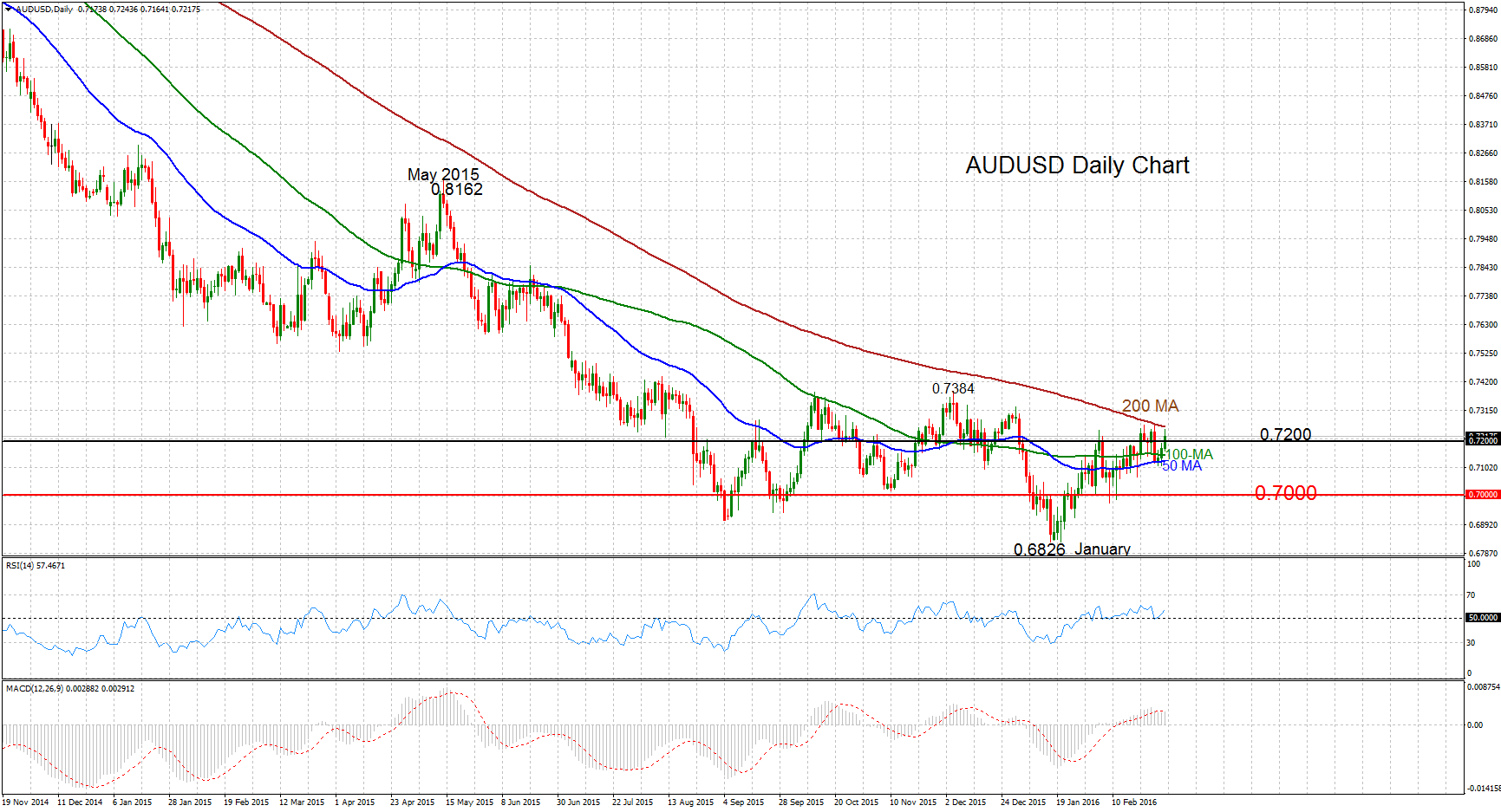

Asian Session – Dollar and oil stage a late rebound; aussie soars above 0.73

Posted on March 3, 2016 at 9:11 am GMTMarket sentiment remained broadly positive on Thursday as the US dollar bounced off yesterday’s lows and oil reversed a sharp slide to end the day higher. The dominating data in today’s Asian session were the services PMI for China and Japan. Services activity slowed in both China and Japan in February according to the latest PMI readings. Market reaction was muted though as traders were more focused on signs of a rebound in commodity prices. Oil prices posted a late [..]