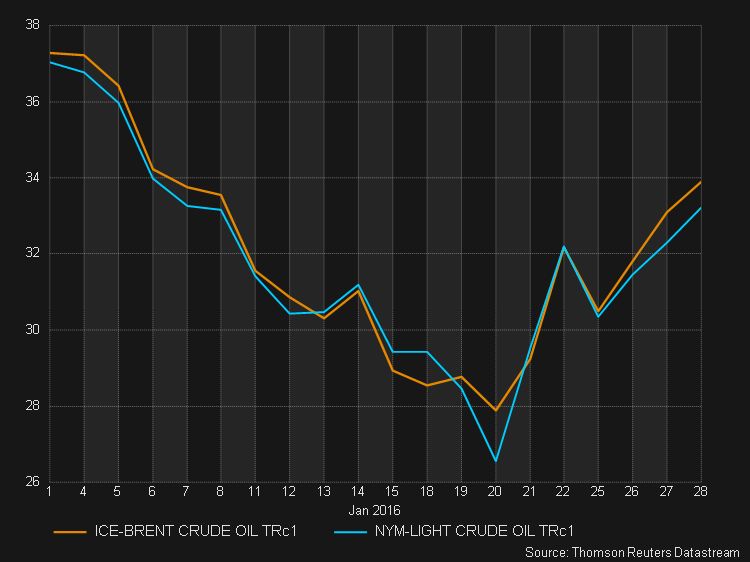

European Session – Euro and sterling rally, oil shows renewed weakness

Posted on February 1, 2016 at 3:59 pm GMTPMI data for various countries were released today but had little impact on currencies as the broader fundamentals were the main market drivers. Risk appetite was off as focus was on China’s slowing economy after the nation’s official manufacturing PMI index fell to 49.4 in January from 49.7 in December, being stuck below 50 for the sixth month in-a-row. The figure was below estimates of 49.6. Eurozone final manufacturing PMI for January came in as expected at 52.3, showing no [..]