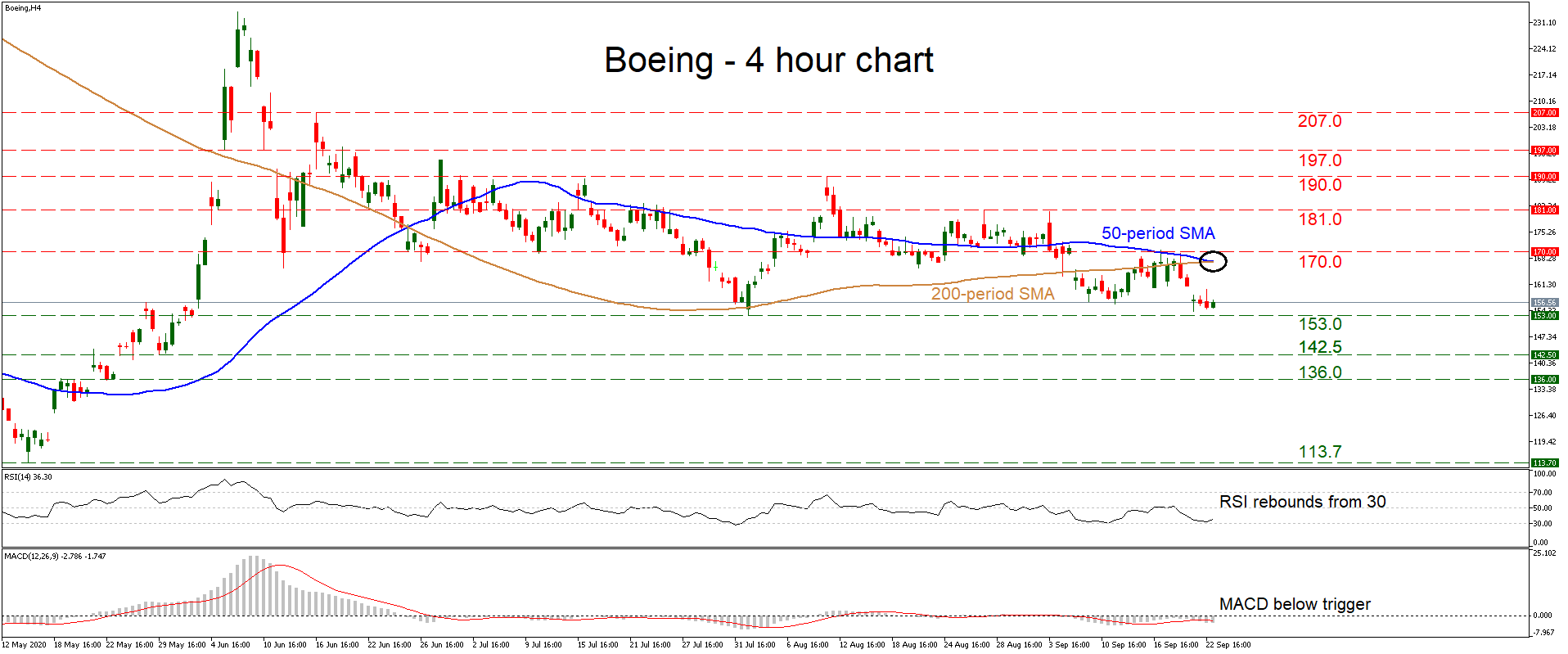

Technical Analysis – Boeing stock testing crucial support region

Posted on September 23, 2020 at 1:40 pm GMTBoeing’s shares have been grinding lower since June, albeit in a slow and controlled manner. The short-term price structure looks cautiously negative, as the stock has been printing lower highs and is trading beneath its 50- and 200-period simple moving averages (SMAs) on the four-hour chart, which seem ready to post a ‘death cross’. The silver lining is that there hasn’t been a lower low, as the 153.0 support zone has held strong so far. Short-term oscillators reflect this mildly [..]