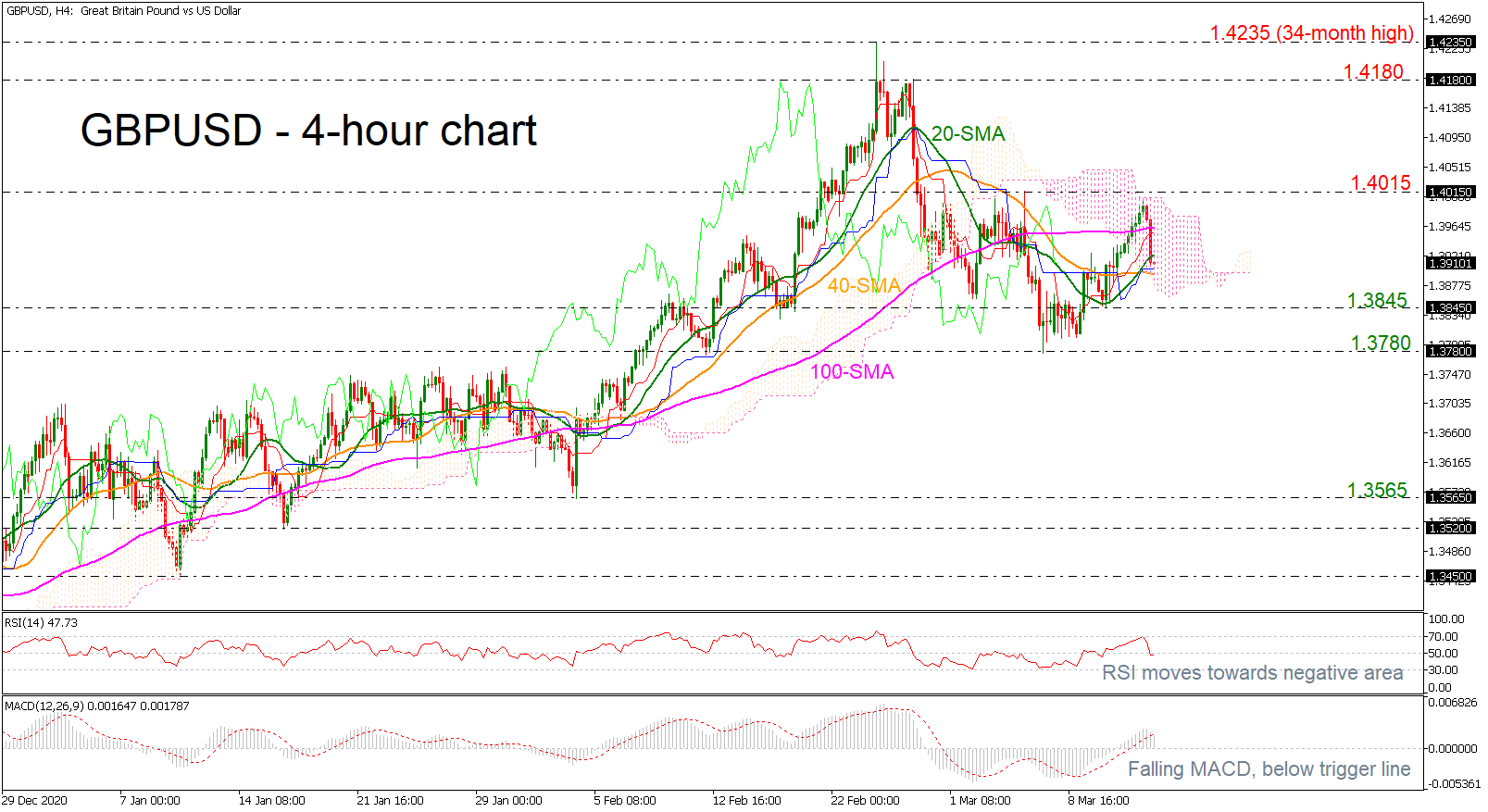

Technical Analysis – GBPUSD unable to defeat 1.4000 but upside risks persist

Posted on March 16, 2021 at 9:12 am GMTGBPUSD is heading for a retest of the 50-day simple moving average (SMA), currently residing within a support base of 1.3757-1.3800. However, the soaring SMAs are defending the more than 5-month uptrend. The flattening red Tenkan-sen line, although beneath the rising blue Kijun-sen line – which is backing the positive picture – is suggesting that the bears may struggle to shift the momentum to the downside. Nevertheless, the now bearish short-term oscillators are signalling that the endured bullish tone has [..]