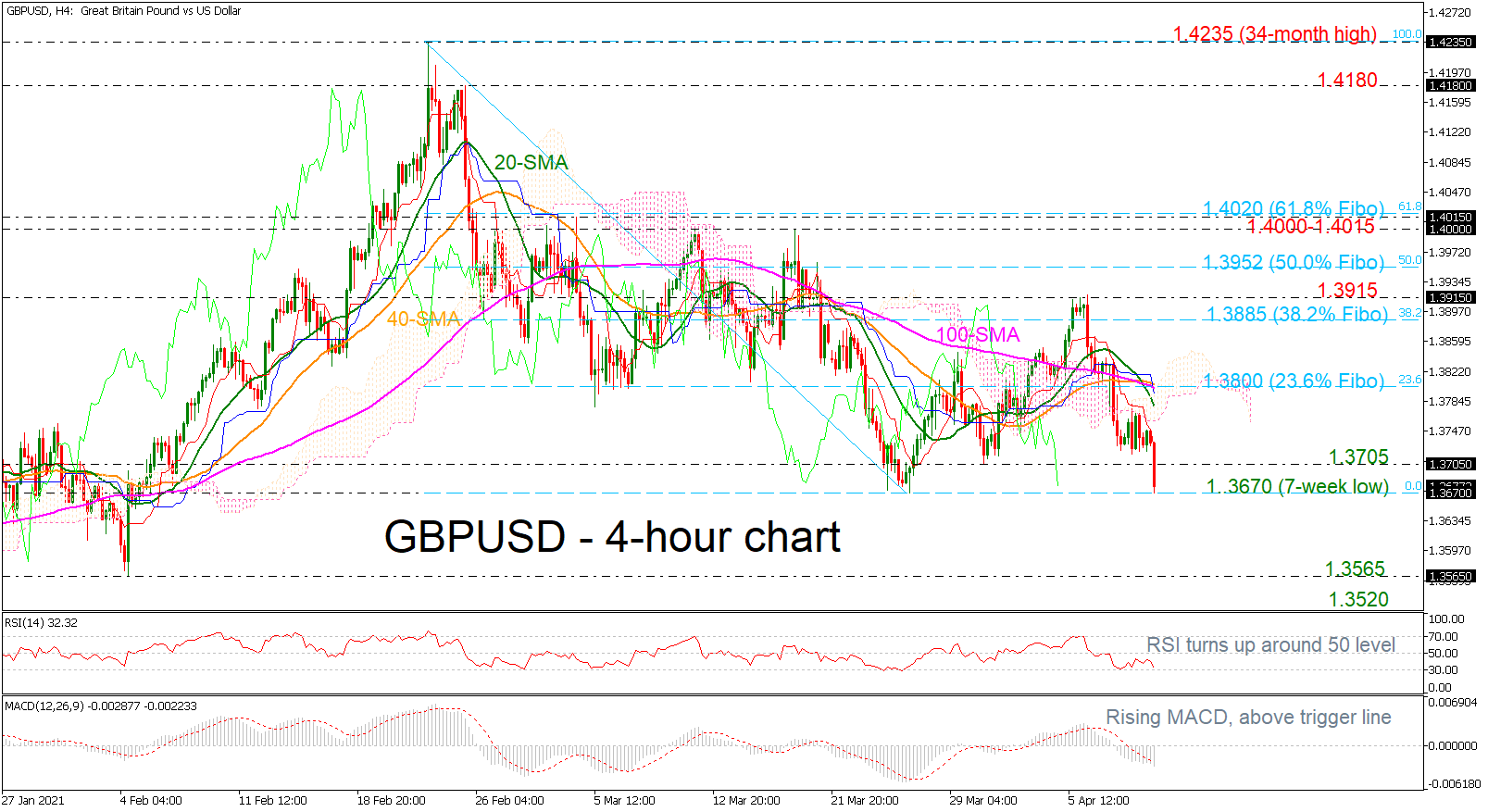

Technical Analysis – GBPUSD plunges below 1.37; bearish bias back on cards

Posted on April 9, 2021 at 7:21 am GMTGBPUSD is plummeting beneath the 1.3700 round number and it touched again the seven-week low of 1.3670 today. The short-term moving averages are pointing all down suggesting more losses, while the technical indicators are extending its bearish movement. The RSI is sloping down in the negative territory, while the MACD is stretching below its trigger and zero lines. More downside movements could meet the 1.3565 support level, taken from the trough on February 4. Below that, the 1.3520 barrier, registered [..]