Technical Analysis – EURUSD absorbs losses but holds above crucial $1.20 region

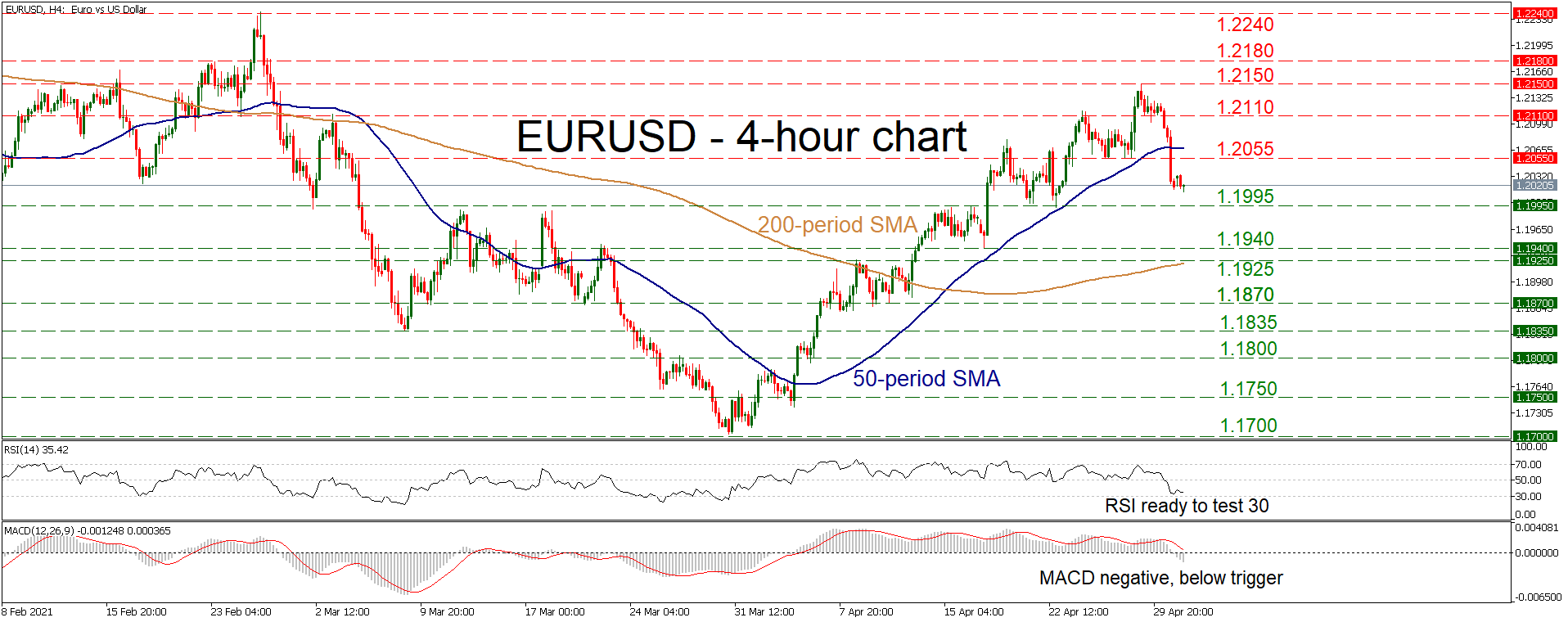

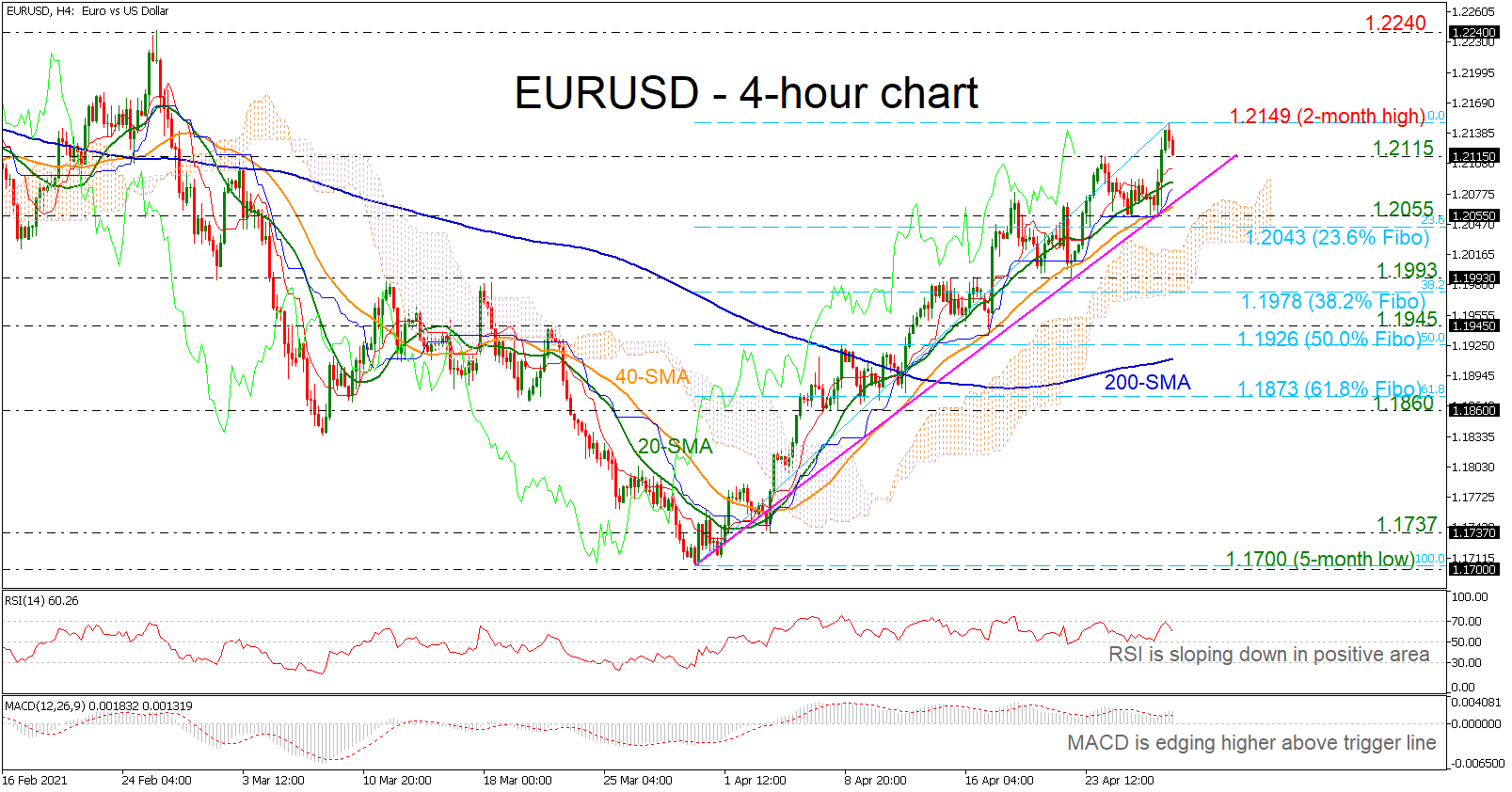

Posted on May 3, 2021 at 6:53 am GMTEURUSD took some heavy fire over the past few sessions, but the current structure of higher highs and higher lows does not appear to have been violated, keeping the recent rally in play for now. That said, a clear close below the critical 1.1995 support zone could change all that, shifting the positive structure back to neutral and setting the stage for further declines. The short-term oscillators reflect the latest drop in the market, with the RSI hovering just above [..]