RBNZ meeting unlikely to rattle the kiwi – Forex News Preview

Quite a lot has happened since the RBNZ last met in February, but since developments have been both positive and negative, they will likely cancel each other out in the central bank's eyes.

On the bright side, the island remains virtually virus-free. Because of this, Australia and New Zealand agreed to establish a 'travel bubble' between them, so there is some relief coming for the struggling tourism sector. Additionally, the government will raise the minimum wage by roughly one kiwi dollar to $20 per hour, which will hopefully boost spending in the economy.

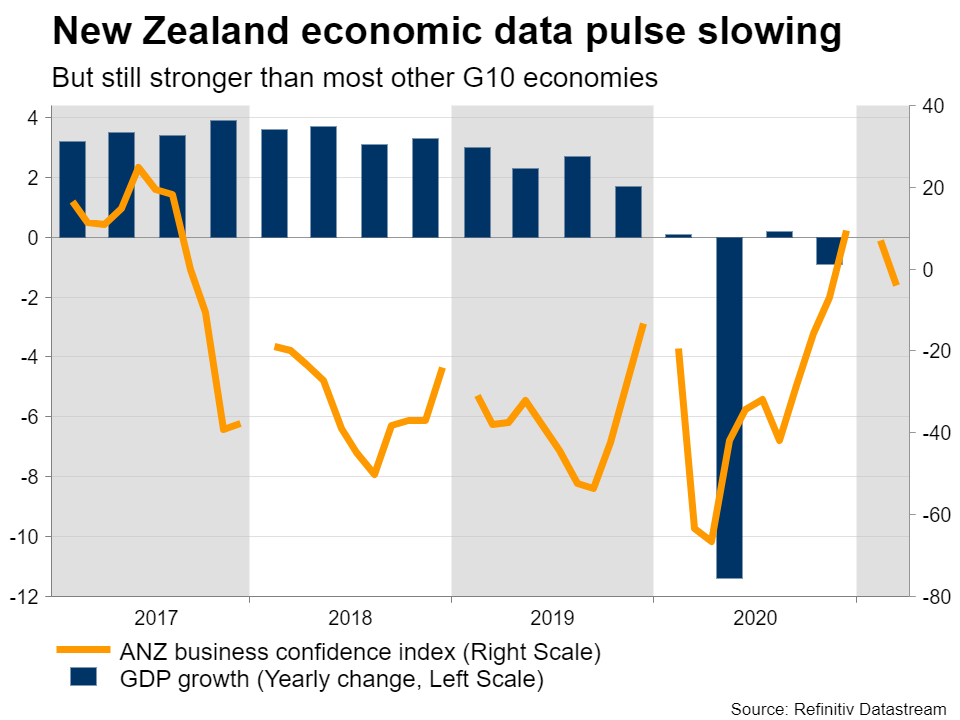

However, the data pulse has started to slow. Retail sales and business confidence both declined lately, while economic growth disappointed in Q4. That said, the RBNZ already expected a gradual slowdown in its latest economic forecasts, so this won't be any huge surprise.

