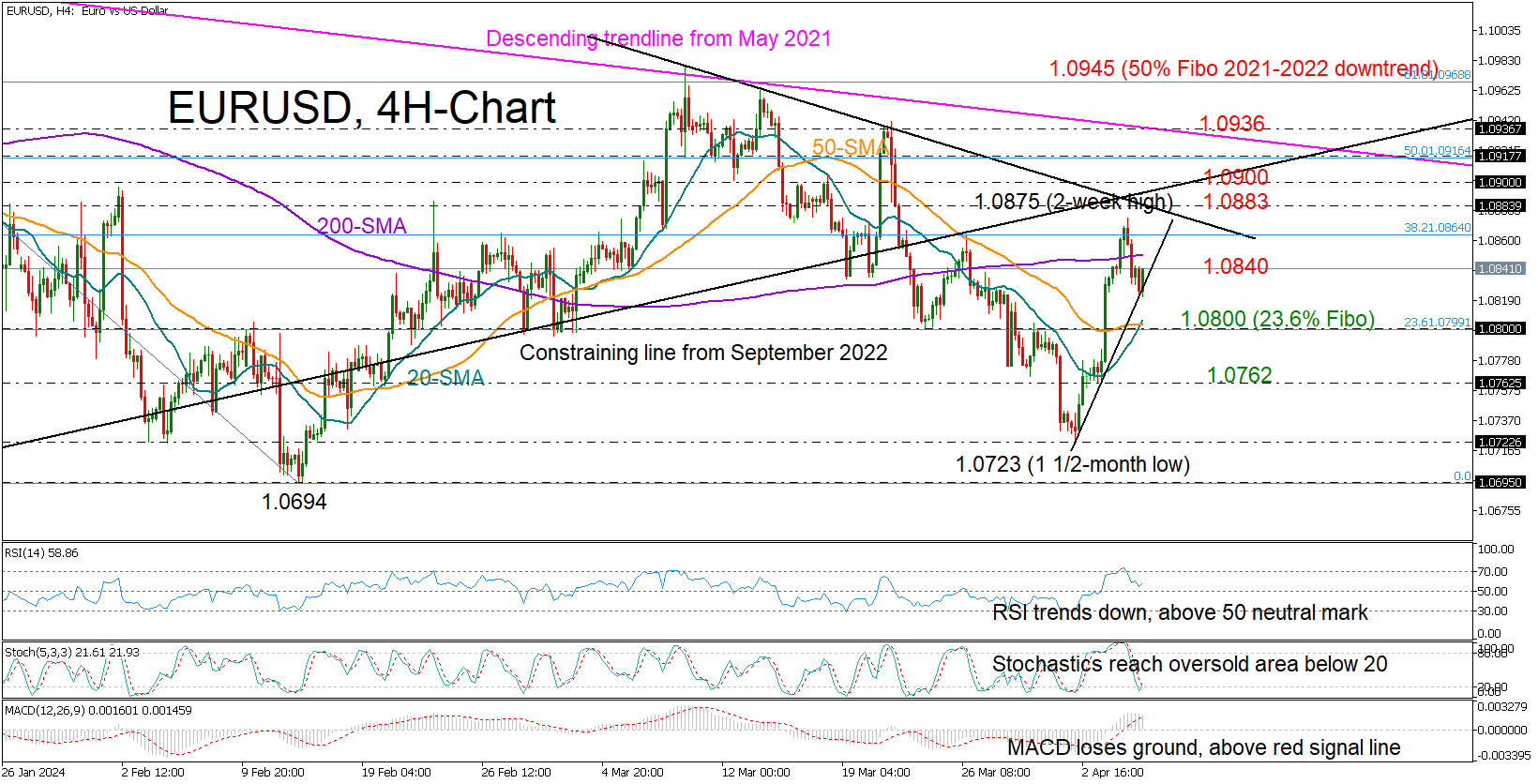

Technical Analysis – EURUSD trims earlier gains as clock ticks down to NFP

Posted on April 5, 2024 at 9:14 am GMTEURUSD pulls back from two-week high Technical bias is not bearish yet EURUSD gave up some ground on Thursday after a sharp rally from a one-and-a-half-month low of 1.0723 to a two-week high of 1.0875. The US nonfarm payrolls report is on the agenda today and investors will look at whether jobs growth slowed down to 212k and wage growth eased to 4.1% y/y as forecasts suggest. The pair might receive some assistance if there are indications of a weakening US labor market, [..]