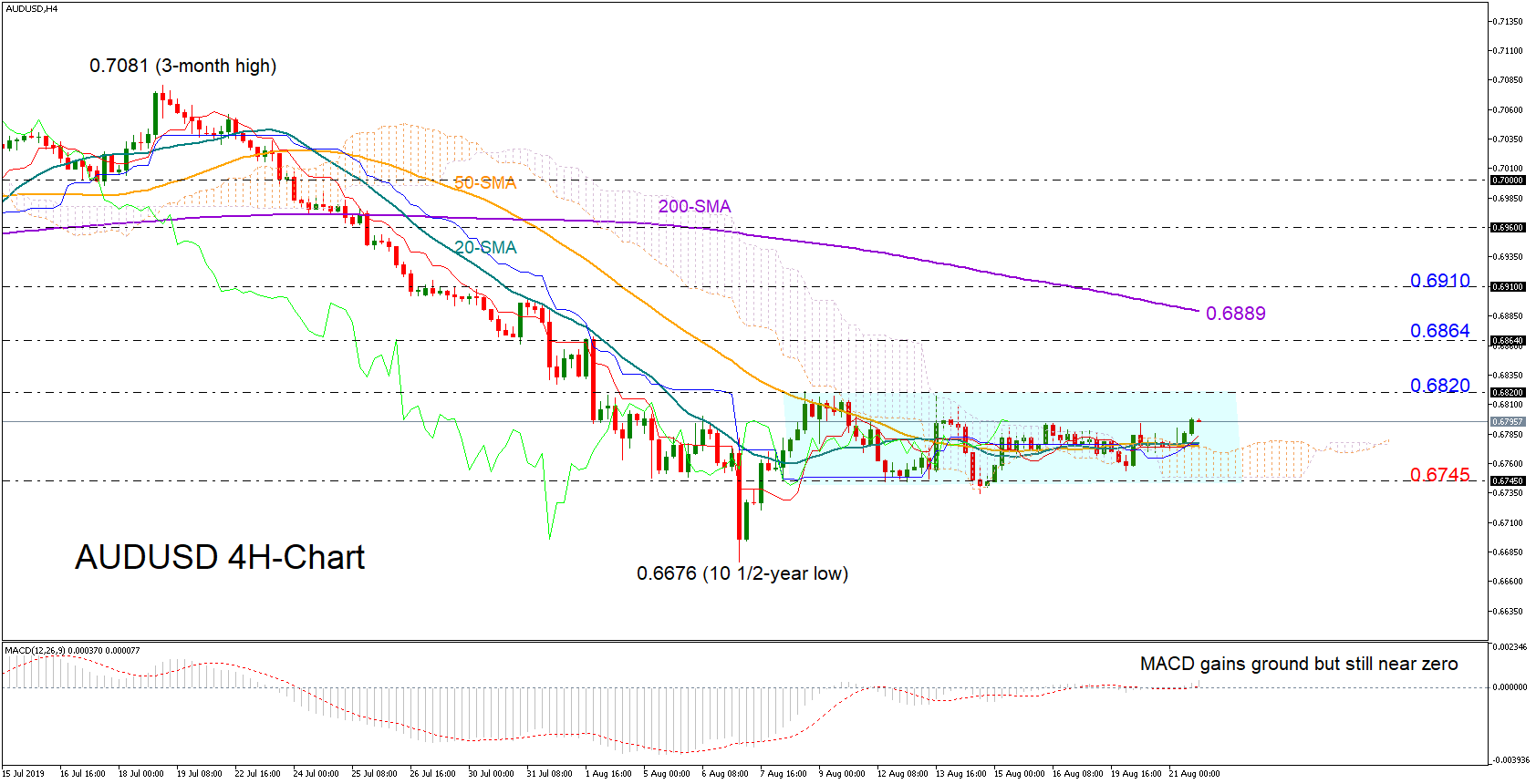

Technical Analysis – AUDUSD stuck in a sideways channel; bullish signals weak

Posted on August 21, 2019 at 1:36 pm GMTAUDUSD continues to trade softly within a sideways channel for the third consecutive week with an upper boundary at 0.6820 and a lower boundary at 0.6745. The MACD in the four-hour chart has gained some strength above its red signal line, endorsing the current upside movement in the price, though the indicator is still close to zero, while the red Tenkan-sen remains flat around the blue Kijun-sen, both giving little hopes for a meaningful rally. The bulls need a decisive close [..]