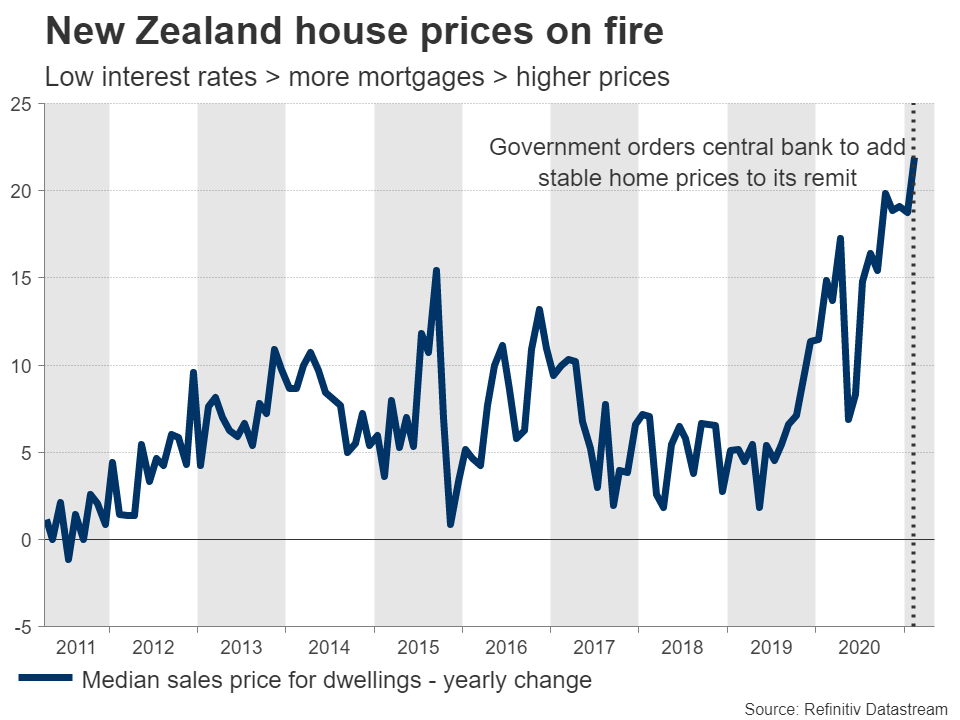

The other piece of news is that the RBNZ's mandate has been changed to also consider the impact on home prices when formulating decisions, in addition to keeping inflation stable and promoting full employment. House prices in New Zealand have been on fire lately as low interest rates encouraged more borrowing for mortgages. This change essentially makes it harder for the RBNZ to cut rates again.

RBNZ to 'hold the line'Turning to the upcoming meeting, no policy changes are on the cards. Given the mixed developments lately, it is also difficult to envision the RBNZ changing its language either. Policymakers will likely repeat that they are 'on hold' for the foreseeable future.

There is no real need to push back against market pricing for future rate hikes. Markets are currently pricing in around a 30% probability for a rate increase by this time next year, which seems fair given the solid shape of the overall economy. Plus, this probability declined substantially lately, so the market itself is having doubts.

If the RBNZ simply reaffirms its wait-and-see stance, any reaction in the kiwi is likely to be minor.

Bigger picture positive, but mind the US dollarOverall, the kiwi's fortunes will depend mostly on how the economy performs, the speed of vaccinations globally, commodity prices, and risk sentiment in the markets. All of these factors seem to be improving, so it is difficult to be pessimistic on the currency.

New Zealand is almost virus-free and the economy is stronger than most other regions thanks to fewer lockdowns, global vaccinations are moving forward, dairy prices are elevated, and America is about to unleash a landslide of stimulus that could keep market happy for a while.

The 'catch' is that the outlook for the US dollar seems promising too with the American vaccination program firing on all cylinders, so any future gains in the kiwi might not be reflected in dollar/kiwi.

Instead, euro/kiwi or kiwi/yen might be better candidates. Despite the latest rebound, the prospects for the euro remain bleak, with the region still partially locked down, behind in stimulus, and unlikely to catch up in vaccinations. It's a similar story for the yen, which is likely to suffer as the global economy heals its wounds, thanks to the BoJ keeping a ceiling on Japanese bond yields.

