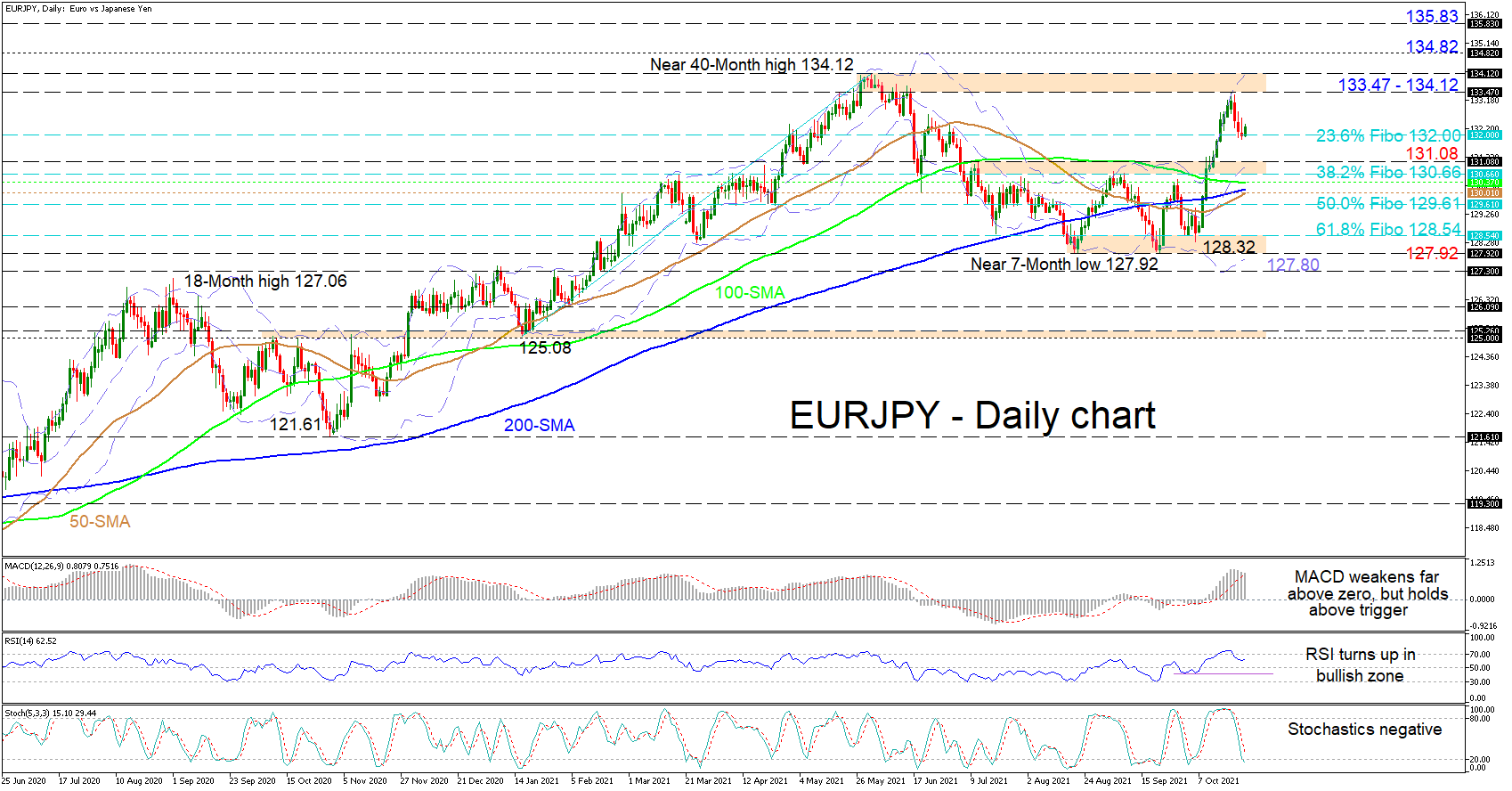

Technical Analysis – EURJPY points to more losses ahead of ECB policy meeting

Posted on October 28, 2021 at 9:25 am GMTEURJPY entered a downhill race following the peak at a four-month high of 133.47 in the four-hour chart, correcting below its shorter-term simple moving averages (SMA) and more recently below the Ichimoku cloud, which kept the bears under control on Wednesday. The downturn in the RSI and the MACD is gaining fresh momentum in the bearish territory as the Stochastics are drifting lower again despite their latest bounce off the oversold area, all flagging additional losses ahead for the market. [..]