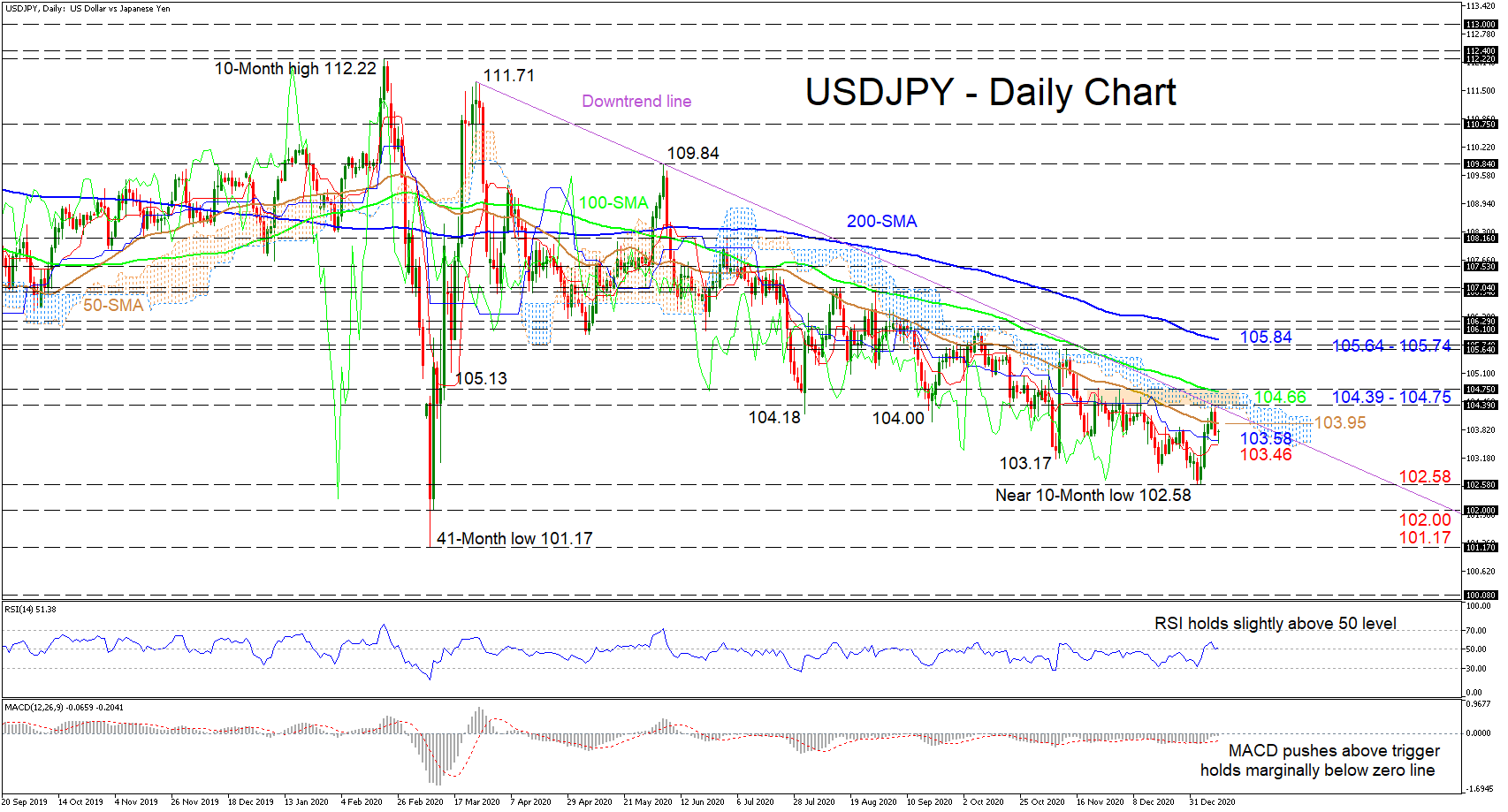

Technical Analysis – USDJPY advances curbed by cloud and downtrend line

Posted on January 13, 2021 at 8:57 am GMTUSDJPY seems to be re-adopting its negative tone after being redirected below the 50-day simple moving average (SMA), following the recent deflection off the downtrend line drawn from the 111.71 peak. The flattening Ichimoku lines are suggesting a pause in negative price action, while the controlling SMAs are escorting the pair even lower. The short-term oscillators currently do not give any compelling signals in directional momentum. The MACD, in the negative region, has thrusted above its red trigger line but [..]