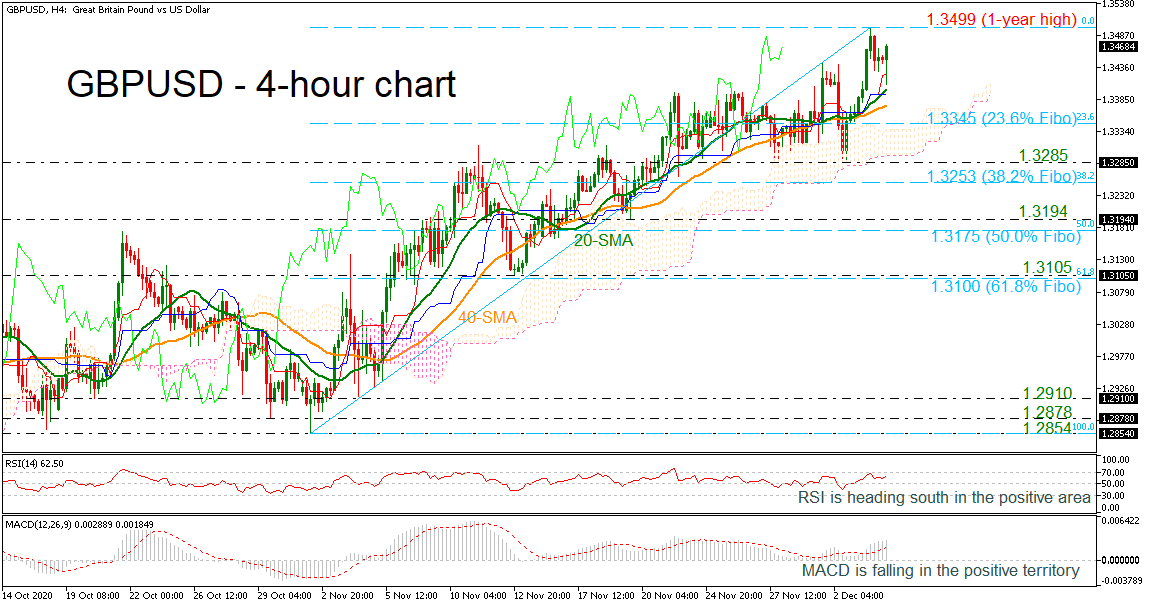

Technical Analysis – GBPUSD takes a hit and fades from fresh 30½-month high

Posted on December 8, 2020 at 9:11 am GMTGBPUSD hit a snag and is retreating from its freshly logged multi-month high of 1.3538, and is even back under the previous highs of 1.3514 and 1.3481. The falling red Tenkan-sen line is showing weakness in the positive drive, while the rising blue Kijun-sen line is backing an improving picture. Furthermore, the slight incline in the 200-day simple moving average (SMA), and the rising 50- and 100-day SMAs are protecting the positive structure. Nonetheless, the short-term oscillators are leaning towards [..]