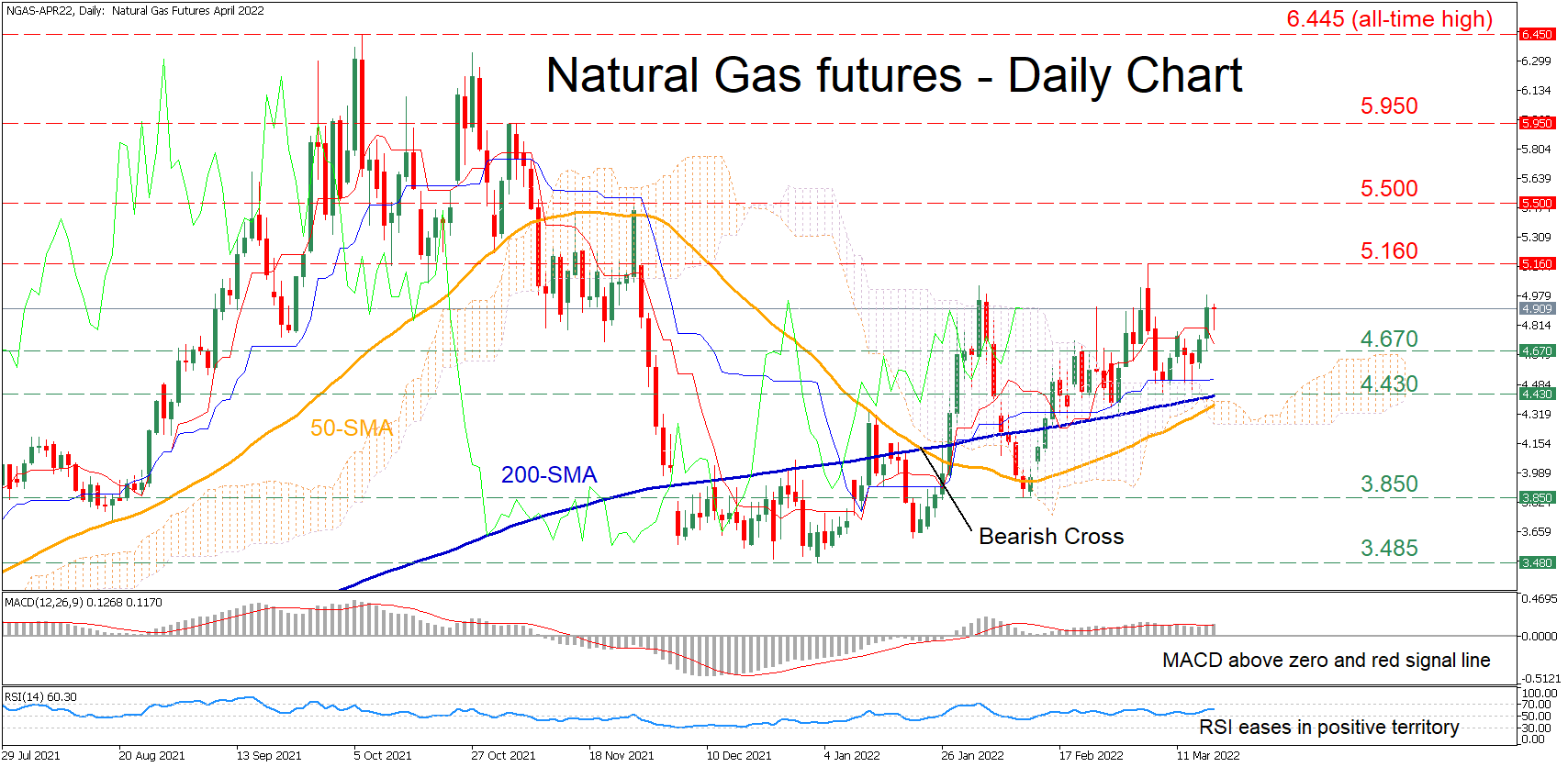

Technical Analysis – Natural gas futures tick higher as bullish forces linger

Posted on March 18, 2022 at 1:57 pm GMTNatural gas futures (April 2022 delivery) have been creeping higher in the short term after their long-term downtrend ceased at the 3.485 region in December. Moreover, the ascending 50-day simple moving average (SMA) is closing the gap with the 200-day SMA, where a potential crossover could endorse the case of a broader rally. The short-term oscillators suggest that buyers have gained the upper hand. The MACD histogram is currently above both zero and its red signal line, while the RSI is hovering beyond its [..]