Daily Comment – Markets hold their breath as America votes

- US presidential election in the spotlight

- Markets in anticipation mode as volatility is elevated

- Dollar, equities and gold remain under pressure

- Aussie fails to materially benefit from RBA’s hawkishness

The long wait is finally over

The countdown for the biggest event of 2024 is finally over as in a few hours around 80 million registered voters will cast their vote across the United States. Along with around 80 million that have already voted by absentee ballot and by mail, these voters will determine the next US president, the House of Representatives and 33 members of the Senate.

US voters will determine the next US president, the House of Representatives and 33 members of the Senate.

In most US states, polls will close at around 9pm ET (2am GMT). Alaska is the last to close its polls at 1am ET (6am GMT) while California has a deadline of 11pm ET (4am GMT). In the seven swing states, which will receive a good chunk of the market’s attention, voting concludes between 7-10pm ET (12-3am GMT).

The swift scenario is that the new president is crowned by Wednesday, with the market adjusting to the new environment and turning its focus to Thursday’s Fed meeting. On the flip side, a tight race, particularly in the swing states, could mean the market might have to wait until the weekend for the final result.

In the meantime, market participants continue to debate about the winner and the likely impact on key market assets. Additionally, countries across the globe are also preparing for the US election. For example, in China, the executive body of the Standing Committee of the National People’s Congress is meeting this week to debate the implementation of the fiscal measures announced in October. However, it is obvious that the US election will be the main topic of discussion, especially if Trump wins and quickly adopts his favourite rhetoric about tariffs.

Markets in anticipation mode

The markets are in waiting mode, with the most notable movements recorded in US equities, gold and bitcoin. The S&P 500 index is experiencing its first correction since the early September weakness, while gold is hovering well below its all-time high. Interestingly, bitcoin is suffering the most, retreating from its recent high of $73,500, as anxiety about the US presidential election is peaking.

The markets are in waiting mode, with the most notable movements recorded in US equities, gold and bitcoin.

