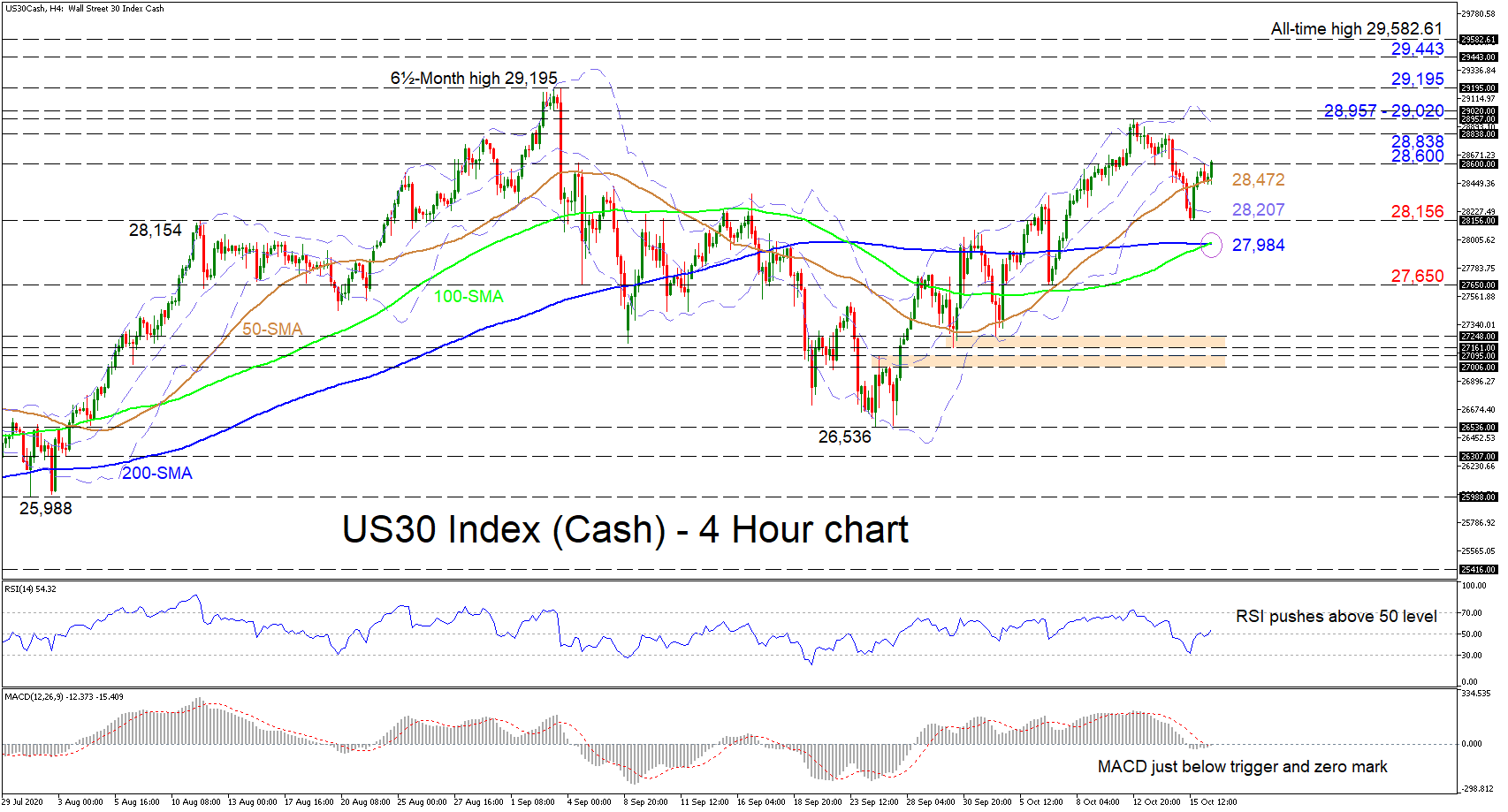

Technical Analysis – US 30 index struggles at mid-Bollinger band; positive signals grow

Posted on October 16, 2020 at 12:42 pm GMTUS 30 stock index (Cash) after having pushed above the 50-period simple moving average (SMA) is now confronting the mid Bollinger band at the 28,600 barrier. The index appears to be regaining strength after a pivot back up from the 28,156 mark. The rising slopes of the 50- and 100-period SMAs and the recent bullish crossover of the 200-period SMA by the 100-period one may boost the short-term uptrend. The short-term oscillators also reflect increasing positive momentum. The MACD, slightly [..]