Implied Volatility Report – October 10, 2023

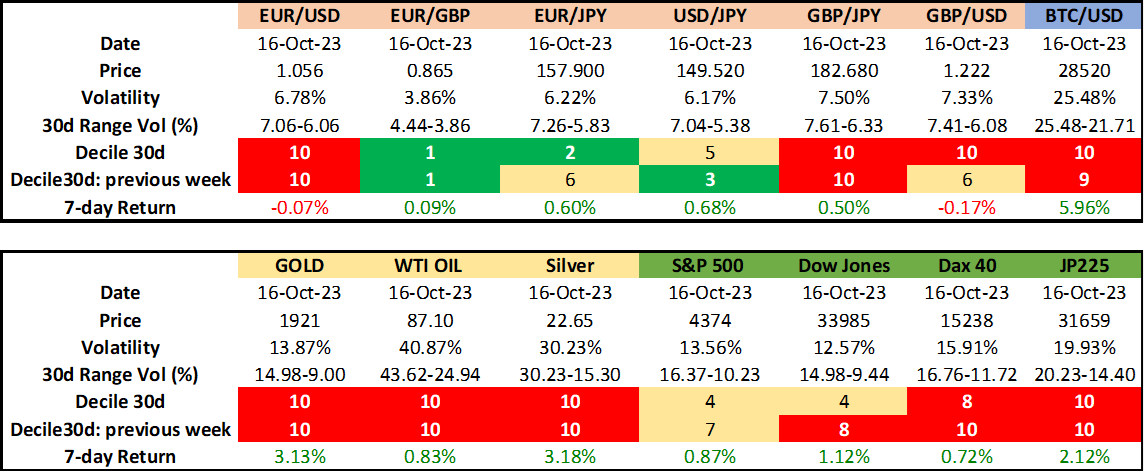

Posted on September 30, 2022 at 11:34 am GMTEUR/USD volatility remains extremely elevated, most JPY crosses at the other end of the spectrum Expected volatility of precious metals and oil stay at month-highs US stock indices in calmer waters; Bitcoin at the highest of its volatility range EUR/USD expected volatility remains extremely high despite the marginal weekly negative return. On the flip side, yen crosses are expected to experience very low volatility going forward with the exception of GBP/JPY. In commodities, gold and silver expected volatility has jumped [..]