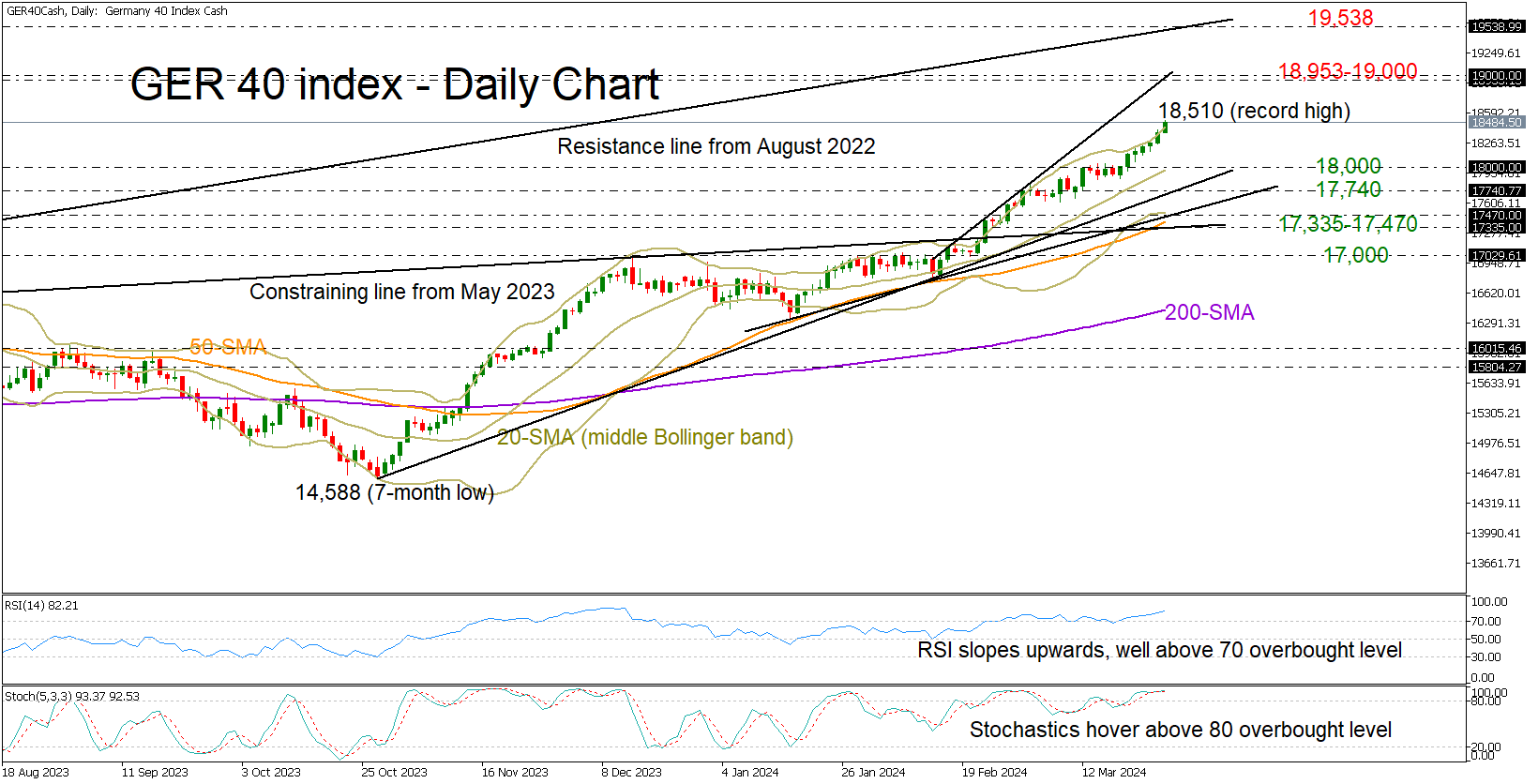

Technical Analysis – GER 40 index in positive mood ahead of ECB rate decision

Posted on June 6, 2024 at 8:21 am GMTGerman 40 index strives to exit bearish formation before a widely expected rate cut Short-term risk skewed to the upside, but confirmation signal could come above 18,672 The German 40 index started Thursday’s session on a positive note, aiming to extend its latest upturn above its 20-day simple moving average (SMA) and out of the short-term bearish channel at 18,672. All eyes will be on the ECB policy meeting today and particularly on the central bank’s guidance on future rate cuts [..]