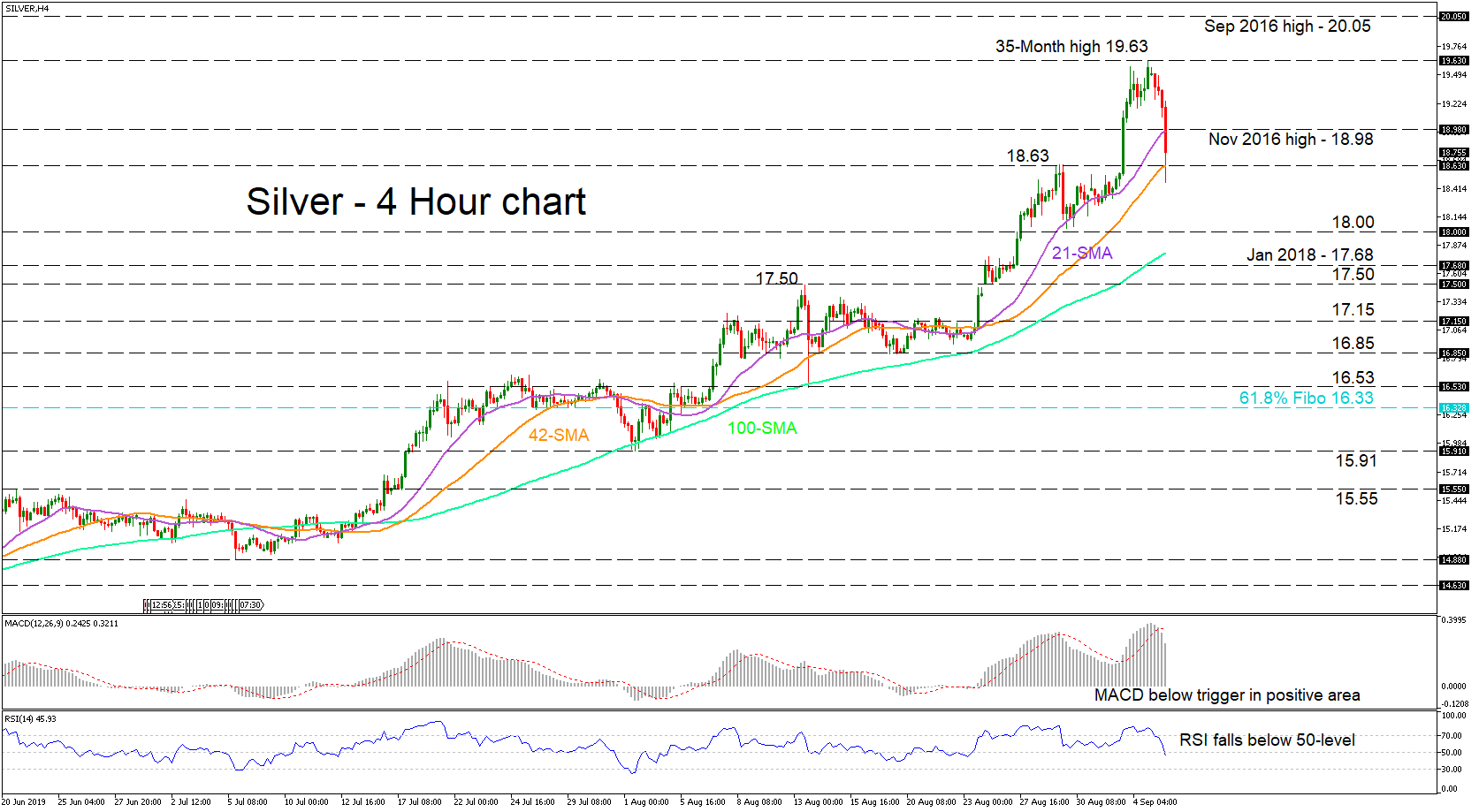

Technical Analysis – Silver moves to multi-year highs; bears correct back down

Posted on September 5, 2019 at 3:54 pm GMTSilver’s bears erased the gains from the move up to a thirty-five-month high of 19.63. The pullback in the price of the metal moved through the 21-period simple moving average (SMA), which coincided with support from the November 2016 high of 18.98. The bears are now testing the 42-period SMA also residing with the swing high at 18.63. Momentum indicators reflect an increasing negative picture for the short-term. The MACD declined below its red trigger line in the positive region, [..]