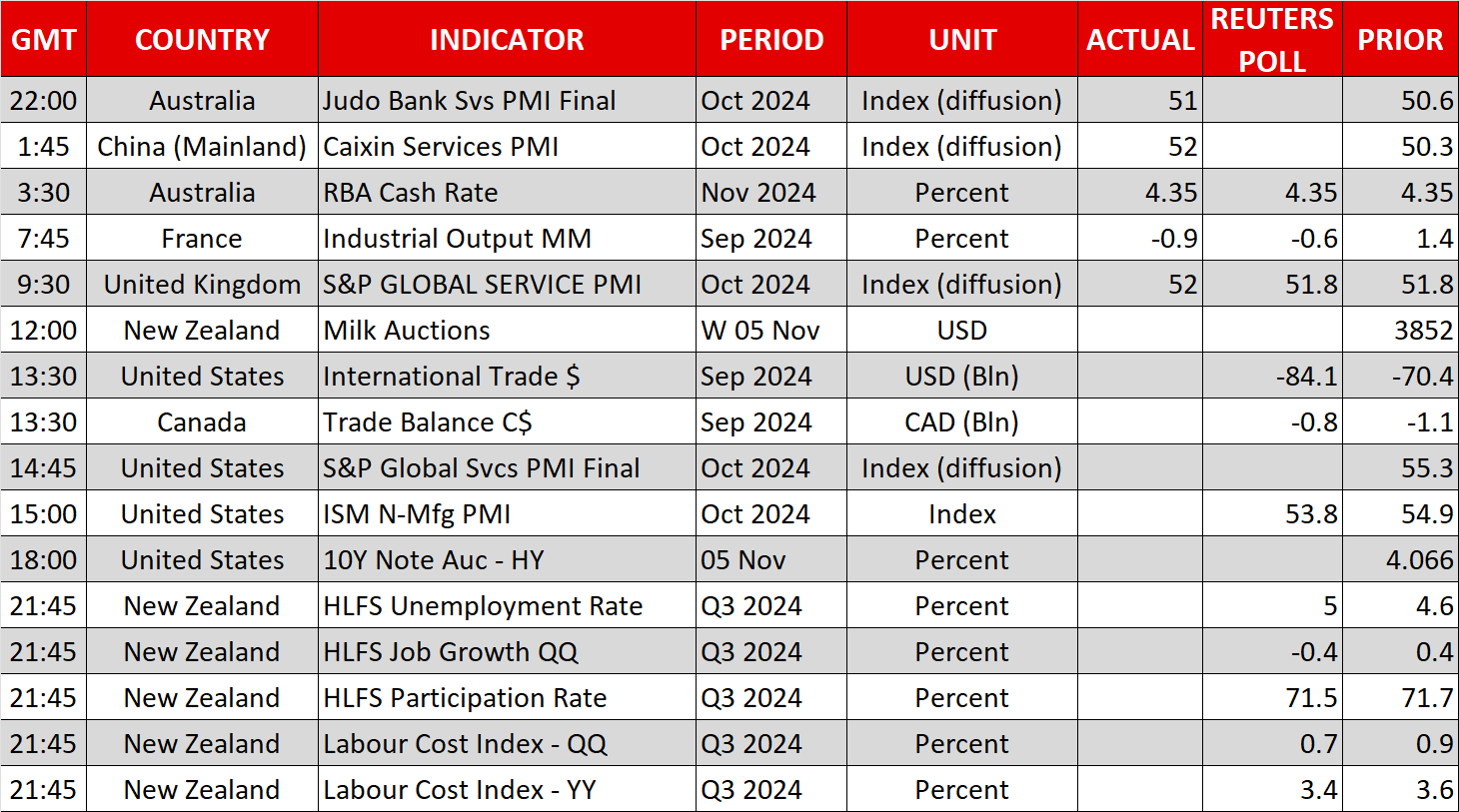

The US dollar is also on the back foot this week, underperforming against both the euro and the pound. But the biggest mover today is aussie/dollar. The RBA meeting did not produce a surprise with Governor Bullock et al maintaining their recent hawkish stance. Despite some downward revisions in the projections, the RBA does not expect inflation to sustainably return to the midpoint of its target until 2026.

The RBA meeting did not produce a surprise with Governor Bullock et al maintaining their recent hawkish stance.

While the first 25bps rate cut is priced in for May 2025, the Australian economy’s performance depends on China’s outlook, which could become even bleaker if Trump gets elected and repeats his 2016-2020 strategy.

German coalition could be under threat

While the market is fully focused on the US election, ignoring today’s calendar that includes the key US ISM services survey, there is a crisis brewing in the German government. The compilation of the 2025 budget is creating new friction among the three coalition partners, which could even result in the dissolution of the current administration and potentially lead to a snap election in early 2025. The euro could be under pressure on the back of such a development.

Related Assets

Latest News

Disclaimer: The XM Group entities provide execution-only service and access to our Online Trading Facility, permitting a person to view and/or use the content available on or via the website, is not intended to change or expand on this, nor does it change or expand on this. Such access and use are always subject to: (i) Terms and Conditions; (ii) Risk Warnings; and (iii) Full Disclaimer. Such content is therefore provided as no more than general information. Particularly, please be aware that the contents of our Online Trading Facility are neither a solicitation, nor an offer to enter any transactions on the financial markets. Trading on any financial market involves a significant level of risk to your capital.

All material published on our Online Trading Facility is intended for educational/informational purposes only, and does not contain – nor should it be considered as containing – financial, investment tax or trading advice and recommendations; or a record of our trading prices; or an offer of, or solicitation for, a transaction in any financial instruments; or unsolicited financial promotions to you.

Any third-party content, as well as content prepared by XM, such as: opinions, news, research, analyses, prices and other information or links to third-party sites contained on this website are provided on an “as-is” basis, as general market commentary, and do not constitute investment advice. To the extent that any content is construed as investment research, you must note and accept that the content was not intended to and has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such, it would be considered as marketing communication under the relevant laws and regulations. Please ensure that you have read and understood our Notification on Non-Independent Investment. Research and Risk Warning concerning the foregoing information, which can be accessed here.