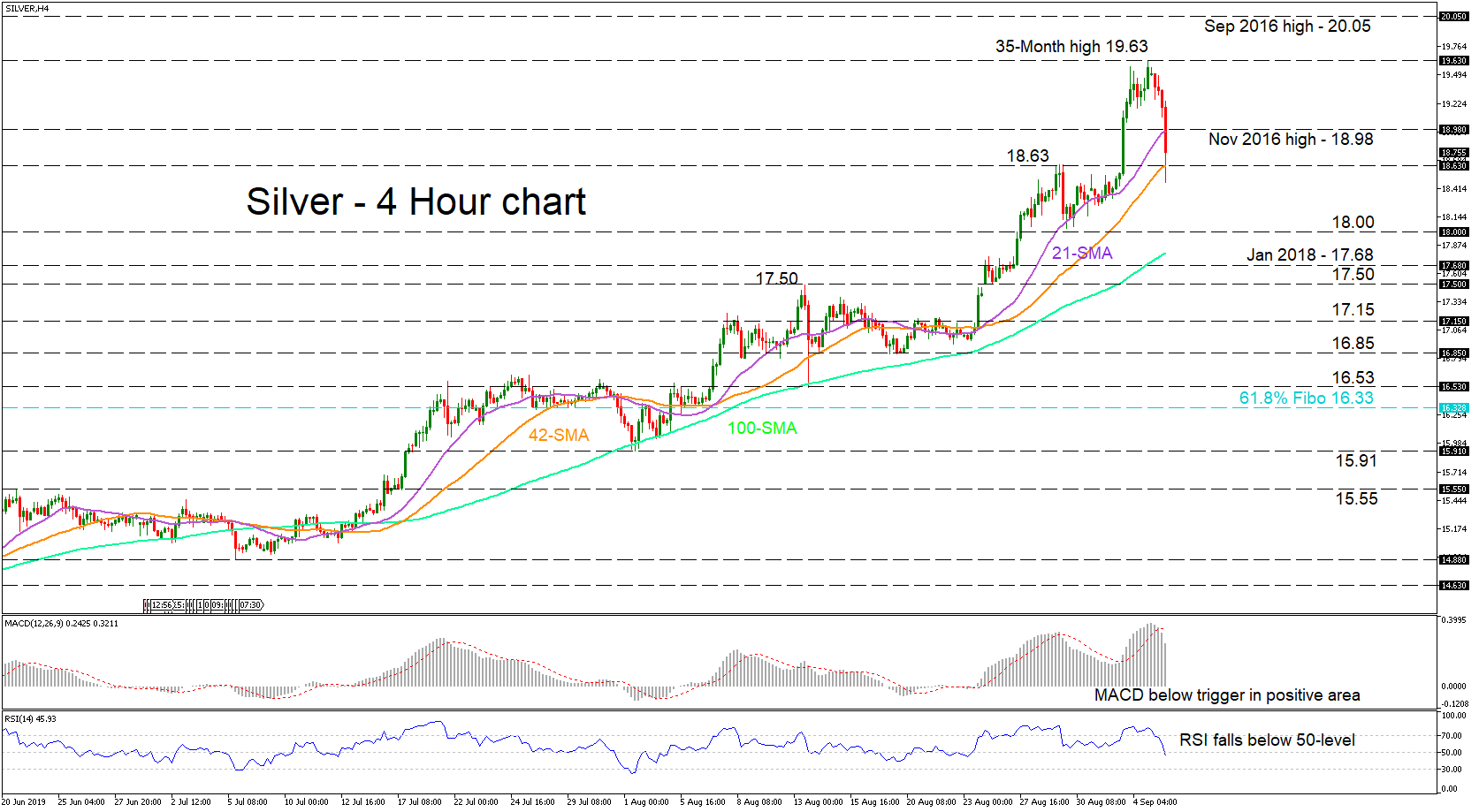

Technical Analysis – Silver reverses up from 200-SMA; bears try to stop the gains

Posted on September 24, 2019 at 7:24 am GMTSilver’s bears resurfaced around the 2017 high of 18.63 after a rally which bounced off the 200-period simple moving average (SMA). The move up began once the price of the metal gapped back above the 200-period SMA, following a brief close beneath it on September 13. The upward sloping 21- and 42-period SMAs indicate that the move up may stick around, with the 200-period SMA also backing the bigger positive outlook. That said, short-term oscillators paint a mixed picture, as [..]