Will a slowdown in UK inflation change the BoE’s plans? – Forex News Preview

Just last week, the BoE decided to hike rates by another 25bps as was widely anticipated, keeping its forward guidance more or less unchanged, namely that should inflation pressures persist, they will not hesitate to raise rates further. However, the spotlight was thrown on the upside revisions in the economic and inflation projections, with the Bank abandoning its call for a recession.

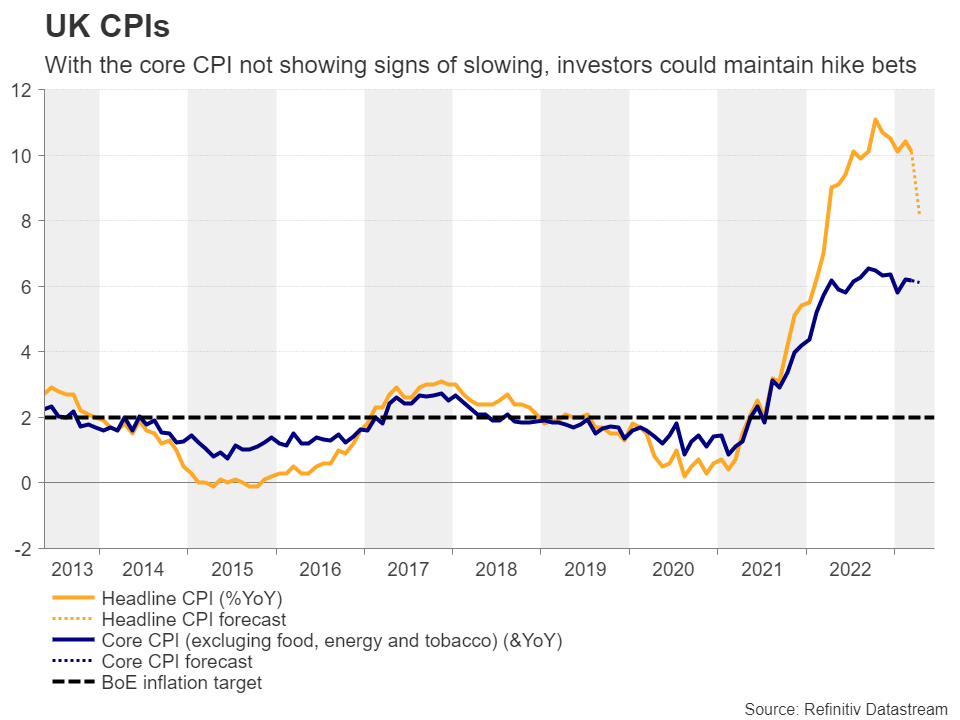

Blending this with Governor Bailey’s remarks that they must “stay the course” to ensure that inflation falls back to the 2% objective, investors were allowed to maintain bets of more rate increases in the months to come. Currently, they are assigning a nearly 80% probability for another quarter-point hike at the June meeting and expect almost one more by the end of the year.

Will the data alter those expectations?

Will the data alter those expectations?Although the manufacturing PMI remained subdued around 2 points below its equilibrium 50 barrier, pointing to contraction for the ninth consecutive month in April, the services index has been expanding for three months now, with April revealing a strong acceleration. This took the composite PMI up to 54.9 from 52.2. Further improvement in the May numbers could increase confidence that the UK economy has dodged a recession and thus, investors will remain convinced that more hikes are coming.

However, they are unlikely to play all their cards just a day ahead of the CPI data, as bringing inflation to heel is the BoE’s top priority. Both the headline and core CPI rates are expected to have declined in April, with the former slipping back below 10%, to 8.2% year-on-year from 10.1%, and the latter ticking down to 6.1% y/y from 6.2%.

That said, according to the April PMIs, price-charged inflation accelerated during the month as private sector firms once again sought to defend margins from rapidly increasing staff costs. This likely tilts the risks surrounding Wednesday’s data to the upside. That said, even if the forecasts are met, inflation would still be well above the BoE’s 2% target, with the core metric not showing signs of sufficient slowdown. For market participants to start scaling back their hike bets, a downside surprise may be needed.

On Friday, retail sales are expected to have contracted again in April, but at a slower pace than in March, which adds to the narrative that inflation may not have cooled down as the forecasts suggest.

Pound could stay in uptrend, especially against aussieThis could further convince investors that another hike is in the BoE’s chamber and that at least another one is likely to follow. Thus, even if the pound corrects lower next week, it could remain in a broader uptrend mode. Nonetheless, exploiting further pound gains against the dollar, which has been receiving massive support from US data and hawkish Fed rhetoric, may not be the wisest choice. With the RBA seen maintaining a soft stance after the disappointment in Australia’s employment report for April and stepping back to the sidelines in June, pound/aussie may be a better option.

Pound/aussie has been in a sliding mode today, after it hit resistance nearly the 1.8830 level on Thursday. However, even if the pair extends its retreat below last week’s lows of 1.8585, the bulls will still have the opportunity to jump back into the action from above the uptrend line drawn from the low of February 2.

If so, they may push for another test at around 1.8830, the break of which could pave the way for the peak of April 28 at around 1.9035. If they are not willing to stop there either, they would then enter territories last seen in February 2022, with the next resistance perhaps being the high of January 28 of that year at 1.9220.

For a bearish trend reversal to start being examined, pound/aussie may need to fall below the 1.8400 zone, which offered support last month. Such a slide may also take the pair below the aforementioned uptrend line and perhaps allow declines towards the low of March 31 at 1.8245.

Related Assets

Latest News

Disclaimer: The XM Group entities provide execution-only service and access to our Online Trading Facility, permitting a person to view and/or use the content available on or via the website, is not intended to change or expand on this, nor does it change or expand on this. Such access and use are always subject to: (i) Terms and Conditions; (ii) Risk Warnings; and (iii) Full Disclaimer. Such content is therefore provided as no more than general information. Particularly, please be aware that the contents of our Online Trading Facility are neither a solicitation, nor an offer to enter any transactions on the financial markets. Trading on any financial market involves a significant level of risk to your capital.

All material published on our Online Trading Facility is intended for educational/informational purposes only, and does not contain – nor should it be considered as containing – financial, investment tax or trading advice and recommendations; or a record of our trading prices; or an offer of, or solicitation for, a transaction in any financial instruments; or unsolicited financial promotions to you.

Any third-party content, as well as content prepared by XM, such as: opinions, news, research, analyses, prices and other information or links to third-party sites contained on this website are provided on an “as-is” basis, as general market commentary, and do not constitute investment advice. To the extent that any content is construed as investment research, you must note and accept that the content was not intended to and has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such, it would be considered as marketing communication under the relevant laws and regulations. Please ensure that you have read and understood our Notification on Non-Independent Investment. Research and Risk Warning concerning the foregoing information, which can be accessed here.