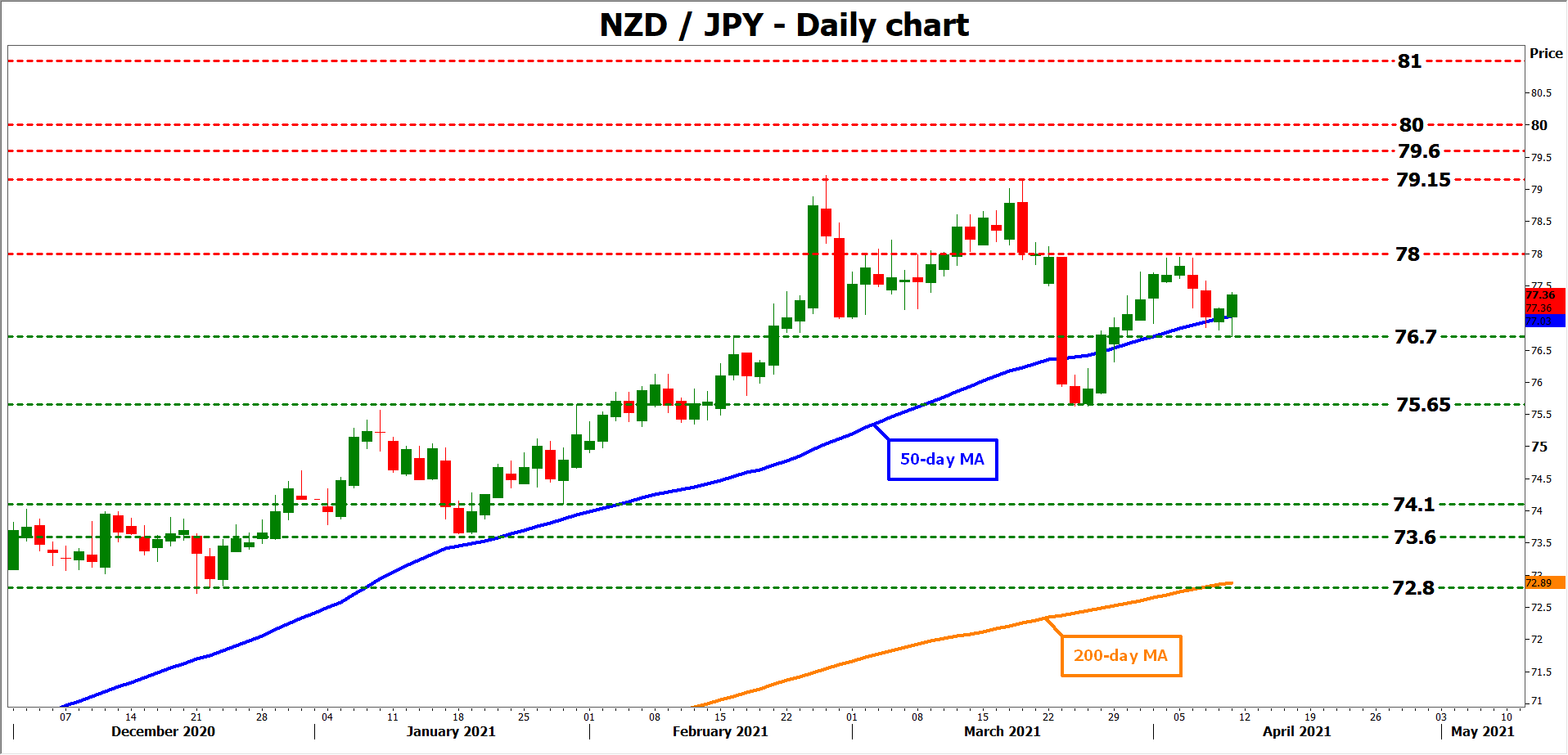

Taking a technical look at kiwi/yen, immediate resistance to advances could come from the 78.00 region, before the recent top of 79.15 comes into play.

On the downside, preliminary support may be found near the 76.70 zone, a break of which would turn the focus to the latest low of 75.65.Latest News

Disclaimer: The XM Group entities provide execution-only service and access to our Online Trading Facility, permitting a person to view and/or use the content available on or via the website, is not intended to change or expand on this, nor does it change or expand on this. Such access and use are always subject to: (i) Terms and Conditions; (ii) Risk Warnings; and (iii) Full Disclaimer. Such content is therefore provided as no more than general information. Particularly, please be aware that the contents of our Online Trading Facility are neither a solicitation, nor an offer to enter any transactions on the financial markets. Trading on any financial market involves a significant level of risk to your capital.

All material published on our Online Trading Facility is intended for educational/informational purposes only, and does not contain – nor should it be considered as containing – financial, investment tax or trading advice and recommendations; or a record of our trading prices; or an offer of, or solicitation for, a transaction in any financial instruments; or unsolicited financial promotions to you.

Any third-party content, as well as content prepared by XM, such as: opinions, news, research, analyses, prices and other information or links to third-party sites contained on this website are provided on an “as-is” basis, as general market commentary, and do not constitute investment advice. To the extent that any content is construed as investment research, you must note and accept that the content was not intended to and has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such, it would be considered as marketing communication under the relevant laws and regulations. Please ensure that you have read and understood our Notification on Non-Independent Investment. Research and Risk Warning concerning the foregoing information, which can be accessed here.