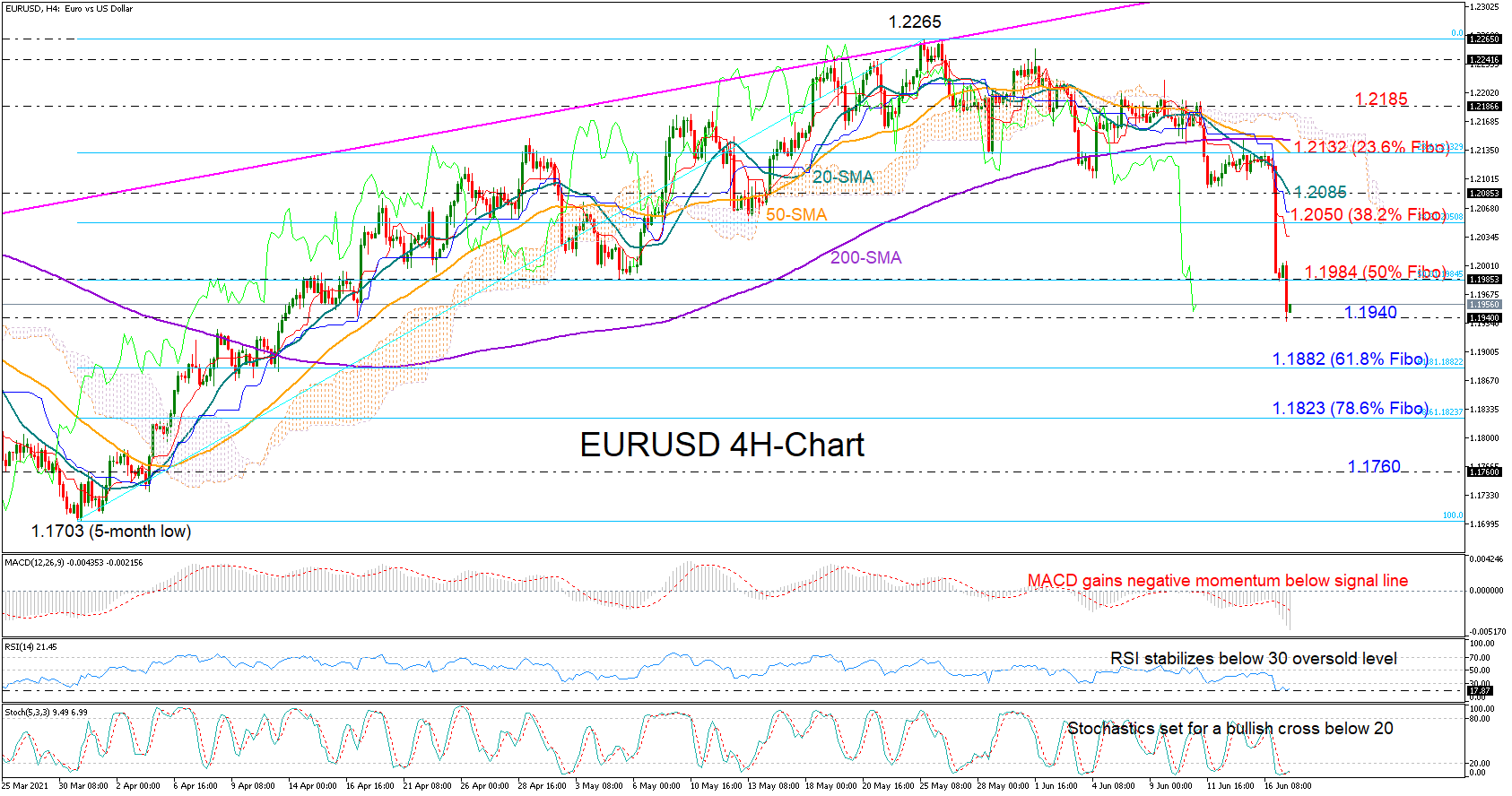

Technical Analysis – EURUSD finds footing near 23.6% Fibo; upside bias weak

Posted on June 21, 2021 at 6:00 am GMTEURUSD has steadied slightly above 1.1856, which is the 23.6% Fibonacci retracement of the January-March downleg, following the sharp slide from the 1.21 vicinity last week. However, the upside pressure is extremely weak as momentum indicators remain deep in bearish territory. The MACD histogram has slumped below zero, falling far beneath its red signal line. The stochastics are also buried in the oversold zone below 20 and the %K line is barely ticking higher. However, should it manage to complete [..]