Daily Comment – Dollar and stocks surge on Trump victory bets

- Donald Trump secures key battleground states

- Dollar rallies as his policies are seen as inflationary

- Stocks celebrate prospect of tax cuts and deregulation

- Bitcoin hits fresh record high, oil retreats

Trump knocks the White House door

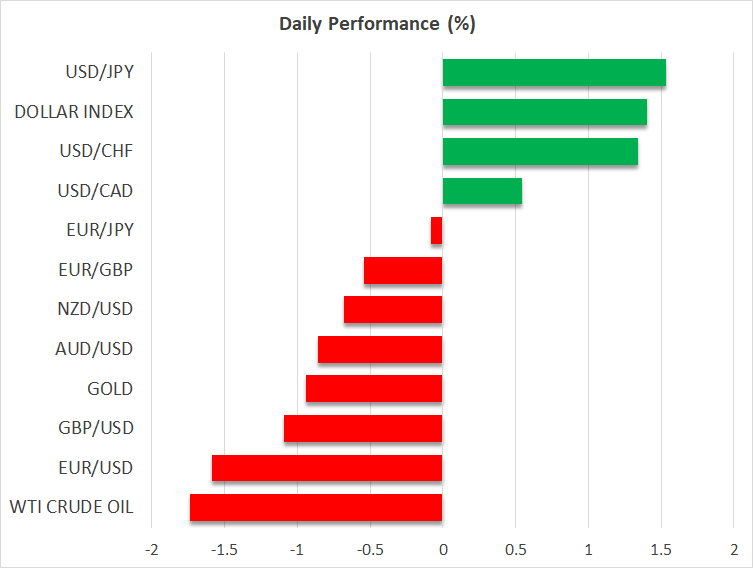

The dollar skyrocketed during the Asian session today, and it appears to be headed for its biggest one-day gain since March 2020.

Following the closing of the election ballots in the US, early signs that former president Donald Trump is likely to return to the White House fueled the so-called ‘Trump trades’, with the US currency beginning to climb north on early indications that the Republican candidate was likely to secure the key battleground state of Georgia. Trump also defeated Democrat candidate Kamala Harris in the critical states of North Carolina and Pennsylvania, with the latter putting him three electoral votes short of winning the presidency.

Early signs that former president Donald Trump is likely to return to the White House fueled the so-called ‘Trump trades’

Inflationary policies imply slower Fed cuts

The former president’s policies, which include massive tax cuts and tariffs on imported goods from around the globe, especially from China, are seen as inflationary, thereby raising the likelihood of the Fed proceeding with slower rate cuts from here onwards. That’s why his lead turbocharged the US dollar.

Indeed, Treasury yields also rose, and according to Fed fund futures, although investors remained convinced that the Fed will cut interest rates by 25bps on Thursday, speculation of a pause in December has increased. The probability of not acting in December rose back to 32%. Now, it remains to be seen whether the Fed will indeed sound more cautious this week about future policy moves.

Although investors remained convinced that the Fed will cut interest rates by 25bps on Thursday, speculation of a pause in December has increased

Wall Street surges on tax cuts and less regulation

The prospect of lower taxes and less corporate regulation under a Trump presidency buoyed stocks, with all three of Wall Street’s main indices gaining more than 1% on Tuesday and the futures market pointing to a stronger open today.

However, the Trump 2.0 era may not be smooth sailing for Wall Street, as the imposition of tariffs and bets of even slower rate reductions by the Fed may be reasons for steep corrective pullbacks.

However, the Trump 2.0 era may not be a smooth sailing for Wall Street

Some policies may need to pass through Congress to become laws. But with Republicans securing the Senate and leading the battle for the House, a unified government under President Trump will have a lot of freedom in deciding on fiscal policy.

Gold and oil pull back, Bitcoin enters uncharted territory

Gold surrendered to the stronger US dollar, but the losses were contained, and a recovery began during the early European hours, as the uncertainty surrounding a Trump government may be a reason for some investors to maintain exposure to this safe-haven asset.

Bitcoin was also part of the ‘Trump trade’, flying more than 9% today and reaching a fresh record high of around $75,390.

Oil on the other hand pulled back after hitting resistance slightly above the key territory of $72.70. Besides the pullback in commodities due a stronger dollar, the pressure on the Chinese economy from Trump’s policies could weigh on demand from the world’s top crude importer.

Related Assets

Latest News

Disclaimer: The XM Group entities provide execution-only service and access to our Online Trading Facility, permitting a person to view and/or use the content available on or via the website, is not intended to change or expand on this, nor does it change or expand on this. Such access and use are always subject to: (i) Terms and Conditions; (ii) Risk Warnings; and (iii) Full Disclaimer. Such content is therefore provided as no more than general information. Particularly, please be aware that the contents of our Online Trading Facility are neither a solicitation, nor an offer to enter any transactions on the financial markets. Trading on any financial market involves a significant level of risk to your capital.

All material published on our Online Trading Facility is intended for educational/informational purposes only, and does not contain – nor should it be considered as containing – financial, investment tax or trading advice and recommendations; or a record of our trading prices; or an offer of, or solicitation for, a transaction in any financial instruments; or unsolicited financial promotions to you.

Any third-party content, as well as content prepared by XM, such as: opinions, news, research, analyses, prices and other information or links to third-party sites contained on this website are provided on an “as-is” basis, as general market commentary, and do not constitute investment advice. To the extent that any content is construed as investment research, you must note and accept that the content was not intended to and has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such, it would be considered as marketing communication under the relevant laws and regulations. Please ensure that you have read and understood our Notification on Non-Independent Investment. Research and Risk Warning concerning the foregoing information, which can be accessed here.